Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

Surplus Property

Start by visiting Surplus Property's Purchasing and Sales website. Here you will find information on public auction dates, store hours, contact information, and parking. There's also an option to sign up for their mailing list, if interested.

Call Equipment Inventory at 543-4663. We can look the item up for you. This will provide us with its history and help us figure out how to move forward. If the item is accidentally in your area and was not a purchase from Surplus, we can contact the department of ownership to arrange for its return.

Enter the information into our UW Equipment Information Card (Web Form). When you submit this web form, the information is sent directly to Equipment Inventory and we will enter it into OASIS for you.

Tagging

It depends on what object code was used to make the purchase. Specific detailes related to this process can be found on the Equipment Acquisition - Capital Projects page.

Threshold Change - Equipment Management

The equipment assets under $5,000 acquired prior to July 1, 2016 will remain active in the OASIS fixed asset system, until they are fully depreciated. These assets will have a new title and the asset information will continue to be available to departments through the OASIS ad hoc reporting function. After July 1st, these items will no longer be included in the physical inventory process.

After July 1st, departments will no longer be required to physically inventory equipment under $5,000 and EIO will not be tracking new equipment purchases under $5,000 (with the exception of sensitive items, such as weapons and art collections). Asset information for purchases prior to July 1st, will be available through the OASIS ad hoc reporting function.

Threshold Change - Financial Accounting

For Non-Sponsored and State Budgets

The purchase order date will determine which threshold will apply. The $2,000 threshold will apply in cases where a purchase order has been fully executed (EI or BPO number issued) prior to July 1, 2016, with the equipment object code “06” regardless of when the equipment is paid for and/or received. We will continue to depreciate these items until they are fully depreciated or disposed of (asset retirement), then remove them from the inventory system.

Purchase orders executed on or after July 1, 2016 will be subject to the new $5,000 threshold.

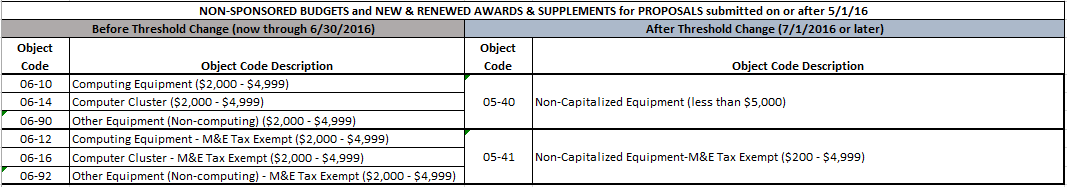

Beginning 7/1/2016, object codes “05-40 non-capitalized equipment (less than $5,000)” and “05-41 non-capitalized equipment - M&E tax exempt ($200 - $4,999)” will replace the existing “06” object codes for specific equipment purchases with a cost of $2,000 - $4,999. (See the non-sponsored budgets and non-grandfathered award object code chart below)

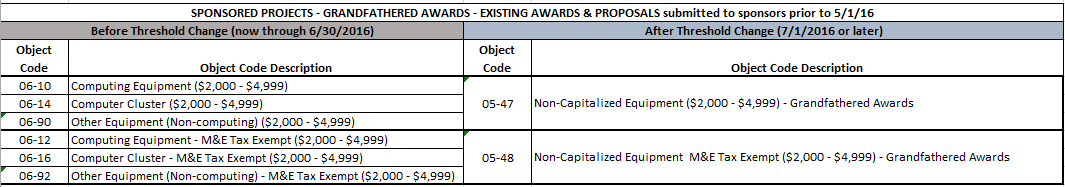

Beginning 7/1/2016, two new object codes “05-47 non-capitalized equipment ($2,000 - $4,999) – grandfathered awards” and “05-48 non-capitalized equipment M&E tax exempt ($2,000 - $4,999) – grandfathered awards” will be available for equipment purchases of $2,000 - $4,999 for grandfathered award budgets. These new object codes will replace the existing “06” object codes for specific equipment purchases with a cost of $2,000 - $4,999. (See the grandfathered award object code chart below)

For non-sponsored budgets, the requisition must be fully executed (BPO or EI number assigned) before June 30, 2016 for the $2,000 threshold to apply. All fully executed purchase orders (BPO or EI number assigned) after July 1, 2016 would use the new $5,000 threshold.

Effective 7/1/2016 the UW will no longer be required to inventory items with a previously acquired value under $5,000 that are still depreciating.

