Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

Award Setup

GCA uses the SAGE Budget worksheet to populate the Workday award plan. We need the SAGE Budget worksheet total to match the amount on the award document to the penny. For Award Setup Requests, SAGE Budget feeds the award amount automatically to Workday so it needs to be exact!

On the other hand, GCA doesn’t need SAGE Budget to be broken down by person or broken down to the sub-object code level, unless the sub-object code is exempt from F&A.

If you are trying to get your SAGE Budget to match the award amount, please refer to the Guidelines for a Budget Difference Between the SAGE Award Budget and the Sponsor Award job aid for help.

Interest is only available to awards where the sponsor pays in advance (scheduled payments or in full) and the agreement states that interest is required. Your award agreement may include the following (or similar) language. For example:

Interest is calculated as the interest rate provided by UW Treasury multiplied by the average monthly cash balance (i.e. cash receipts less expenditures).

GCA does not receive a notification from SAGE when a comment is added to a Award Setup Request, Modification Request or Advance Request. GCA periodically reviews items that have been returned to campus for activity.

Individuals who have the Workday Grant Manager security role automatically become an Award Portal contact for that grant worktag. If you are not listed as an Award Portal contact, check your Workday security role to make sure you are listed as a Grant Manager.

If you are not a Grant Manager, and you should be, complete the Provision security roles for UW Academy/Enterprise Finance Security Access request form available in UW Connect Finance.

You can also add an Award Portal contact by following the instructions in the Managing Campus Contacts in Award Portal job aid.

If you see that the Salary Over The Cap (SOTC) Basis worktag is not set up in Workday, send an Award Portal ticket to GCA with the following:

Topic: Other

Subject: Missing Salary Over The Cap Basis Worktag

Description: Please complete an award correction given the Salary Over The Cap Basis Worktag is missing for GRXXXXXX.

Cash Received

The revenue amount displayed in FIN and MyFD corresponds to the grant/contract award amount. The revenue displayed in FIN often does not correspond with cash received on the project. If a grant or contract is prepaid (paid in advance) then the revenue most likely will correspond to the cash received. However, if the grant or contract is invoiced, then the cash received will correspond to invoices the sponsor has paid to date and will not match the revenue amount displayed in FIN.

Information regarding cash related to a particular budget can be found on the GCA (Grant and Contract Accounting) Grant Tracker. All GCA budgets can be viewed online through Grant Tracker. You can search by various criteria, including budget number, grant number, and PI. One of the items displayed on Grant Tracker is a list of payments received from the budget’s sponsor. Grant Tracker can be found at: /gca/grant-tracker-welcome

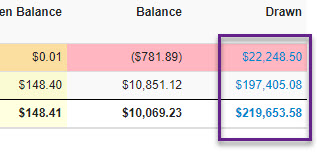

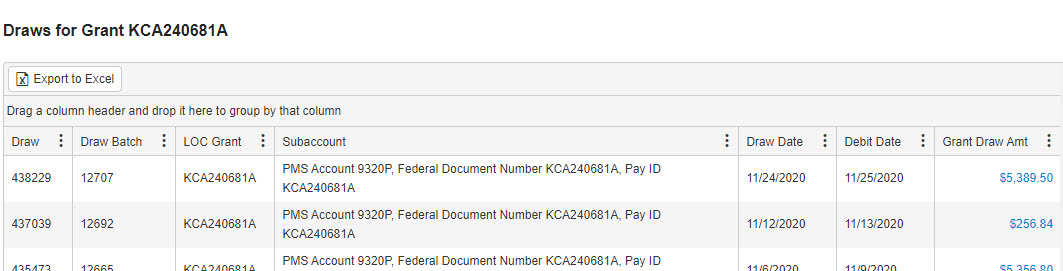

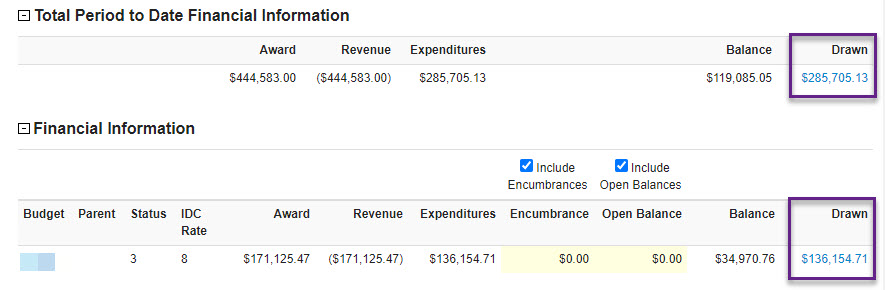

This information is available on the Grant Tracker Budget Information page. Clicking the number in the Drawn column in the Financial Information section will pull up a current report:

Note that drawdown reports are available for the parent and any sub budgets separately or combined. If the award is a multi-year project that receives a new budget number each year, you may you view drawdown reports for the current period or for the award period as a whole.

Please send the check to GCA and let us know how much is for each budget. GCA will apply the payment to the award budget and loop in Banking & Accounting to apply the payment to your non-award budget

Clinical Trials

Checks for industry-sponsored Clinical Trials should be sent directly to GCA. In order for GCA to be able to apply the payment appropriately, the following information must be included with the check:

- Budget Number

- Principal Investigator

- Sponsor

- Study Title

- Administrative contact

The check, along with the required information above, should be sent to:

UW Grant and Contract Accounting

4300 Roosevelt Way NE, Suite 300

Box 354966

Seattle WA 98195-4966

Payments posted on a Clinical Trial budget can be viewed using Grant Tracker.

