The transition to the University's new financial system, Workday Finance, has changed several post-award processes and the products that are sent to our sponsors. This webpage provides information about those changes for organizations that provide sponsored program awards to the University of Washington. Please send questions to gcahelp@uw.edu.

Cost Reimbursable Invoices

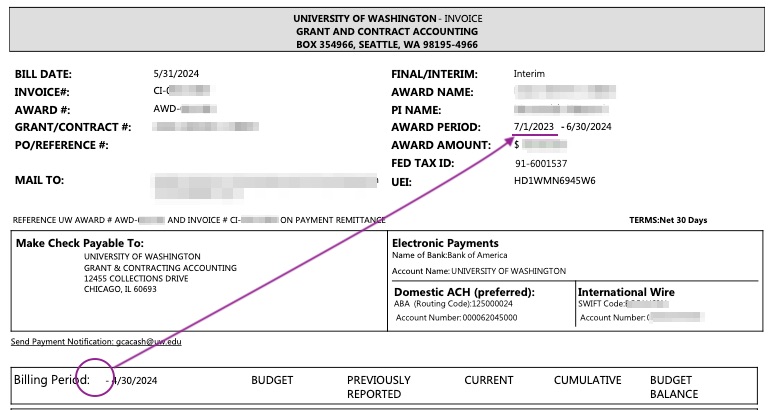

Billing Period Start Date

We implemented a process change to only display the Billing Period Start Date in certain circumstances. This allows the invoice to be generated automatically and ensures invoices are generated timely.

For invoices that have no Billing Period Start Date, the Billing Period Start Date that applies to that invoice is the Award Period Start Date, which is located in the invoice header.

This screenshot is of a standard cost reimbursable invoice where the Billing Period Start Date is missing. The Award Period Start Date, displayed in the invoice header, is 7/1/2023 so the Billing Period Start Date is 7/1/2023.

Award Period and Pre-Award Spending

When a sponsor allows expenses to be incurred before the award’s official start date, the Award Period on a standard University invoice will include the approved pre-award spending period. This allows the Principal Investigator to post expenses during the pre-award spending period in Workday Finance.

For example, the award in the following invoice screenshot has an official start date of January 12, 2024, and a pre-award spending period of October 15, 2023 - January 11, 2024.