Workday Budget Dates

Definition of Budget Date

Workday transactions have many different dates associated with them that drive when transactions post, are incurred, and how they are treated if posted to a sponsored program award. For sponsored program awards, there are two key dates: the Budget Date and the Accounting Date.

Budget Date: The date the transaction is recognized or incurred. The Budget Date has several purposes specific to sponsored program awards including:

- To determine if an expense is allocable to a sponsored program award. If the Budget Date falls within the award line start and end dates, it is allocable to the award. If the Budget Date falls outside of the award line start and end dates, it is not allocable to the award.

- To determine whether the expense will be billable to the sponsor. If the Budget Date falls on or within the award line start and end dates, it will be eligible to be reimbursed by the sponsor. If the Budget Date does not fall within the award line start and end dates, it will not be billable to the sponsor.

- To determine the applicable Facilities and Administrative rate (F&A) that the UW has negotiated with the US Department of Health and Human Services. These rates can change over time so the Budget Date dictates which F&A rate will be applied.

Viewing Budget Dates in Workday

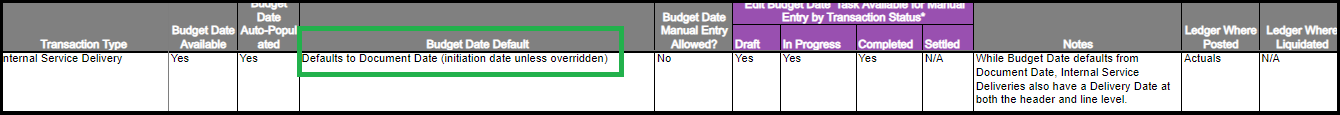

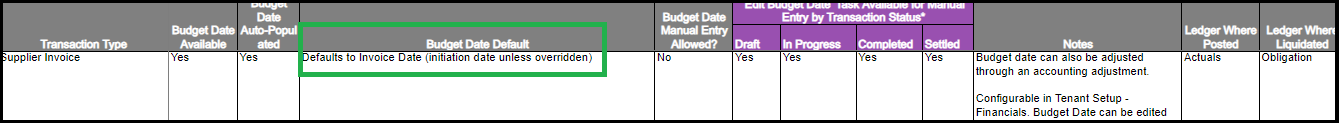

The Budget Date may be manually entered or automatically generated by Workday, depending on the transaction. The Budget Date in Workday shows each Workday transaction type, how the Budget Date is selected, and whether the Budget Date can be edited once the transaction is settled.

The following examples show how to determine the Budget Date for two different transaction types.

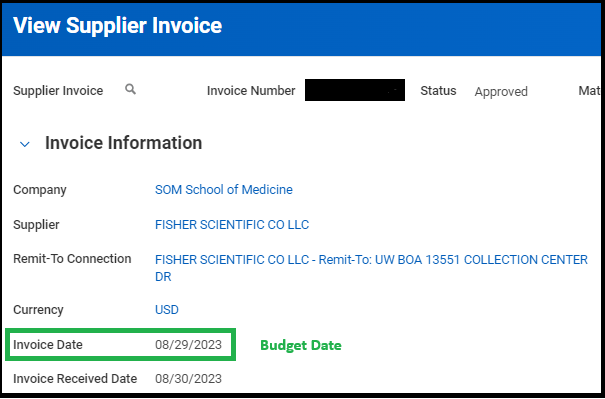

Example 1: Find the Budget Date for a Supplier Invoice

Step 1: Go to the Budget Date in Workday spreadsheet and find Supplier Invoice in the Transaction Type column. The Budget Date Default column indicates which field is used as the Budget Date. For a supplier invoice, the Invoice Date is used as the Budget Date.

Step 2: View the supplier invoice transaction in Workday and locate the Invoice Date. In the following example, the Invoice Date is 08/29/2023. This means that the Budget Date is 08/29/2023.

