You can find training classes on Cost Share through the UW's CORE program. Check out the current classes below!

CORE 2001: Understanding Cost Share at the UW: When is it really Cost Share? (eLearning)

CORE 2041: Managing Cost Share at the UW (Live/Zoom; Offered Fall, Winter, Spring)

- Definition

- Components

- UW Cost Share System

- Types of Cost Share

- Cost Share Components

- What is Not Cost Share

- Cost Share Contributions

- Cost Share F&A Rate

- Cost Share's Impact on the UW's F&A Rate

- Managing Cost Share

- Close Out

Definition

Cost Share occurs when a quantified portion of the costs of an Award are not paid by the sponsor, but paid instead using resources within a department, school/college, or other party outside of the UW. Cost Share is a commitment, either required by the Sponsor or proposed (volunteered) by the PI, to use resources other than the Award itself for completion of the Award objectives.

Cost Share is Mandatory when required by the sponsor, or Voluntary when the PI voluntarily commits to providing quantified resources to complete the Award objectives.

Some sponsors specifically prohibit Cost Share and many explicitly state that Cost Share does not enhance the competitiveness of a sponsored research proposal. In these instances, Cost Share should not be included in the proposal.

UW’s policies on Cost Share can be found in GIM 21.

Cost Share Components

The UW discourages Cost Share Commitments when not required by the sponsor due to 1) the high administrative burden of meeting Cost Share requirements and 2) the negative impact of Cost Share on the UW’s Facilities & Administration (F&A) Rate. For more information, see Cost Share’s Impact on the UW’s F&A Rate below.

Cost Share Commitments must be met by Contributions, using allowable sources (budgets) and expenses. When an expense is identified as a Cost Share Contribution, it must be charged to the applicable Cost Share Award Line in Workday by using the Cost Share Grant Worktag.

See “Cost Share Contribution Sources” below for more information on Cost Share Contributions.

An Award with a Cost Share Commitment is often referred to as the “Benefiting” award; the funding source where the expense is posted that has the Cost Share Contribution is often referred to as the “Contributing” source.

Cost Share Addendum

The Cost Share Addendum is used by departments to identify the individual Cost Share Commitments and calculate the value and/or percentage of effort, as well as to identify the funding source responsible for covering the Cost Share Commitments.

Unit of Measure

The Cost Share Commitment is calculated by one of the following Units of Measure:

- a fixed dollar amount (e.g., $20,000);

- a match where the amount of funds provided by the sponsor will be matched by the amount of funds provided by the department (e.g., a 1:1 match would be where the department matches the sponsor in equal amounts);

- a percentage of the amount provided by the sponsor (e.g., the department will Cost Share 20% of the funds provided by the sponsor); or

- a commitment of the faculty’s effort (e.g., the faculty will commit to Cost Share 20% of her effort).

UW Cost Share System

Both the Cost Share Commitments and Contributions must be recorded in the official system of record for the UW, which is Workday. A Cost Share grant worktag must be set up for any award which has a cost share requirement.

Completion of a Cost Share Addendum and submission of the addendum to GCA, facilitates the setup of a Cost Share grant worktag.

Types of Cost Share

Mandatory: Cost Share required by the sponsor as a condition of the Award.

Voluntary: Cost Share the PI voluntarily commits to in the Award proposal.

Both Mandatory and Voluntary Cost Share are considered binding terms and conditions of the award and must be met unless the sponsor provides written approval to reduce or remove the commitment.

Other Types of Cost Share

There are other situations (namely Salary Cap, K Awards, or other instances of sponsored-required budget limitation) where faculty effort-related costs are incurred on an Award but cannot be charged in full to the Award. The unallowable amount must be covered by department resources other than the Award. These amounts are also sometimes referred to as “cost share” (as the cost must be shared by the department) but they are not treated as Cost Share as described in this section, and a Cost Share Addendum or tracking in Workday is NOT required.