Please forward the email notification to gcacash@uw.edu. If the following information is not shown in the notification, please add it:

- Budget Number

- Principal Investigator

- Sponsor

- Study Title

- Administrative contact

The Cash Team will claim the payment and apply it to the budget. Payments posted on a Clinical Trial budget can be viewed using Grant Tracker.

Closing

GCA begins the closing process after the Final Action Date has passed, any final reporting and/or invoicing requirements have been met, and all sponsor payments have been received. The department can request an early closeout via Award Portal.

Our goal is to close a grant worktag within 120 days of its end date. However, closeout may be delayed by a variety of unresolved issues. Visit our Closing Your Award webpage for more information on what GCA needs.

An accounting adjustment must be used if an expense posted to the grant worktag is unallowable per the terms of the award agreement. GIM 15 outlines the policy for accounting adjustments on sponsored program awards.

A deficit transfer is appropriate when all expenses are allowable and total expenses exceed the award amount or the amount of cash received from the sponsor.

Deficit transfers and accounting adjustments both pose audit risks to the University of Washington:

- Deficit transfers can indicate that an award may have been mis-managed when overspending occurs

- Accounting adjustments can represent an audit risk for the University

- Multiple transfers indicate continuous errors

- Transfers of expenses after 90 days from posting indicate reconciliation issues and potential internal control weaknesses

In most cases, the answer is "no." However, the answer is "yes" if your award falls into one of the following categories:

- a clinical trial award

- a firm fixed price contract

- has written sponsor approval to keep the unspent the balance

Unspent balances from sponsored program awards must be transferred to a residual balance worktag. Please give GCA your residual balance worktag, and we will transfer the balance when we close the award line. If the surplus is greater than 25% of the award amount, you must confirm that all the work has been completed and provide a justification. (In rare cases, surpluses in budgets other than clinical trials or fixed price contracts may be retained, but only with explicit written authorization from the sponsor.)

If you need a new residual balance worktag, follow the process in the Worktag Template UW connect article. If you have a question about residual balance worktags, contact the UW Finance Operations (Fin Ops) team.

Visit our Closing Your Award webpage for more information.

It depends on the sponsor and the award. Please review your award agreement and/or sponsor policies for more information. If they are silent on carryforward, GCA will require written sponsor authorization to carry a balance or deficit forward.

If for any reason your sponsor is cutting off your project before the original, agreed-upon end date, or if your PI is leaving UW employment and transferring their grants to their new institution, you must work with OSP to create an Early Termination SAGE Modification Request.

GCA cannot update the award line's end date or send the sponsor a final report or invoice until we receive the MOD. In the absence of such a MOD, we are obliged to follow the original final reporting or invoicing schedule. However, we can immediately put the award line in a status to prevent additional transactions from posting. You can request a status change and inform us of the early termination via Award Portal.

Know your Final Action Date (FAD), which is displayed on Grants tab in Award Portal. If any charges have not posted on or before that date, you MUST notify GCA of the charges by that date, or we will not be able to include them in the final report or invoice, and the charges will become a deficit to the department.

If you are expecting a no-cost extension or a supplement/extension (adding additional funds to the budget), you may notify GCA in Award Portal. We will then flag the budget to prevent it from being fully closed. However, we cannot extend the end date unless we receive an Extension SAGE Modification Request (MOD) or a Supplement/Extension MOD from OSP.

If you are confident you will receive the extension but expect sponsor approval to be delayed, you may ask OSP to provide an Temporary Internal Extension MOD to extend the end date with a department guarantee worktag as backup in case the extension is denied.

A grant worktag with a short window for final invoicing and/or reporting will generate an early Final Action Date (FAD). Most sponsors allow 60-90 days after the award line's end date to complete final invoicing or reporting, which generates a FAD over a month after the end date.

However, if the sponsor allows 30 days or fewer, the FAD window will also be short. GCA recognizes that this short turn-around time produces challenges for departments, especially for Procard charges, travel reimbursements, subaward invoices, and other charges where expenditures post after they are incurred. However, if you follow the procedure below for pending charges, credits, or transfers, we can incorporate these transactions.

If your grant's Final Action Date (FAD) is approaching or has already passed, please notify GCA of any pending charges ASAP via Award Portal. This will allow us to incorporate the charges into our final invoice and/or report. If the charge is for a pending supplier invoice, including subawardees, please use the Pending Supplier Invoice topic for your ticket.

If the final invoice or report has already been issued, you will also need to provide written sponsor confirmation that they will accept a revised final invoice or report.

Visit GCA's deficit webpage for the list of worktags that can receive a deficit.

Self-sustaining, gift, and recharge worktags cannot receive a residual balance. The residual balance worktag must have resource worktag RS100184 and fund worktag FD108.

GCA can reverse the residual balance transfer journal and issue a sponsor refund.

To transfer a deficit from the ICR worktag to a different worktag, send a request to your Shared Environment to create a manual journal entry. Please refer to the UW Connect article Shared Environment Customer Support Manual for more information.

Contacts

Budget information is available to on-campus users for all GCA budgets via Grant Tracker. You can search by various criteria, including budget number, grant number, and PI. You can ask questions through Grant Tracker itself or by calling GCA's main phone number, 206-616-9995. If your request isn't related to a specific budget or is for multiple budgets, you may instead email us at gcahelp@uw.edu.