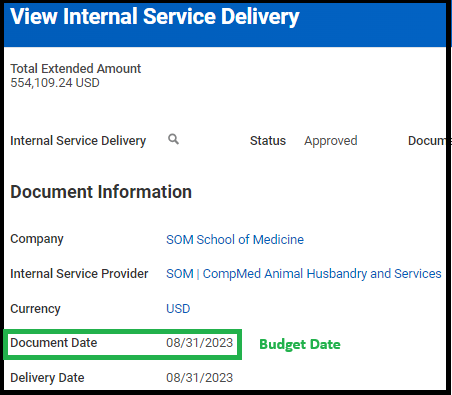

Example 2: Find the Budget Date for an Internal Service Delivery transaction

Step 1: Go to the Budget Date in Workday spreadsheet and find Internal Service Delivery in the Transaction Type column. For an Internal Service Delivery transaction, the Document Date is used as the Budget Date.

Step 2: View the Internal Service Delivery transaction in Workday and locate the Document Date. In the following screenshot, the Document Date is 08/31/2023. This means that the Budget Date is 08/31/2023.

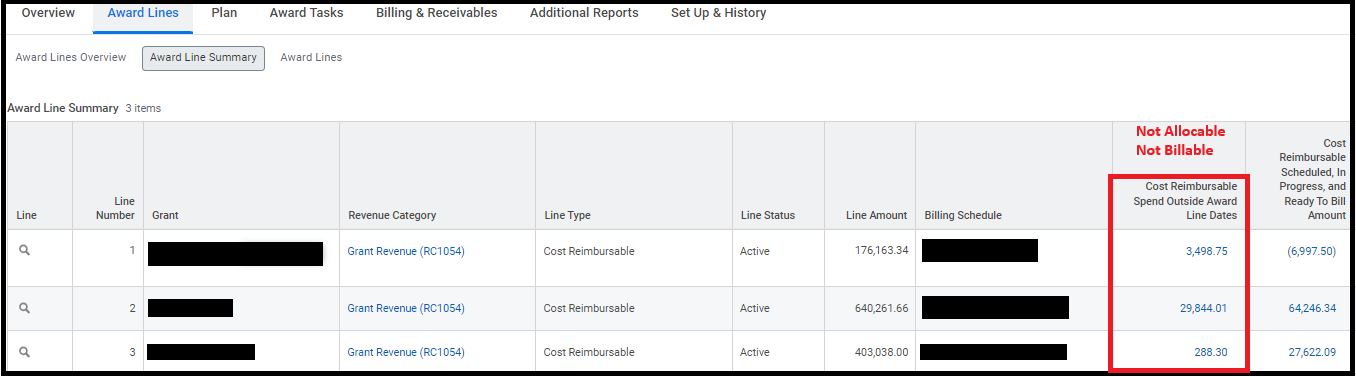

Viewing Spend Outside Award Line Dates

The Workday award structure view makes it easy to see when expenses have posted outside the award line dates. In the Award Lines Summary of an award, the column named Cost Reimbursable Spend Outside Award Line Dates displays expenses that have Budget Dates that fall outside if the award line start and end dates. Expenses that appear in this column are not allocable to the award and will not be included in sponsor invoices or letter of credit drawdowns.

It is important that campus units monitor these expenses regularly to ensure that they are either transferred from the grant worktag or that the Budget Date is corrected to fall within the award line start and end dates.

Correcting Budget Dates in Workday

Campus units can correct the Budget Dates on certain transaction types. To determine whether the Budget Date can be edited, refer to Budget Date in Workday go to the column named Budget Date Manually Entry Allowed. A "Yes" in this column means that the Budget Date can be corrected, either by a campus unit or by GCA.

Campus units, along with their Shared Environments, can edit the Budget Date on the following settled transactions:

- Expense Reports

- Procurement Card Transactions

- Supplier Invoices (fully paid or partially paid)

- Supplier invoice adjustments

Details on how campus units can adjust budget dates are included in the Adjust Accounting – Update Budget Date on Transaction job aid.