UW Financial Reporting has consulted with the University’s auditor (KPMG) and has determined that the impact to the financial statements will be material if records with previously acquired values under $5,000 are removed from the inventory system and written-off from the financial records. We will continue to depreciate these items over the next 5 years (FY17 – FY21) until they are fully depreciated or disposed of (asset retirement), then remove these items from the fixed asset system. In FY22, the remaining items under $5,000 will be written-off and removed from the fixed asset system.

The exception to this will be equipment deemed as sensitive items in the 10XX class code series (weapons, firearms, signal guns and accessories). These items are considered at risk or vulnerable to loss and will remain in the inventory system (regardless of the acquisition cost) and physically verified periodically.

Equipment purchases from $2000 to $4,999 will now be included as operating expenses rather than depreciable assets.

This change will not affect the University’s capital construction threshold, but may affect the overall construction project budget. After the change, equipment purchases between $2,000 and $4,999 that were previously budgeted as capital purchases, will become operating expenditures.

Threshold Change - Medical Center

In order to minimize confusion, remain consistent and take advantage of this opportunity to relieve administrative burden, UW Medical Center and Harborview Medical Center have decided to migrate at the same time as the University.

Threshold Change - Sponsored Projects

EXISTING AWARDS & PROPOSALS approved prior to May 1, 2016

The $2,000 threshold will continue to apply to existing funding. The $2,000 threshold will also continue to apply to non-competing renewals. In addition, funding received in response to proposals with an EGC-1 approval date prior to May 1, 2016 will continue to have the $2,000 threshold apply, even if the award has a start date of 7/1/2016 or later, to accommodate the use of the lower threshold in budgeting.

PROPOSALS FOR NEW, COMPETING RENEWALS & SUPPLEMENTS approved on or after May 1, 2016

Proposals for new, competing renewal, and supplemental funding with an EGC-1 approval date on or after May 1, 2016 will be subject to the new $5,000 threshold. Budgets submitted with these proposals must categorize items with an acquisition cost of $5,000 or more and a useful life exceeding one year as equipment. Indirect cost (F&A) must be calculated on all non-capital equipment/supplies with an acquisition cost under $5,000.

Implementing this change via a phased approach will allow Principal Investigators the opportunity to request funding that reflects the new capitalization threshold when submitting competitive proposals. If all aspects of this change were implemented on July 1, 2016, sponsored projects would feel an immediate impact.

No. This is effective July 1, 2016. If you have already submitted a proposal or received an award prior to this date, the threshold remains at $2,000 until a subsequent request for new funds is processed at which time the new threshold.

“Grandfathered awards” are those that continue to use the $2000 equipment threshold beyond July 1st. These come in three categories:

- Existing funding already at the University

- Funding received in response to a proposal submitted prior to May 1st (no matter the start date of that funding)

- Noncompeting renewals (a form of the above)

Starting July 1st, grandfathered award budgets will be identified by grant flag 14 in the FIN budget index. The grandfathered award budget indicator (grant flag 14) can also be found in the budget profile in MyFD. See the instructions below to locate the grant flag.

- Log into MyFD http://ucs.admin.uw.edu/MyFD/Home.aspx

- Under the reports drop down arrow, select budget profile

- In the view budget # field, enter the budget number (no dash)

- Scroll down to the Grant section, look at GrantFlag14

- Grandfathered award – Flag turned on

- Non-grandfathered award – Flag turned off

Contact Grant and Contract Accounting (GCA) through Grant Tracker or at gcahelp@uw.edu.

For more information: http://finance.uw.edu/gca/contacts

The University prefers a “bright line” date to use in order to begin using the new threshold in proposal budgets. Therefore, proposal budgets should continue using the $2000 threshold for submissions prior to May 1st. If you believe you have a reason to use the new threshold sooner, then please contact OSP at osp@uw.edu with your eGC1 # and your reasoning.

The University intends to “grandfather in” usage of the $2000 threshold for proposals submitted prior to May 1st, no matter the award start date, so there should not be a negative impact to the budget.

Your award, when it arrives, will be “grandfathered in” using the $2000 threshold.

If the request will be submitted to the sponsor before May 1st, use the $2000 threshold. If the request will be submitted on or after May 1st, use the new $5000 threshold. When the funding arrives in response to this request, it will be “separated” from the existing award through use of a sub-budget.