Cost Share Components

The following components can be used for Cost Share. Each item below includes a description and information on Commitment and Contribution requirements.

Direct Expenses Cost Share

Direct expenses Cost Share includes faculty salaries, non-faculty (staff or student) salaries, and non-salary expenses, such as supplies, equipment, travel costs, etc. Staff (faculty or non-faculty) expend effort on an Award, but do not charge the cost of that effort to the Award.

Faculty salary could be a dollar or an effort-based commitment. It is responsibility of the PI to ensure the requisite cost share effort level is contributed to the award.

Third Party Cost Share

Third (3rd) Party Cost Share is provided by an individual or organization other than either UW or the Award Sponsor. The provision of Cost Share is not tied to any formal agreement or financial instrument (such as a subaward or purchase order). Provision of Cost Share is voluntary and is not subject to or made as a requirement of any other agreement with the UW.

3rd Party Commitments are typically in the form of donated effort, resources (equipment or materials), or in-kind (volunteer effort).

The Cost Share Contributions are external to the UW; they are not recorded in the UW financial system and do not incur any Cost Share F&A. Because this is not a UW resource, 3rd Party Cost Share is not included in the UW's F&A Rate calculation.

If the 3rd Party Cost Share involves the contribution of an individual’s effort (either percentage- or dollar-based), the Commitment and Contribution letters can come from that individual even if the individual is within an organization. For example, some organizations do not have an effort tracking system or will not disclose compensation information. In that case, the 3rd Party can be the individual providing the effort within the organization.

Third Party Cost Share where the Contribution is an individual’s effort can be either percentage of effort or dollar-based. Since Workday only allows for 3rd Party Cost Share to be recorded as a dollar amount, an estimated dollar amount should be calculated for any percentage of effort-based 3rd Party Cost Share Commitments and Contributions. These estimated amounts should be entered into Workday on the Cost Share grant worktag.

If a 3rd Party Contribution is in the form of cash (which is rare), the cash should be deposited into a Gift or other discretionary budget and then that budget may be used as a funding source for the applicable Cost Share grant worktag.

Commitment Requirements

At the time of proposal, the department must obtain a written commitment from the 3rd Party contributor (individual or organization). A list of requirements for the written commitment follows, and a Commitment letter template is also available.

- the identity of the benefiting Award and, ideally, the PI

- the date range in which the contributions will be made the (must be within the start and end dates of the benefiting Award)

- a description of the items or services being contributed

- a statement indicating how the contribution will benefit the Award,

- confirmation that the resources being used for Cost Share are not from a federally sponsored resource and will not be used to meet any other Cost Share commitment

- the dollar value of the contribution, including, if applicable, any allowable indirect costs (e.g., fringe, F&A). If the contribution is effort-based, then include the amount of effort.

- signature of the individual or organization's authorized official

Third Party Cost Share Commitments are entered into the Workday by GCA. Departments should submit the letters to GCA via Award Portal.

Contribution Requirements

When the third party has completed their Cost Share Contribution, they must provide written confirmation of the Contribution. A list of requirements for the written confirmation follows, and a Contribution letter template is also available.

- the identity of the benefiting award

- the date range in which the contributions have been made

- a description of the items or services provided

- confirmation that the contributions are not from a federally sponsored resource and have not been used to meet any other Cost Share commitment

- the dollar value, including, if applicable, any indirect costs or, if the contribution is effort, the amount of effort provided

- signature of the individual or organization's authorized official

Third Party Cost Share Contribution letters should be submitted to GCA by sending the letter and a completed GCA Cost Share Contributions Form via Award Portal. GCA will then enter the Contribution information into Workday.

Per GIM 21, the PI is responsible for fulfilling the total cost share commitments. If a 3rd party does not provide the amount of Cost Share entered into Workday as a Commitment (which may, as above, be an estimate), the PI must either find an acceptable alternative 3rd party contribution or request that the sponsor modify the Award to reduce the Cost Share Commitment.

