This webpage has been updated with Workday-related content.

Description/Definition

The University of Washington deposits all cash received for sponsored program awards into UW bank accounts. This cash subsequently earns interest, or the UW may also invest it. The UW uses the term "interest income" to refer to the income earned from both bank interest and investments. The UW Treasury office administers the policy for the distribution of interest income earned by sponsored program awards.

This webpage contains information about the interest income process in Workday. For information about interest income applied in the previous financial system, FAS, please contact GCA.

Process Overview

The Office of Sponsored Programs (OSP) notifies Grant & Contract Accounting (GCA) that an award is eligible to earn interest income by selecting the Interest Income on the Terms and Conditions section of the ASR. This is typically stated in the sponsor’s award document and is most common for awards where the sponsor remits payments on a set schedule.

GCA adds the Interest Income special condition to the Workday award.

GCA then creates a new award line specifically for the interest income revenue. This allows the activity to be excluded from sponsor invoices.

The Interest Income special condition is also visible in Award Portal.

Applying Earned Interest

Annual Distribution

Every year, after May 31, Finance, Planning and Budgeting performs an automatic computation to determine how much interest income the University will distribute to the awards eligible to receive interest income. The applicable rate is multiplied by the average monthly cash balance of the budget for the number of months the budget was active during the period between June 1 and May 31, and the interest is posted by journal to Workday in the month of June.

Ad Hoc Distribution

After an award expires, GCA will prepare and post a final interest income journal so interest revenue is reflected accurately on any final financial reports or other closeout documents.

Materiality

In both cases above, the minimum amount of interest applied is $50.

Monitoring Interest Revenue in Award Portal

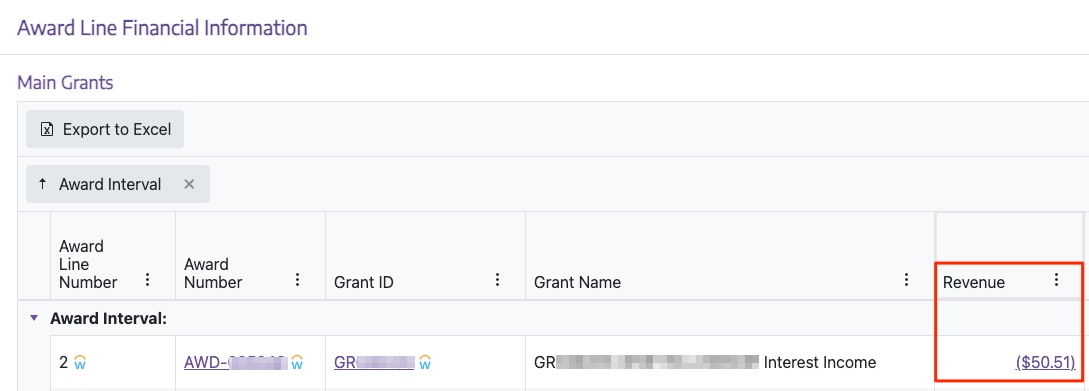

You can see the interest earned by going to interest award line in Award Portal then to the Revenue column. The Revenue column is on the far right side of the row by default and has been moved up for the following screenshot.

Managing Earned Interest

Campus units are highly encouraged to periodically transfer allowable expenditures to the interest income award line during the life of the award. This ensures that the interest revenue is consumed before the sponsored program funding.

Closing an Award with Interest

Most sponsors allow earned interest to be used towards the award and usually allow UW to retain interest-only balances, but not always. If there is unspent interest at closeout and it is not clear if we can retain or need to return the funds to the sponsor, GCA will reach out to the sponsor for clarification.

If there is unspent interest at the end of the award, GCA will ask the campus unit to transfer expenditures from the primary award line to consume the unspent interest before closing the award.

Converted Awards with Interest

The interest income process used in FAS differs from the process in Workday. For converted awards, interest applied in FAS (up through and including FY23) is available on the primary award line. Starting in FY24, interest revenue is added to the interest income award line.

Contacts

- Contact the Treasury Office if you have any questions about the current interest rates applied to eligible sponsored program awards. Treasury Office: 206-543-3524; invest@uw.edu

- Contact the Office of Sponsored Programs if you believe that a sponsored program award is eligible to receive interest income, but the ASR did not indicate that and there is no special condition or award line in Workday. Office of Sponsored Programs: 206-543-4043; osp@uw.edu

- Contact GCA if you believe that a sponsored program award is eligible to receive interest income and the ASR has interest income selected but there is no special condition or interest income award line in Workday. Grant and Contract Accounting: 206-616-9995; gcahelp@uw.edu