Overview

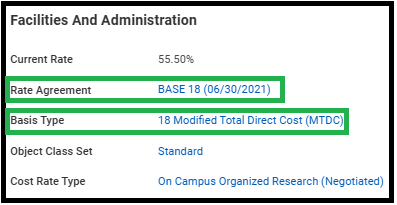

Workday has introduced the concept of Rate Agreement, and while Basis Type is very similar to prior state, both are necessary elements to set up an award in Workday. This webpage defines these elements and explains how each is used.

Rate Agreement

In Workday, a grant rate agreement, also known as a Facilities and Administrative (F&A) or indirect cost rate, is a negotiated rate between the University of Washington and the sponsor that determines the percentage of direct costs for awarded funds to be used for funding indirect costs associated with sponsored program awards. These rates are used to calculate the amount of indirect cost that can be charged to a sponsored program award.

For the University of Washington, Management Accounting and Analysis (MAA), is responsible for submitting the F&A rate proposal to DHHS. MAA negotiates rates with the Department of Health and Human Services (HHS) approximately every four to six years. Rates are negotiated and are dependent on the activity type associated with the sponsored program award.

When setting up a new award, GCA reviews the award document to ensure that the correct rate agreement is selected in Workday. If the sponsor awards an F&A rate that is lower than the negotiated rate, GCA will select the rate agreement that is applicable to the activity type and enter the F&A rate in Workday that matches what the sponsor awarded.

Basis Types

In Workday, the Basis Type refers to which direct expenses F&A can be applied to. The most common basis type is “Base 18 Modified Total Direct Costs (MTDC)”, which matches the federal base outlined in the Uniform Guidance. This basis type excludes the following direct costs from F&A: equipment, capital expenditures, charges for patient care, and tuition remission, rental costs, scholarships fellowships, participant support costs, as well as the portion of each subaward in excess of $25,000.

GCA will create a new basis type when five or more awards have the same basis type. If the basis type does not exist in the SAGE Budget worksheet settings, the Custom type can be used to manually select the object classes the F&A is applicable to. If you have questions about creating custom bases in SAGE Budget please refer to the Office of Research's webpage describing How to Make a Custom Base Type in SAGE Budget.

Workday Basis Types

The section below is a complete list of Workday Basis Types and the object classes that are subject to F&A.

- 01 Salaries and Wages

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

Exemptions:

-

Standard: 03_Fringe_Benefits

-

Standard: 04_Personal_Service_Contracts

-

Standard: 05_Other_Contractual_Services

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 08_Subaward

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 11_Other_Outside_Contractual_Services

-

Standard: 12_Travel

-

Standard: 13_Supplies_and_Materials

-

Standard: 14_Software

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 17_Scholarship

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 02 Salaries & Wages and Benefits Only

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

Exemptions:

-

Standard: 04_Personal_Service_Contracts

-

Standard: 05_Other_Contractual_Services

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 08_Subaward

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 11_Other_Outside_Contractual_Services

-

Standard: 12_Travel

-

Standard: 13_Supplies_and_Materials

-

Standard: 14_Software

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 17_Scholarship

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 03 Salaries & Wages, Supplies, and Benefits Only

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

Exemptions:

-

Standard: 04_Personal_Service_Contracts

-

Standard: 05_Other_Contractual_Services

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 08_Subaward

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 11_Other_Outside_Contractual_Services

-

Standard: 12_Travel

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 17_Scholarship

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 21_Restricted_Funds

-

Standard: 22_Capital_Projects

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 24_Unallocated_not_subject_to_FA

-

Standard: 25_Unallocated_subject_to_FA

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 04 Direct Costs Excluding Tuition & Fees and Fixed Fee - Up to the Amount of IDC Allocation

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 19_Tuition

-

Standard: 21_Restricted_Funds

-

Standard: 22_Capital_Projects

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 24_Unallocated_not_subject_to_FA

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 05 Supplies and Equipment only

-

Object Classes Subject to F&A:

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

Exemptions:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

-

Standard: 04_Personal_Service_Contracts

-

Standard: 05_Other_Contractual_Services

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 08_Subaward

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 11_Other_Outside_Contractual_Services

-

Standard: 12_Travel

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 17_Scholarship

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 11 Total Direct Costs (TDC) Excluding Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

- Standard: 32_Program_Income_Internal_Sales

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 12 Direct Costs Excluding Rent, Equipment, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 06_Cloud_Computing_Services_not_subject_to_FA

- Standard: 10_Rent

- Standard: 15_Equipment

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 13 Direct Costs Excluding Travel, Benefits, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 03_Fringe_Benefits

- Standard: 06_Cloud_Computing_Services_not_subject_to_FA

- Standard: 12_Travel

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 14 Direct Costs Excluding Benefits, Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 03_Fringe_Benefits

- Standard: 06_Cloud_Computing_Services_not_subject_to_FA

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 15 Direct Costs Excluding Equipment, Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 06_Cloud_Computing_Services_not_subject_to_FA