Outgoing Subaward Cost Share

Subaward Cost Share is a Cost Share Commitment made by a Subaward Recipient. Subaward Cost Share is discouraged due to the administrative burden of tracking the Cost Share, both on the part of UW and the Subaward Recipient. Typically, Cost Share should only be included on a Subaward agreement when the Sponsor has a Mandatory Cost Share Commitment and:

- The amount of Cost Share is significant (e.g., a 1:1 match where for every dollar the Sponsor provides on the Award, the UW must provide one dollar of Cost Share); and/or

- The Subaward Recipient will be performing a significant portion of the Award.

Subaward Cost Share should be clearly specified in the Subaward agreement. Subaward Recipients should include their Cost Share Contributions as part of their routine invoicing. Cost Share should not be reported on separately.

Not all Subaward Cost Share needs to be reported to GCA and entered into Workday. That determination is made on the following basis:

Subaward Cost Share Reported to GCA

If the Subaward portion of the Cost Share is reported to the Sponsor, then that Subaward Cost Share must be reported to GCA. This typically happens under the following circumstances:

- Mandatory Cost Share where the Sponsor’s Cost Share Commitment has been passed down (all or in part) to the Subaward Recipient.

- Voluntary Cost Share where the UW proposal states that a Subaward Recipient will be providing a portion of the Voluntary Cost Share.

In either case, because the Subaward Cost Share is part of the Award agreement with the Sponsor, the Subaward Cost Share Commitment and Contributions should be reported to GCA so that it can be entered into Workday system.

The Subaward’s Cost Share Commitment should be entered onto the Cost Share Addendum (under the 3rd Party/Subaward Cost Share section). The Subaward Recipient’s Cost Share Contributions, as reported on their invoice, should be recorded by the department on a GCA Cost Share Contribution Form. The department submits the completed form, along with a copy of the invoice with the reported Cost Share Contribution, to GCA via Award Portal. Upon receipt, GCA will enter the amount of the Contribution in Workday.

Subaward Cost Share Not Reported to GCA

If there is an agreement between the UW and Subaward Recipient for the Subaward Recipient to provide Cost Share but that Cost Share is not part of the Award agreement between the UW and the Sponsor, then that Cost Share does not need to be reported to GCA because the UW Cost Share systems are only to record Cost Share that is between the UW and the Sponsor. In this case, the agreement is between the UW and the Subaward Recipient, and the tracking and reporting is the responsibility of the department.

Unrecovered Indirect Costs (UIDC) Cost Share

If the Actual F&A Rate on an Award is less than the Standard F&A Rate (see below) then the UW is not recovering the full F&A amount on this Award. The amount of F&A that is the difference between the Actual and Standard rate is referred to as Unrecovered Indirect Costs (UIDC). This amount can be used as Cost Share only if the sponsor provides written authorization to allow for UIDC as a Cost Share contribution. GCA calculates and enters the UIDC into Workday on a periodic basis.

What is Not Cost Share

There are a few items which have the characteristics of - or just look like - Cost Share but they are not considered to be Cost Share at the UW:

Department Internal Tracking

On occasion, a department will have an agreement with a UW employee in a different department for the provision of effort on an Award. If that agreement is not formalized as a Cost Share Commitment with the Award Sponsor, the department does not need to record it in Workday. However, if the department wants to track that effort, they may use the “Shift in Funding Source” functionality in ECC to record that effort on the faculty’s Effort Report but not report it as Cost Share to the Award Sponsor.

NIH Training Grants

For NIH Training Grants, funds are limited and are to cover the costs of supporting the Trainee. The salary of the PI is an allowable cost on a T32 Training Grant but, typically, there are insufficient funds to cover PI or other staff effort on the Award. The PI may choose to have their effort paid from non-sponsored funds. While PI and other staff will expend effort on the Award, and that effort paid from non-sponsored funds, that effort does not need to be recorded as a Cost Share commitment unless the Program Announcement specifically states that Cost Share will be a factor in Award selection. To the best of GCA’s knowledge, no NIH Training Grant Program Announcement has included Cost Share as a factor.

