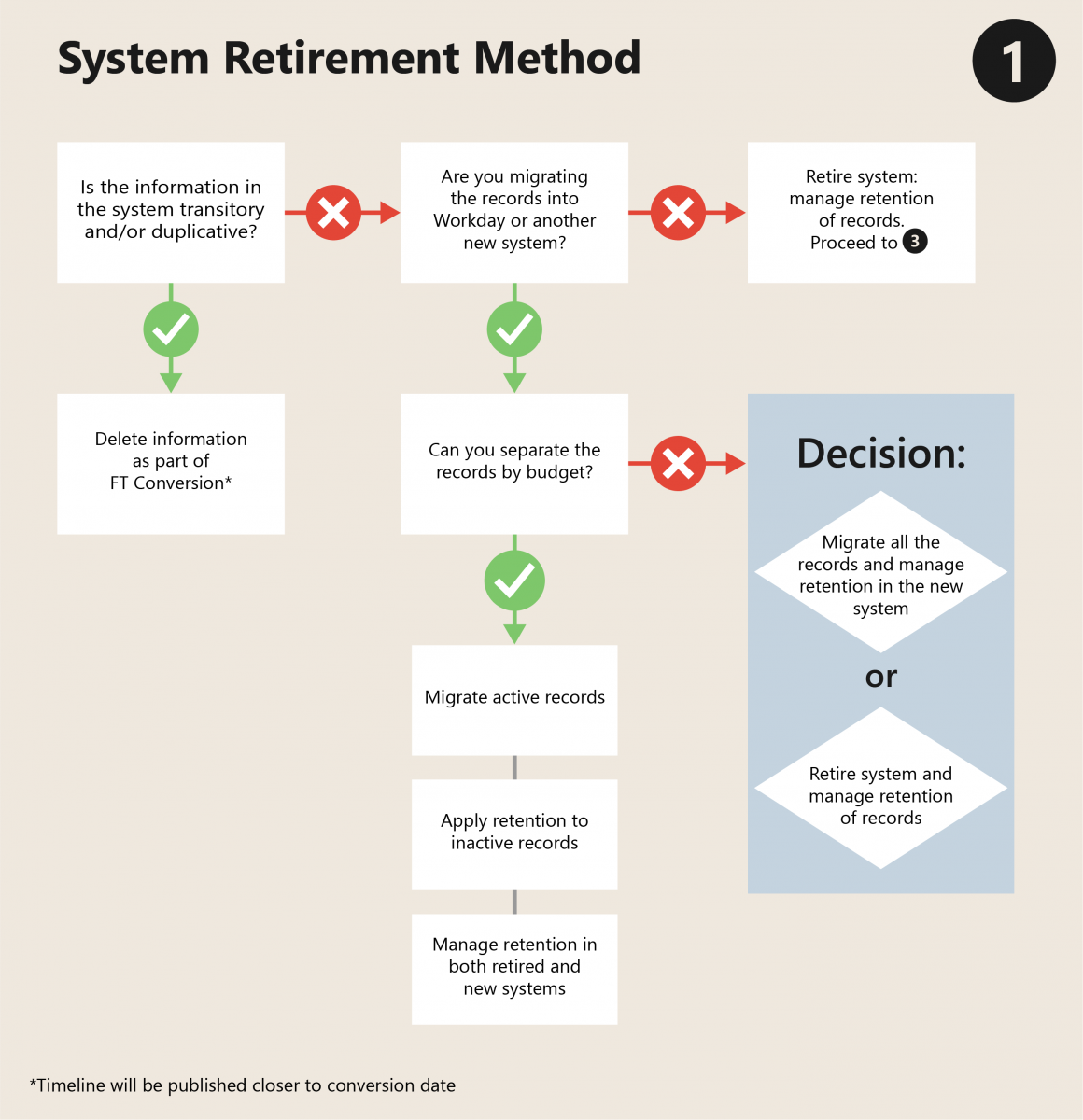

As part of the Finance Transformation initiative, most existing systems have been earmarked for either remediation or retirement as Workday and different supporting system replace their functionality.

The next step in this process is planning how the remediation or retirement of each system will occur. This includes identifying what records need to be kept in the existing system, what records can be deleted and what records will be migrating to another system. Remember, all records created or received by the University must be retained and be accessible for the legally approved retention period. This includes information in databases and other records stored in electronic repositories. The following are the recommended steps to categorizing each system and identifying a plan ensuring records are retained and accessible for the legally approved retention period.