If the transaction type is not one that a campus user/Shared Environment can edit, submit an Award Portal ticket using the “Other” topic. Include the transaction's spend category, dollar amount, the original Budget Date, the correct Budget Date, and confirm that the expense is allocable to the award. GCA will update the Budget Date in Workday on behalf of the campus unit.

Transaction Reversals and Budget Date Impacts

If a campus unit determines that a transaction needs to be adjusted or transferred from the grant, choosing the correct Budget Date is critical for the transaction to be allocable to the award, eligible for reimbursement, and for the appropriate F&A rate to be applied.

Example 1: Transaction's Budget Date is Outside Award Line Period for a Posted Expense

| Award Line Period | Original Budget Date | Date of Correction | Action Needed |

|---|---|---|---|

| 1/1/2025-12/31/2025 | 12/31/2024 | 3/30/2025 | Accounting Adjustment |

The original entry was not allocable to the award or eligible for reimbursement because the Budget Date fell outside of the award line period. If the transaction's Budget Date is incorrect, the campus unit would adjust the Budget Date to fall within the award period.

Example 2: Transaction's Budget Date is Within Award Line Period for an Expense Transfer

| Award Line Period | Original Budget Date | Date of Correction | Action Needed |

|---|---|---|---|

| 1/1/2025-12/31/2025 | 2/15/2025 | 3/1/2026 | Manual Journal |

The original entry posted within the award line period and had previously been billed to the sponsor. If the Date of Correction is used as the Budget Date when transferring the expense from the grant, the credit would not be billable to the sponsor, which would result in an overstatement of expenses. To avoid this issue, it is recommended that the same Budget Date of 02/15/2025 be used.

Workday Accounting Dates

Definition of Accounting Date

Accounting Date: The date the transaction or adjustment was processed. It controls the accounting period and fiscal year in which the transaction is recorded in the general ledger. This impacts when a transaction appears on certain Workday reports such as the Grant Budget vs Actuals report (referred to as “R1234”).

* Accounting Date can generally be edited on most transactions up until the date the month has closed.

Accounting Date Impacts on R1234

GCA uses the R1234 and the Cost Reimbursable Line Status Report to determine expenditures by period. The Accounting Date determines when and whether the transaction appears on both reports.

The following examples help illustrate how the R1234 report works in three different scenarios.

Example 1: Accounting Date falls within the Award Line Period

| Award Line Period | Transaction Accounting Date | Transaction Budget Date | Treatment on R1234 |

|---|---|---|---|

| 1/15/2025-12/31/2025 | 1/15/2025 | 1/15/2025 | Appears in January 2025 |

The transaction’s Accounting and Budget Dates were both within the award line period so the transaction posted correctly and will display in January 2025.

Example 2: Accounting Date is before the Award Line Period start date

| Award Line Period | Transaction Accounting Date | Transaction Budget Date | Treatment on R1234 |

|---|---|---|---|

| 1/15/2025-12/31/2025 | 1/1/2025 | 1/15/2025 | Will appear in January 2025 if pre-award spend period exists |

If the Award Calendar in Workday shows a Pre-Award period that includes the Accounting Date, the transaction will display in January 2025. If a Pre-Award period does not exist in Workday, submit a GCA Only SAGE Modification Request requesting that a Pre-Award Spend period be added. GCA will confirm that pre-award spending is allowed by the sponsor and update the Workday Award Calendar so the transaction appears on the R1234.

Please send an Award Portal ticket using the "Other" topic if you have an expense that posted to a grant worktag but isn’t appearing on the R1234 so we can review the expense and award and provide the appropriate guidance.

Example 3: Accounting Date is after the Award Line Period End Date

| Award Line Period | Transaction Accounting Date | Transaction Budget Date | Treatment on R1234 |

|---|---|---|---|

| 1/15/2025-12/31/2025 | 2/15/2026 | 12/31/2025 | Appears in Life to Date Column |

The transaction will appear in the Life to Date column of the R1234. The R1234 report was built to include expenditures that post after the award line period end date.