Intramural (Sponsor-Provided) Cost Share

Intramural Cost Share is when a Federal Sponsor commits to providing non-funding resources on an Award. For example, a Federal Sponsor may commit to allowing the Awardee to utilize federal resources or commit to an employee providing a specified level of effort on an Award. This is NOT considered to be Cost Share as these are resources provided by the Sponsoring agency rather than by the UW.

Cost Share Contributions

The Cost Share Commitment cannot be ignored or removed due to any limitations from the Contributing funding source. The requirement to meet a Cost Share Commitment is based on the Benefiting award; therefore, the Commitment cannot be eliminated due to limitations of the Contributing resource. Example: a 3rd party states that it cannot provide any supporting documentation on the value of a Cost Share Contribution. This does not mean that the Cost Share Commitment can be removed or ignored. Instead, either the 3rd Party must provide the documentation, or the PI must identify another resource to meet the Cost Share Commitment.

There are limitations on the types of funding sources and the individual expenses that can be used as Cost Share Contributions.

Cost Share Contribution Funding Sources

Cost Share contributions are typically made with unrestricted (department or gift) budgets.

Sponsored Award funds may not be used for Cost Share contributions without the prior written approval from both the benefiting and contributing Award Sponsors.

NOTE: If the cost share on your award will be met by contributions in whole or in part from another sponsored award, you must reach out to GCA via Award Portal for instructions on documenting those contributions.

Any federal flow through Awards used for Cost Share must have prior written approval from both the federal sponsor and the flow through sponsor.

The following funding source/budget types are typically not allowed to be used for Cost Share contributions. It is the responsibility of the PI to ensure that the funding source used to cover cost share contributions is a permissible use of those funds.

- Recharge center operating budgets

- Cost center operating budgets

- Recharge center reserve budgets

- Cost center reserve budgets

- Staff assignments

- Royalty Research Fund

- Washington Technology Center (WTC)

Cost Share Contribution Allowable Expenditures

Expenditures used for Cost Share contributions must meet the four cost principles of Allowable, Allocable, Reasonable and Consistently Treated.

This means:

- Cost Share Contributions must be incurred within the benefiting budget period; and

- All contributions must be verifiable from the UW’s financial systems or, in the case of third party, from the department’s records.

Cost Share Contribution Limitations

An individual expense cannot be counted as a Cost Share Contribution on more than one Award.

The following types of expenses are typically not allowed to be used as Cost Share:

- Postdoctoral Research Trainee Salaries

- Graduate Stipends

- Marketing Services

- Scholarships

- Stipends

- Prizes and Awards

- Loans (Student)

- Loan Cancelations

- Debt Service

Use of Tuition Waivers for Cost Share Contributions

Tuition payments can be used to meet Cost Share Commitments. However, how the Tuition Commitment is recorded in the Workday depends on the type of Tuition. There are two types of Tuition:

- Tuition Payment: when the cost of the tuition is charged to a UW funding source.

- Waived Tuition: when the UW waives, or does not charge, the tuition. UW is absorbing the cost of tuition, and no funding source is being charged for the cost of the tuition. Thus, the UW is the provider of the Cost Share Contribution.

A Tuition Payment charge to the Cost Share grant worktag. Tuition payments are not handled any differently than any other expense.