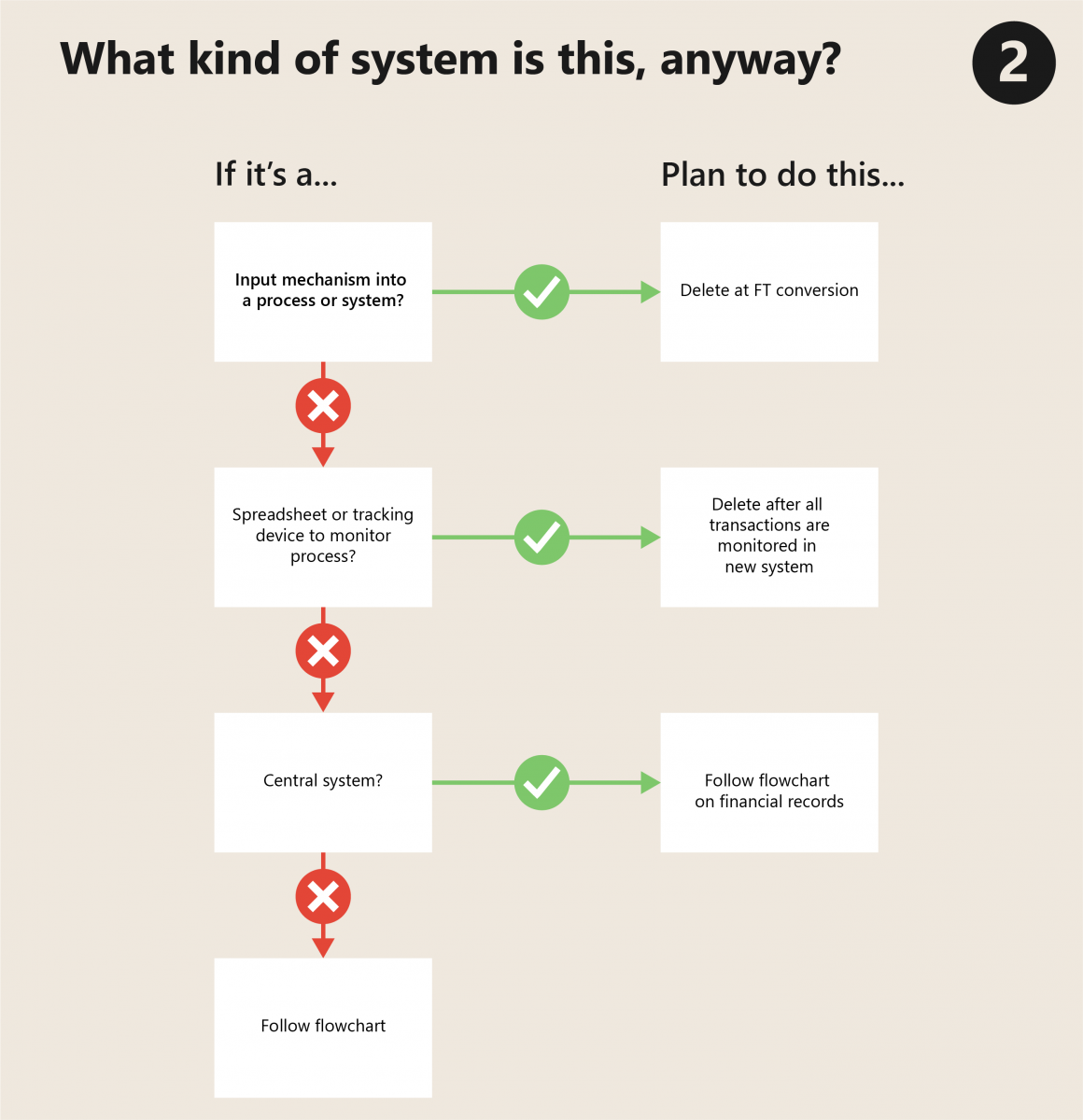

Place each system into one of five categories:

- Duplicative

- Transitory

- Retiring

- Migrating

- Hybrid of Migrating and Retiring

Duplicative: some systems maintain records that are duplicates of records found in a primary system. Does your department maintain a copy for ease of access? This is very common for example: Procard receipts that have been attached to ARIBA. However, the centralized systems of record will be retained for the full retention period of these records and you can begin making plans now to discontinue storing duplicates under the current process so that when WD Finance goes live, your office can transition to the new workflows and systems.

Transitory: some systems have been created to allow your department to move records from one location to another. Webforms is an example that many departments use. After the data is input into this transitory system, it is delivered to the system of record or workflow and resides there until its completion and end of retention. For the transitory system, the goal has been met; the data has been moved from one location to another. These intermediary records are considered transitory and can be deleted. Identify the date this system will be discontinued. Delete system in its entirety.

