At the University of Washington our mission promises to enhance lives everywhere – a goal that simply could not be achieved without endowed support. As lasting legacies, endowed gifts provide perpetual resources for students, faculty members, and university programs and services. They serve as the foundation upon which we build our success. While we can measure the CEF’s annual fiscal performance in this report, the impact that your gift will make in perpetuity is immeasurable.

Explore all report sections below

The University of Washington Consolidated Endowment Fund

Generous donors have created a lasting legacy

TOTAL ENDOWMENTS

IN CEF

NEW ENDOWMENTS ADDED

IN FISCAL YEAR 2025

FISCAL YEAR 2025

ENDOWMENT DISTRIBUTIONS

The impact is felt year after year,

generation after generation.

- UW Medicine 21

- Operating Funds 21

- Other Colleges/Programs 15

- Arts and Sciences 13

- Centrally Administered 6

- Engineering 9

- Foster School of Business 6

- College of the Environment 3

- School of Law 4

- Intercollegiate Athletics 2

Endowed gifts coupled with investment returns

resulted in the growth of the CEF.

ANNUALIZED RETURN OVER

THE LAST 20 YEARS

IN NET GROWTH OVER

THE LAST 20 YEARS

Impact

The impact of endowment gifts is evident in every corner of the University of Washington, from the inspiring faculty members who hold endowed professorships to the extraordinary students who choose the UW because of scholarships and fellowships.

Endowment Support by Purpose

- Student Support 29

- Faculty Support 21

- Other University Activities* 22

- Program/Academic Support 22

- Research Activities 6

* A portion of the University's operating funds is invested in the CEF. Distributions benefit campus wide programs.

Investment Performance

For the fiscal year ending June 30, 2025 (FY25) the University of Washington's CEF returned +12.4% versus +13.2% for the passive benchmark and +10.4% for the preliminary public university peer median. Global public equities had another year of strong performance in FY25 but saw a rotation away from US dominance. While the US showed continued strength, international developed equities outperformed, as did emerging markets led by a rebound in China.

The CEF had solid absolute performance across all portfolio strategies. Given the outperformance of international markets, the portfolio's geographic diversification was helpful. Performance relative to the passive benchmark lagged due to private market strategies trailing very strong public markets.

CEF Relative Performance as of June 30, 2025

| 1 Year - 1st Quartile | ||

|---|---|---|

| University of Washington: 12.4% | Cambridge Associates Median*: 10.4% | Passive Benchmark**: 13.2% |

| 5 Year - 2nd Quartile | ||

|---|---|---|

| University of Washington: 11.1% | Cambridge Associates Median*: 10.9% | Passive Benchmark**: 9.6% |

| 10 Year - 2nd Quartile | ||

|---|---|---|

| University of Washington: 8.3% | Cambridge Associates Median*: 8.1% | Passive Benchmark**: 7.6% |

| 20 Year - 1st Quartile | ||

|---|---|---|

| University of Washington: 7.9% | Cambridge Associates Median*: 7.3% | Passive Benchmark**: 6.8% |

* Preliminary Cambridge Associates Quarterly Survey of Public University Endowments of $1-$7 billion

** Passive Benchmark: 70% MSCI ACWI (Net) + 30% Bloomberg Intermediate Government Bond Index

Our focus remains on long-term results, where the CEF has maintained solid relative performance. The CEF returned 11.1%, 8.3% and 7.9% for the 5-, 10- and 20-year periods, respectively, and exceeded the passive benchmark for all periods. The UW's performance relative to public peers is first quartile for FY25 and above median for all longer-term periods.

Investment Strategy

The 20-year picture highlights remarkable growth for the endowment. The CEF grew from $1.4 billion to $6.0 billion during this time. In addition to new gifts totaling nearly $1.3 billion (net of fees), almost $2.7 billion of investment returns were distributed, primarily to support scholarships, faculty innovation and programmatic excellence.

CEF Asset Allocation - $6.0 Billion

as of June 30, 2025

| Capital Preservation - 25% |

|---|

| Fixed Income - 8% |

| Absolute Return - 17% |

| Capital Appreciation - 75% |

|---|

| Emerging Markets Equity - 9% |

| Developed Markets Equity - 44% |

| Private Equity - 18% |

| Real Assets - 4% |

| Opportunistic - 1% |

The CEF's $6.0 billion portfolio is diversified across two distinct investment categories: Capital Appreciation and Capital Preservation. Capital Appreciation investments are growth oriented and support the purchasing power of distributions over time. Capital Preservation investments are stability oriented and facilitate liquidity. As of June 30, 2025, 75% of the CEF was invested in Capital Appreciation and 25% in Capital Preservation.