Waived Tuition, which is not charged to a funding source, uses the following process:

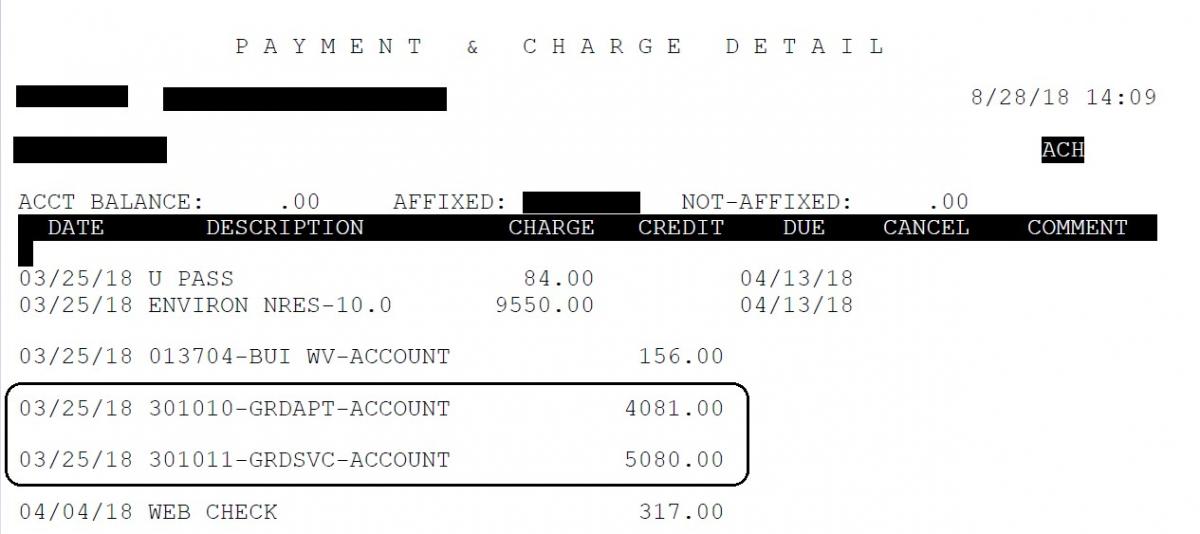

- Department personnel obtain a copy of the student’s quarterly Payment & Charge Detail from the Student Database (SDB). Instructions for accessing and navigating the SDB may be found by contacting Student Fiscal Services (SFS).

- Identify the tuition waived, which can be found in the “Description” column with the following codes:

- 031010

- 031011

The amounts in the “Credit” column are the amount of the waived tuition. In the example below, the amounts of $4,081 and $5,080 are waived tuition:

- Enter the amount of the tuition waiver to be claimed as a Cost Share Commitment on the GCA Cost Share Contributions Form in the “Tuition Waiver” line. Note that the amount of Waived Tuition to be used as Cost Share must be equal to or less than the amount of tuition shown in the student’s quarterly Payment & Charge Detail.

- If applicable, you can include the additional waived fees associated with the tuition waiver. For a list of applicable fees, please refer to the Graduate Appointment Waivers webpage for more details.

- Submit the tuition waiver backup and completed NFCS Reporting Template to GCA via Award Portal under the Cost Share topic. GCA will enter the Tuition contribution into Workday.

Tuition that is charged to a sponsored award is charged to Object Class 19_Tuition.

Cost Share F&A Rate

In order to determine the correct Cost Share F&A Rate, users need to understand the three different F&A rates that apply to an Award:

Standard F&A Rate: The negotiated percentage rate of recovery for calculating indirect costs at the time the Award is issued. This is the rate negotiated between the UW and the federal government for actual cost recovery on a sponsored Award. Information on the Standard Rate can be found at MAA.

Actual F&A Rate: The actual percentage rate of recovery applied by the sponsor on the Award to the Award expenditures. This rate can be the same or different from the Standard Rate.

For example, if the Sponsor accepts the Standard Rate, then both the Standard and Actual rates would both be 55.5%. If the Standard Rate is 55.5% but the Sponsor limits F&A to 25%, then the Actual Rate is 25%.

Cost Share F&A Rate (also referred to as “Cost Share I/C Rate”): This is the F&A rate applied to the applicable Cost Share expenses.

If the Sponsor:

- is silent on the applicable F&A Rate for Cost Share expenses, then F&A Rate is the Standard F&A Rate (most common);

- explicitly disallows F&A to be incurred on Cost Share expenses, then the F&A Rate is 0% (rare); or

- specifies the F&A Rate to be on Cost Share expenses, then that is the F&A Rate (rare).