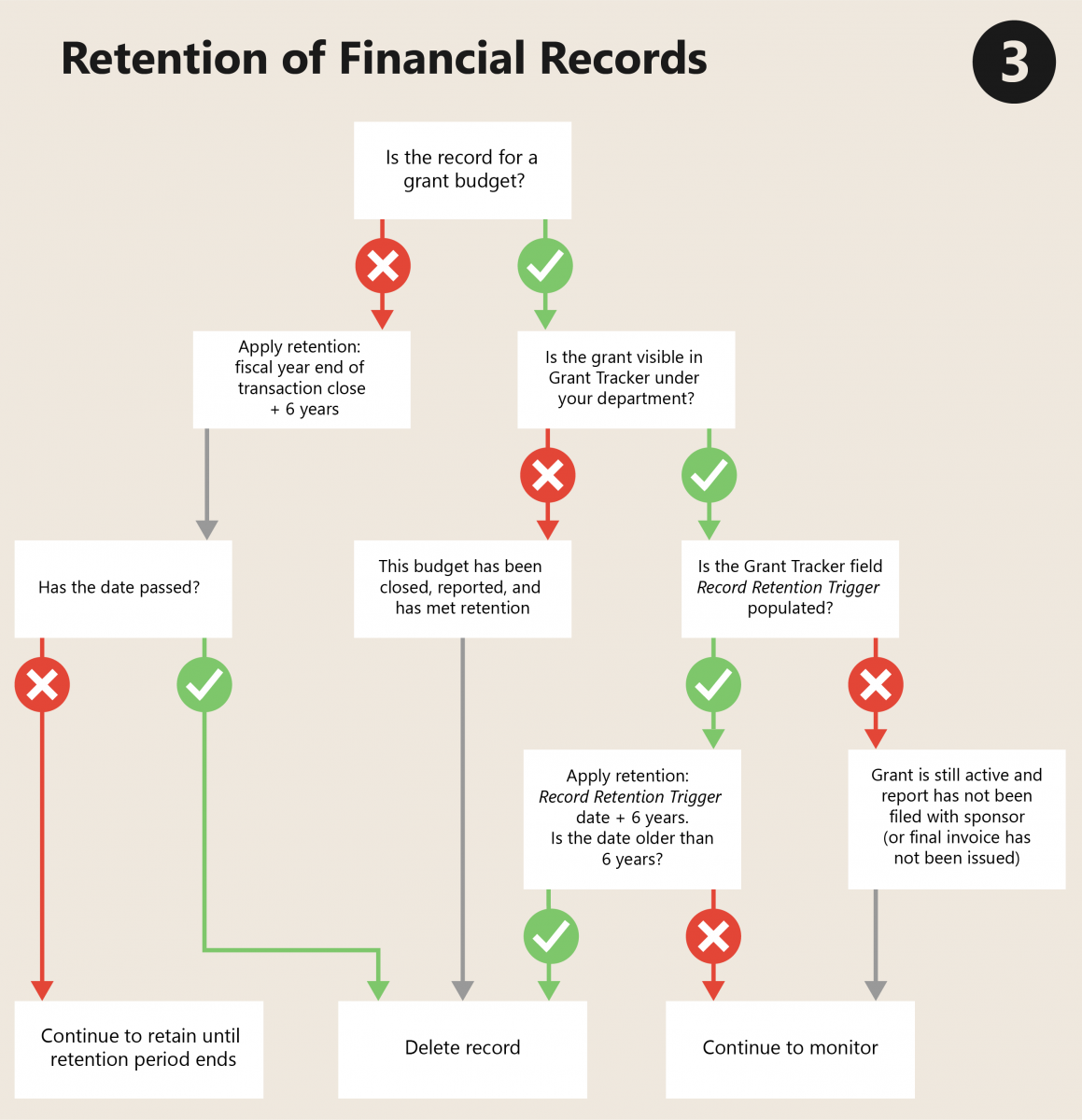

Retiring: System data will not be migrated but will still be maintained in the current system for business needs and compliance to records retention. All records must be accessible and be retained for the full retention period. Open transactions will processed and completed; however, no new transactions will be added to a retired system For most systems, records will fall into two categories:

- Grant budgets, and

- Everything else (state, revenue, gift, etc.)

For grant budgets, the retention is 6 years from the trigger date displayed in Grant Tracker. For non-grant budgets, the retention is simply 6 years after the end of the fiscal year. Identify the date for system retirement. Below is a more detailed guide.

Migrating: All system data with continuing retention requirements will be moved from an existing system to a new one. Identify the date this migration will occur. After ensuring all data has successfully been migrated, the initial system becomes duplicative and may be deleted.

Hybrid: Some records from the existing system will be migrated to the new system. The remaining records will be preserved and maintained for business needs and compliance to records retention as the old system is retired.

There are additional record categories which need to be managed:

- Reports

- Data Warehouse data sets

- MAA reports

- Contracts

- Assets

Known challenges:

- Systems which have records where there is a hybrid of migration and retirement

- Systematically applying retention to grant budget records

- Records which have more than one budget (and thus more than one trigger date).