Washington State Taxes

Information about state and local sales tax issues such as taxability of items, exemptions and deferrals.

- Tax Training - Classes offered by the UW Tax Office

- Purchasing Goods and Services - Tax information related to buying

- Use tax - Information about sales and use tax when using a revolving fund

- Selling Goods and Services - Tax information related to selling

- Exemption for Research Related Machinery and Equipment - Research related exemption

- Deferral for High Tech Research Related Building Construction - Research related deferral

- High Technology Deferral - University Policy and Procedure - Additional information about the high tech deferral

- High Technology Deferral Definitions

- Taxability and Suggested Object Code Grid

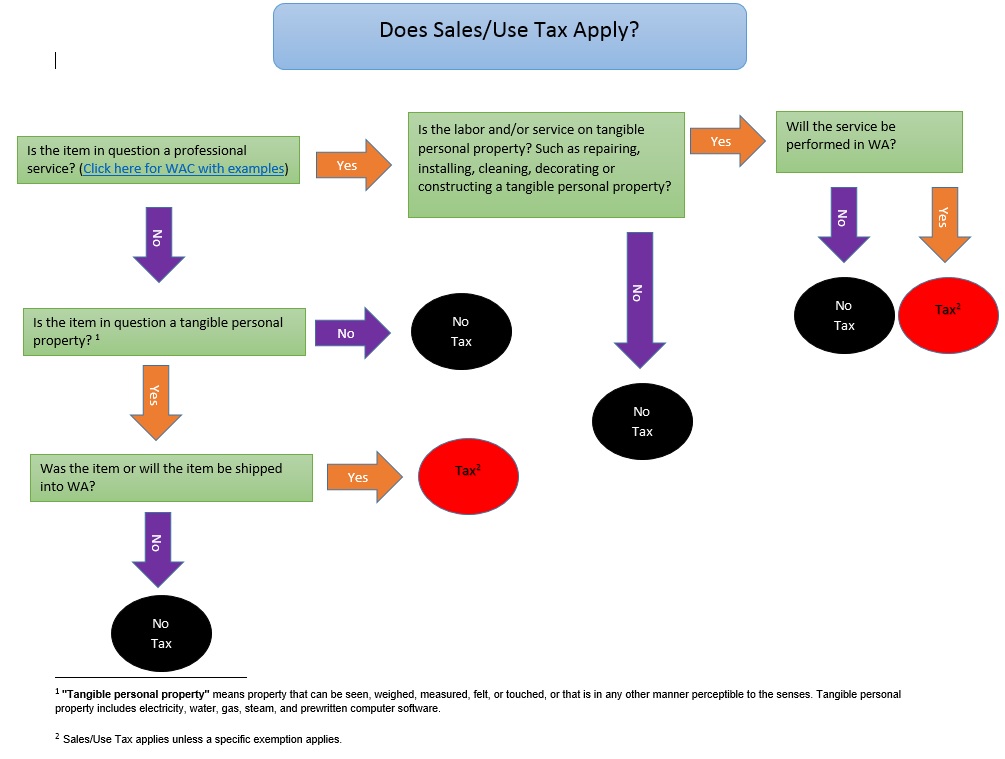

- Does Sales/Use Tax Apply? - Decision flow chart

Exemptions - Other States

While the State of Washington requires the University of Washington to pay sales tax, many states exempt certain entities from paying their state's sales tax.

- University Sales Tax Exemptions - Other States - matrix containing exemption certificates for various states

Federal Taxes

Information about Federal tax issues such as Unrelated Business Income Tax, Federal taxation of certain payments and other Federal tax matters.

International Taxes

Links to the Global Support page with information about Foreign National Payments and Taxation.

- ITIN FAQs - Individual Taxpayer Identification Number information

Miscellaneous Taxes

City of Seattle business license - The Seattle business license allows the UW to conduct business in the city.