The F&A Base is Modified Total Direct Cost (MTDC). See GIM 13 for more information on MTDC.

Cost Share F&A Rate on Awards with More than One F&A Rate

If an Award has more than one Standard F&A Rate (see GIM 13 for more information) then the Cost Share F&A Rate is the Standard F&A Rate on the Award’s Parent award line.

If Cost Share contributions are benefiting more than one F&A rate on an Award (such as off-campus and on-campus work), multiple Cost Share grant worktags could be set up by GCA to facilitate multiple Cost Share F&A Rates. Other exceptions may apply: contact gcahelp@uw.edu if you have any questions or need to request multiple Cost Share grant worktags.

F&A applied to Cost Share contributing expenditures does not represent any additional financial burden to the department. Cost Share F&A is not represented as an increase in expenditures on either the Benefiting or Contributing funding source and is not represented as a transaction within Workday. It is simply a representation of recovery of institutional costs incurred to support the research enterprise.

Cost Share's Impact on the UW's F&A Rate

Cost Share Contributions (not including 3rd Party Cost Share) are factored into the UW’s Standard F&A Rate negotiations. The Standard F&A rate is calculated by taking the total direct costs from a selected period of time and dividing it by the total indirect costs for the same period. The ratio is the basis for the Standard F&A Rate. The Cost Share Commitments for that same period are added to the total direct costs, which decreases the Standard F&A Rate. 3rd Party Cost Share is not included as part of this F&A Rate calculation as the 3rd Party Contributions are from external, and not UW, resources.

For example:

- F&A Costs/Direct Costs = $50,000/$100,000 = an F&A Rate of 50%

- Factor in Cost Share Commitments of $20,000:

- F&A Costs/(Direct Costs + Cost Share Commitments) = $50,000/($100,000 + $20,000) = an F&A Rate of 42%

Factoring in Cost Share Contributions reduces the UW’s F&A rate, which means fewer resources for the UW.

Setting up Cost Share

The Cost Share Addendum (CSA) is used by departments to identify the individual Cost Share Commitments and identify the funding source(s) which will cover the Cost Share Contributions.

Upon Award signature, OSP forwards the completed CSA to GCA who enters the Cost Share information into Workday. The Cost Share grant worktag in Workday is the official record of the Cost Share Commitment.

There may be discrepancies between the CSA (created manually in Excel) and Workday (pulls data from the UW financial systems). In such cases, GCA will notify the department via Award Portal.

Managing Cost Share

Identifying Contributions

Once the Cost Share Commitment has been set up in Workday, it is the department's responsibility to ensure that Cost Share Contributions are identified, and the supporting information is submitted to GCA (as appropriate).

Cost Share Contributions are recorded on the Cost Share grant worktag in the following ways:

- Salary: A Workday payroll costing allocation using the appropriate Cost Share grant worktag. Salary will not be documented as cost share unless the individual has a payroll costing allocation in Workday to charge a percentage of their salary to the Cost Share grant worktag. A PAA could also be used to move salary to the Cost Share grant worktag.

- Non-Salary costs: The expenditure must have the appropriate cost share grant worktag associated with the cost in Workday. The non-salary cost will not be documented as cost share unless it is charged to the Cost Share grant worktag. This could also be accomplished through the use of an Accounting Adjustment.

- 3rd Party Cost Share: Department must submit a contribution letter to GCA via Award Portal.

- Subaward Cost Share: Department must submit invoices from subrecipient which state the Cost Share contribution from the entity to GCA via Award Portal.

- Unrecovered Indirect Costs (UIDC): Calculated and updated by GCA in Workday.