Our long-term strategy is to favor an equity-oriented portfolio and we plan to continue to increase our equity exposure over time with a focus on private investments. We continue to target ample liquidity within Capital Preservation to meet the CEF's funding requirements.

Spending Policy

The CEF Investment Policy's spending rate distributes quarterly to programs based on an annual percentage rate of 3.6%, applied to the 20-quarter (5-year) rolling average of the CEF's market value. Additionally, the CEF Investment Policy allows for an administrative fee of 0.90% supporting campus-wide fundraising and stewardship activities and offsetting the internal cost of managing endowment assets.

In June 2025, the University of Washington Board of Regents approved a change to the University's CEF spending policy effective July 1, 2026. This update will allow for greater support of the UW's mission while continuing to safeguard the long-term health of the endowment pool. The distribution rate will change from 3.6% to 4.0% to increase support for campus programs. To ensure a smooth transition the changes will be implemented gradually over several years. This means more funding will be available for student scholarships, faculty excellence, research and academic programs, in line with each fund's purpose. The administrative fee will be reduced from 0.90% to 0.75%, ensuring more of each endowment dollar goes directly to its intended purpose. The reduced fee will continue to support University-wide fundraising, stewardship activities, and the costs of managing the CEF. The timing and administration of these spending policy changes will be finalized by the Board of Regents in spring 2026.

Absent a major market correction or prolonged downturn, endowment distributions are still projected to increase at least into FY26, as FY21 performance (+35.1%) continues to factor into the 20-quarter rolling average spending formula. University of Washington Investment Management Company (UWINCO), along with Senior Administration and the regents, will continue to closely monitor spending to ensure alignment with projected longer-term returns and best practices.

To learn more about the upcoming changes to the spending policy and the impact of the 20-quarter rolling average, please visit https://uw.edu/giving/cef-faq.

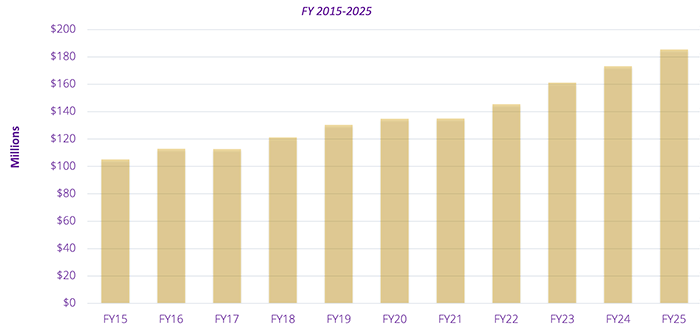

Investment Distributions vs Returns - Fiscal Year 2015-2025

| Fiscal Year | Returns | Yearly Payouts |

|---|---|---|

| FY15 | 7% | 3.21 |

| FY16 | -2% | 3.31 |

| FY17 | 14% | 3.38 |

| FY18 | 10% | 3.52 |

| FY19 | 6% | 3.64 |

| FY20 | 1% | 3.62 |

| FY21 | 35% | 3.55 |

| FY22 | -6% | 3.63 |

| FY23 | 6% | 3.80 |

| FY24 | 11% | 3.90 |

| FY25 | 12% | 4.09 |

The Power of Investment Returns

and a Prudent Spending Policy

The generous $200,025 gift from Samuel and Althea Stroum, invested in 1995, has provided powerful long-term impact. This fund has distributed over $490,000 in support of students with disabilities and still has a market value five times more than its original value.

UW Endowment Impact

As of June 30, 2025

Samuel and Althea Stroum Endowed Fellowship in Business Administration

Endowment value creation

since April 1, 1995 inception

Endowment Purpose

The Stroum fellowship was established to ensure the Foster School could attract and support graduate students to become future leaders within private and public sector roles where business training is vital. Since its inception, the fellowship has provided academic year funding to more than 70 high-achieving students.

Endowment Current Impact

Currently supports three full-time MBA students who are actively engaged in rigorous coursework, while also gaining hands-on experience through internships with local technology-driven companies, and contributing to the UW community through various student organizations.

Further Information

For further information on the University’s investment programs, please visit: http://uwinco.uw.edu

For endowment information, please visit: http://finance.uw.edu/treasury/CEF

If you have any questions or comments about this report, or would like copies of the Consolidated Endowment Fund investment policies, please contact:

Keith Ferguson

Chief Investment Officer

206-685-1822

invest@uw.edu

Robert Bradshaw

Senior Associate Treasurer

206-221-6752

robertcb@uw.edu

Endowment Giving

If you would like to receive information on how you can support the University’s programs, please contact:

Mary Gresch

Senior Vice President for University Advancement

President, UW Foundation

mgresch@uw.edu

View & Download Annual CEF Reports for Prior Fiscal Years