- Definition of Final Action Date

- Where to Find the Final Action Date

- Calculating the Final Action Date

- Common Final Action Dates

- Roles and Responsibilities

- Impact on GCA and Department Processes

- Resources

- Questions

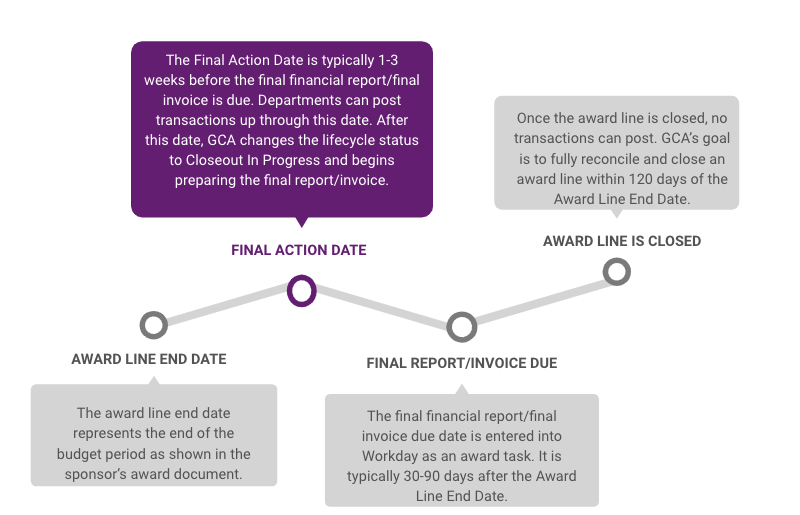

Definition

The Final Action Date (FAD) is the last day the award line is open for the department to post expenditures. After the FAD, GCA will update your award line lifecycle status from Expired to Closeout In Progress. For more information about the lifecycle statuses, visit our Workday Award Line Lifecycle Statuses webpage.

