Overview

A cash surplus occurs when expenditures are less than the cash receipts received on the award. The treatment of cash surpluses at the end of an award are dictated by the sponsor’s terms and conditions of the award.

During the closing process, GCA reviews the sponsor’s terms and conditions to determine whether the cash surplus needs to be returned to the sponsor (“sponsor refund”) or can be retained at the University (“residual balance transfer”).

How to Tell If an Award Requires a Sponsor Refund

If an award has any of the following characteristics, a cash surplus needs to be returned to the sponsor. Click on any of the screenshots to enlarge the image.

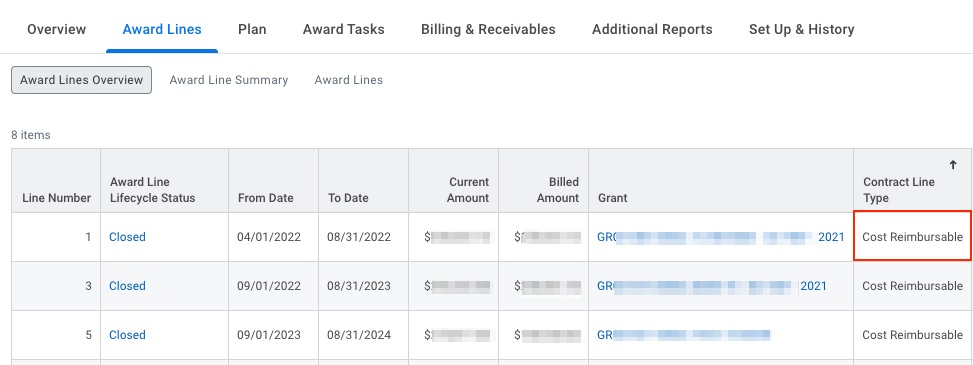

The Workday Contract Line Type is Cost Reimbursable. This field is in the Award Lines Overview tab under Award Lines.

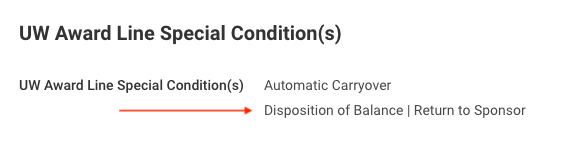

One of the Workday Award Line Special Conditions is Disposition of Balance | Return to Sponsor. To see this field, go to the Award Lines Overview under Award Lines and click on the magnifying glass icon under the Contract Line column. Special Conditions are in the Additional Data section.

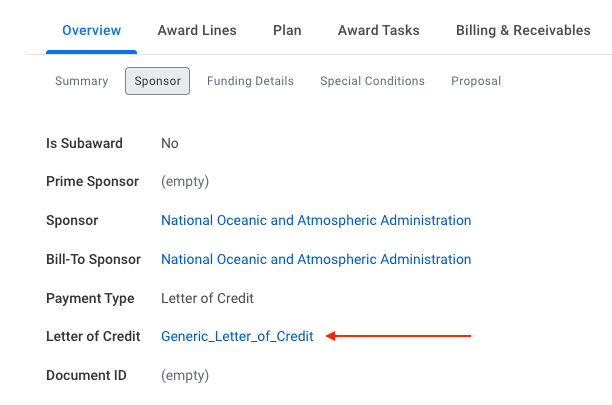

The sponsor reimbursement method is Letter of Credit. This is similar to Cost Reimbursable and any cash surpluses must be refunded. This field is in the Sponsor tab under Overview.

Viewing a Sponsor Refund in Workday

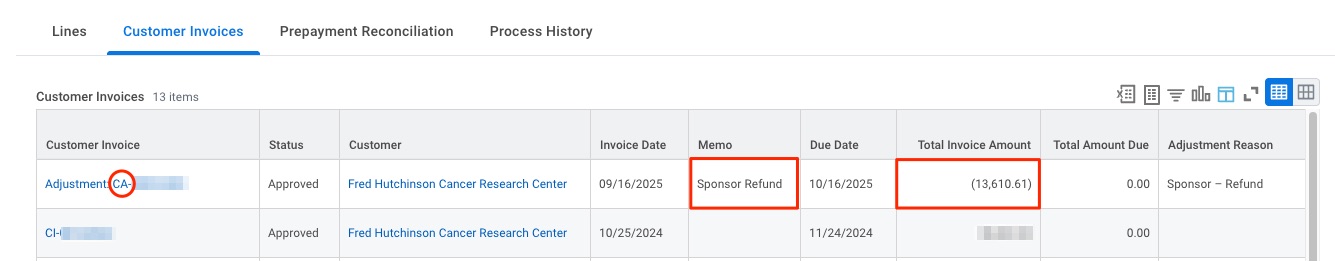

GCA creates a Workday Customer Adjustment for the amount of the refund. It is located in the Workday Billing Schedule in the Customer Invoices section and has the following attributes:

- The Customer Invoice number begins with “CA”

- The Memo field contains “Refund”

- The Total Invoice Amount is negative

Note: If the Total Amount Due is 0.00, the refund has been fully processed.