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

- Standard: 28_Department_Fixed_Fee

- Standard: 30_Program_Income

- 16 Direct Costs Excluding Fellow & Trainee Salary, In-Patient, Out-Patient, Vessel Recharge, Subcontracts, Rent, Equipment, Stipends, Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 17_Scholarship

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 02_Pre-doc_and_post-doc_salaries

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 08_Subaward

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 17 Direct Costs Excluding Contract Personnel Services, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 04_Personal_Service_Contracts

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 18 Modified Total Direct Cost (MTDC)

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 08_Subaward

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 02_Pre-doc_and_post-doc_salaries

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 17_Scholarship

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 19 Direct Costs Excluding Salary & Wages, Benefits, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

-

Standard: 03_Fringe_Benefits

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 20 Direct Costs Excluding Equipment and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 15_Equipment

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 21 Direct Costs Excluding Subcontracts, Outside Services, Equipment and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 08_Subaward

-

Standard: 11_Other_Outside_Contractual_Services

-

Standard: 15_Equipment

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 22 Direct Costs Excluding Subcontracts and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 08_Subaward

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 23 Direct Costs Excluding Subcontracts (in excess of 1st $25K), Equipment, Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 24 Indirect Costs Up to the Amount of IDC Allocation

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 26 Direct Costs Excluding Equipment, Benefits from PostDoc Rsch Trainees, Benefits from Fellows & Trainees, Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 27 Direct Costs Excluding Travel, Equipment, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 12_Travel

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 28 Direct Costs Excluding PostDoc Trainee Salary & Benefits , Salaries & Benefits from Fellows & Trainees, Stipends, Tuition & Fees, Equipment (Over $5,000), and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 17_Scholarship

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 02_Pre-doc_and_post-doc_salaries

-

Standard: 03_Fringe_Benefits

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 07_Patient_Costs

-

Standard: 08_Subaward

-

Standard: 09_Vessel_Usage

-

Standard: 10_Rent

-

Standard: 11_Other_Outside_Contractual_Services

-

Standard: 12_Travel

-

Standard: 13_Supplies_and_Materials

-

Standard: 14_Software

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 29 Total Direct Costs (TDC) Excluding Subcontracts, Equipment, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 08_Subaward

-

Standard: 15_Equipment

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 30 Direct Costs Excluding Stipends, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 18_Stipend

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 31 Direct Costs Excluding Software, Equipment, Tuition and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 14_Software

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 19_Tuition

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 32 Direct Costs Excluding PostDoc Trainee Salary & Benefits , Salaries & Benefits from Fellows & Trainees, Subcontracts (in excess of 1st $25K), Equipment, Stipends, Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 17_Scholarship

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

- Standard: 01_Salaries_and_Wages

-

Standard: 03_Fringe_Benefits

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 15_Equipment

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 18_Stipend

-

Standard: 19_Tuition

-

Standard: 20_Program_Course_Fee

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 33 Direct Costs Excluding Tuition & Fees, and Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 16_Student_Aid_and_Other_Grants

-

Standard: 19_Tuition

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 34 Direct Costs Excluding Personal Service Contracts, Subcontracts & Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 09_Vessel_Usage

- Standard: 10_Rent

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 04_Personal_Service_Contracts

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 08_Subaward

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

- 35 Direct Costs Excluding Rent, Fixed Fee

-

Object Classes Subject to F&A:

- Standard: 01_Salaries_and_Wages

- Standard: 02_Pre-doc_and_post-doc_salaries

- Standard: 03_Fringe_Benefits

- Standard: 04_Personal_Service_Contracts

- Standard: 05_Other_Contractual_Services

- Standard: 07_Patient_Costs

- Standard: 08_Subaward

- Standard: 09_Vessel_Usage

- Standard: 11_Other_Outside_Contractual_Services

- Standard: 12_Travel

- Standard: 13_Supplies_and_Materials

- Standard: 14_Software

- Standard: 15_Equipment

- Standard: 16_Student_Aid_and_Other_Grants

- Standard: 17_Scholarship

- Standard: 18_Stipend

- Standard: 19_Tuition

- Standard: 20_Program_Course_Fee

- Standard: 25_Unallocated_subject_to_FA

Exemptions:

-

Standard: 06_Cloud_Computing_Services_not_subject_to_FA

-

Standard: 10_Rent

-

Standard: 23_APL_Non-UW_Vessel_Rental_FA_Exempt

-

Standard: 28_Department_Fixed_Fee

-

Standard: 30_Program_Income

Resources

- GIM 13: Facilities & Administrative Rates

- F&A Rates and Costs | Management Accounting & Analysis

- Institutional Facts and Rates - UW Research

- Understanding the costs of conducting research – UW Research

- Facilities and Administration Overview (UWCF Video)

- Facilities & Administrative Costs

- How to Make a Custom Base Type in SAGE Budget