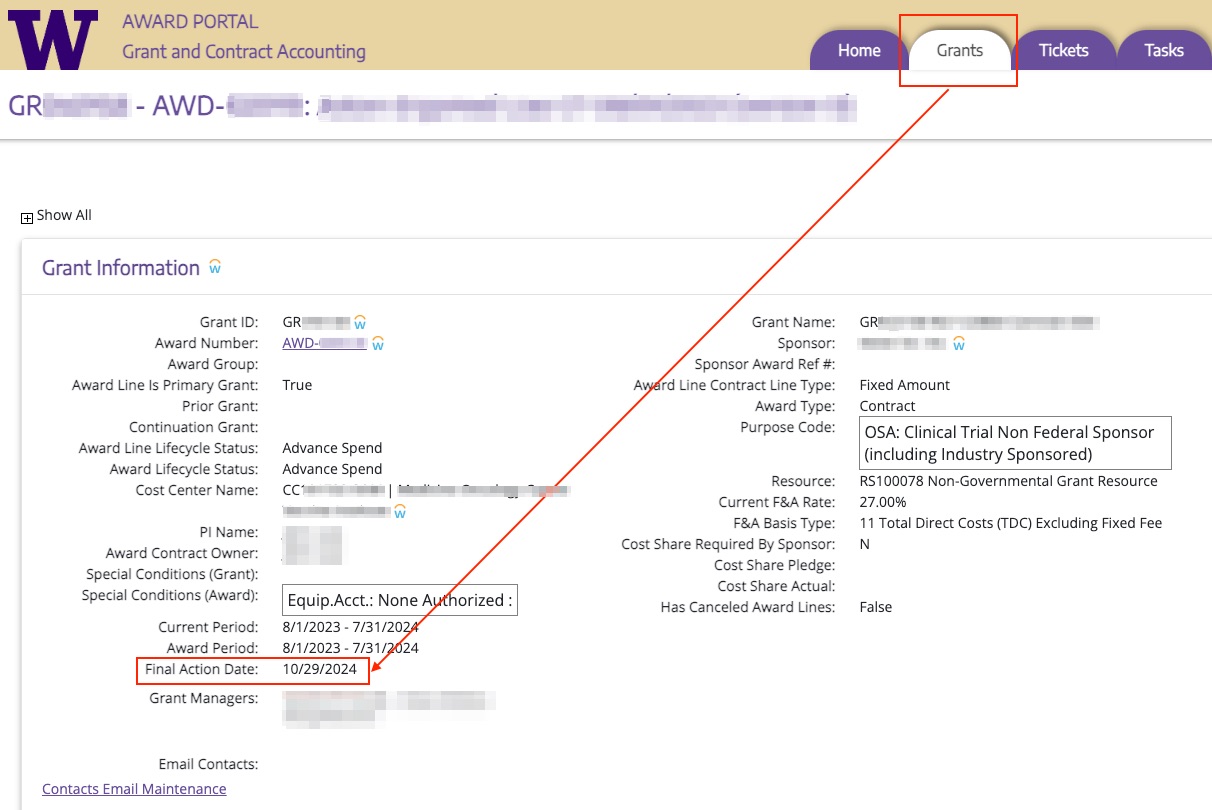

Where to Find the Final Action Date

Each award line’s FAD is displayed in Award Portal. Go to the Grants tab and scroll to the Grants Information section.

Calculating the Final Action Date

The FAD is based on the due date for your award line's final financial report and/or final invoice as stipulated in your award agreement. The FAD is before the due date stated in the award to allow GCA sufficient time to prepare each award line’s final reconciliation.

Common Final Action Dates

Our two most common FAD calculations are for 1) awards with final financial reports and 2) awards with final cost reimbursable invoices.

Awards with Final Financial Reports

The FAD for an award with a final financial report is three weeks before the report due date. Since final financial reports are typically due within 90 days of the award line end date, this provides 69 days for the campus unit to post expenditures after the award line ends.

-

For example, a NOAA award that expires on March 31, 2024, will have a Final Action Date of June 8, 2024, (69 days), and a final financial report due date of June 29, 2024 (90 days).

Awards with Final Cost Reimbursable Invoices

The FAD for an award with a final cost reimbursable invoice is one week before the invoice due date. Many final invoices are due within 60 days of the award line end date, so this provides 53 days for campus to post expenditures.

-

For example, a FDP subaward that expires on March 31, 2024, will have a Final Action Date of May 23, 2024, (53 days), and a final financial report due date of May 30, 2024 (60 days).

Note that in a typical month, GCA is responsible for submitting approximately 2,200 invoices and 200 financial reports. Setting the FAD before a final financial report or invoice is due allows GCA to manage this workload.

Roles and Responsibilities

Campus

- Ensure that all expenses, including transfers and adjustments, have posted to the award line by the FAD and are allowable and allocable to the sponsored program

- Transfer unreimbursed expenses to a non-sponsored program worktag

Grant & Contract Accounting

- Prepare and submit final financial reports and final invoices by the sponsor due date

- Work with campus and sponsors to prepare and submit revised financial reports and revised final invoices in a timely manner

Impact on GCA and Department Processes

Once an award's FAD has passed, it is eligible for final reporting and/or invoicing based on the expenditure total as of the FAD. Therefore any charges that post to a budget after its FAD will not be included in the final report, invoice, or letter of credit draw. While GCA will consider submitting a revised report or invoice where there are extenuating circumstances, the sponsor is not contractually obligated to accept a late or revised report or invoice, or to allow a late draw of funds. If a sponsor does not reimburse an invoice or allow drawing of charges that posted after the FAD, the department is responsible for the resulting cash deficit.

By working to ensure that all expenditure transactions, including expense transfers, have posted to the budget by the FAD, you will help UW maintain good relationships with our sponsors by providing them timely and accurate final deliverables, reports, and reimbursement requests.

Resources

GIM 39 - Closeout of Sponsored Programs

Questions about Final Action Dates

For inquiries on a specific award line, please use Award Portal. If you have more general questions about the Final Action Date process, please email gcahelp@uw.edu.