IMPORTANT NOTE: SALARY WILL NOT BE DOCUMENTED AS COST SHARE UNLESS THE INDIVIDUAL HAS A WORKDAY PAYROLL COSTING ALLOCATION FOR A PORTION OF THEIR SALARY TO THE COST SHARE GRANT WORKTAG OR A PAYROLL ACCOUNTING ADJUSMTENT MOVES THE SALARY TO THE COST SHARE GRANT WORKTAG.

Monitoring Balances

Cost Share Commitments, both Mandatory and Voluntary, are part of the Award agreement. This means that Commitments must be met and documented by the end of the Award.

Awards with Cost Share Commitments cannot be closed out with the Sponsor, or in the UW system, until all Cost Share Contributions are documented in Workday and the Contributions match the Commitment.

Use the Workday R1234 or the R1205 Report for your Award to monitor cost share commitments and contributions.

Best Practices

Monitor the Cost Share Contributions in Workday as Workday is the official record of all Cost Share Contributions. Use the R1234 or R1205 reports to monitor commitments and contributions.

Salary and other direct expenses must be charged to the Cost Share grant worktag in order for the costs to be documented as a Cost Share Contribution. Do not charge these costs to the Cost Share funding source; the costs must be charged to the Cost Share grant worktag. The funding source will be charged for the contribution via a reclass journal in Workday.

Monitor the Cost Share Contributions to determine if the Cost Share Commitment will be met. If it is anticipated that the Cost Share Commitment will not be able to be met, then the Sponsor may need to be contacted.

Monitor the linked funding sources to ensure 1) the desired funding source is being charged correctly, and 2) there are enough funds available to cover the applicable charges. GCA does not monitor funding sources linked to Cost Share grant worktags.

Post Award Changes in Commitments

Changes to Cost Share Commitments in Workday can either be made by GCA or may require sponsor approval.

Changes Made by GCA

- When there is a data entry error in Workday; and/or

- Cost Share Commitment types need to be rebudgeted, as long as there is not a change in the scope of the Award.

- Updating or revising Cost Share funding sources.

Changes That Require Sponsor Approval

Written sponsor approval is required to increase or decrease the total amount of the Cost Share Commitment. This is the case for both Mandatory and Voluntary Cost Share.

There is some confusion about why a change in Voluntary Cost Share requires sponsor approval, since the PI volunteered to provide the Cost Share. The proposal, including any Voluntary Cost Share, is a binding commitment made by the UW and is part of the Award agreement. If the University includes Cost Share in the proposal, then the Sponsor accepted that proposal with that commitment. The UW is thus committed to providing that Voluntary Cost Share. In order to change that commitment, the PI must obtain the sponsor’s written approval.

Departments should submit an OSP/GCA MOD in SAGE following these instructions for Cost Share Changes that require sponsor approval. Once documented sponsor approval has been obtained, OSP will approve the MOD in SAGE and send it to GCA for entry into Workday.

Removing Erroneous Commitments

GCA may remove a Cost Share Commitment from the UW systems if Cost Share has been erroneously identified in an Award. GCA will edit the Funding Action to remove the commitment and, if necessary, remove the Commitment from Workday. GCA will add a note to the Award's file to record the reason for the removal and who authorized it and will notify the department via Award Portal of the removal.

Sponsor Reporting

Cost Share is reported to the sponsor using either the sponsor’s requirements or UW’s standard reporting template.

The only time Cost Share is not reported to the Sponsor is if:

- A non-federal sponsor does not require reporting of Cost Share on the Sponsor’s template; or

- A federal sponsor specifically directs the UW not to report Cost Share (rare).

GCA only reports Cost Share Contributions up to the Cost Share Commitment amount. Any Contributions that exceed the Commitment amount are not reported to the Sponsor by GCA.

Close Out

Requirements

Per GIM 21 Cost Share is a binding requirement of an Award. Any unmet Cost Share at the end of the Award period may lead to a reduction in the total awarded amount made by the sponsor or may result in the PI providing the Commitment from other sources (even if unmet third-party Cost Share). The Cost Share Commitment must be met in order to close out the sponsored Award.