Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

Threshold Change - Sponsored Projects

If the budget is prepared and submitted to the sponsor on or after May 1, 2016, the cost of the microscope must be reflected in supplies (object code 05-40 or 05-41) and included as a direct cost to which F&A will be charged. For more information on F&A base exclusions, please see GIM 13.

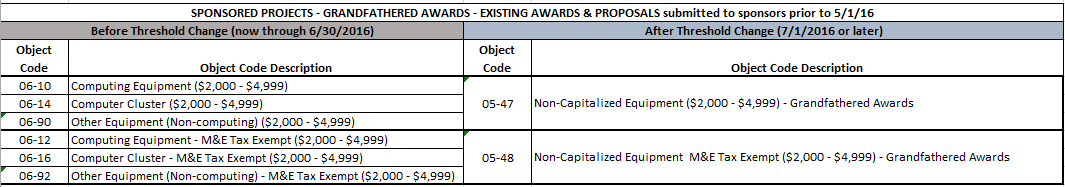

Beginning 7/1/2016, two new object codes will be available for equipment purchases of $2,000 - $4,999 for grandfathered award budgets. These new object codes will replace the existing “06” object codes for specific equipment purchases with a cost of $2,000 - $4,999. (See the grandfathered award object code chart below)

- 05-47 non-capitalized equipment ($2,000 - $4,999) – grandfathered awards

- 05-48 non-capitalized equipment M&E tax exempt ($2,000 - $4,999) – grandfathered awards

Please check the applied Base Type selected for the budget in question. The base type determines whether the new “05” codes are excluded from the base and therefore not charged F&A or whether the “05” object code is included in the base and therefore charged F&A. Possible Base Types include:

- Salary and Wages (S&W) – the new “05” object codes are excluded from being charged F&A

- Total Direct Cost (TDC) – the new “05” object codes, along with all other direct costs, are charged F&A

- Modified Total Direct Cost (MTDC) – the new “05” object codes are excluded from being charged F&A

- Total Direct Cost less Equipment & Tuition (TDC less E&T) – the new “05” object codes are excluded from being charged F&A

You can review the applied Base Type by clicking on the F&A tab of your budget. The “Change the F&A Rate or Base Type” link below the base type allows you to change the base type if needed. You must provide a justification when you select a custom base type and identify the object codes to which the custom F&A rate should be applied. The F&A rate will be applied to these budget categories only.

The financial system is set up with indirect cost base codes to inform the correct application of F&A. When F&A is calculated, it is applied to those direct cost object codes that are subject to the F&A base. The base code for Modified Total Direct Costs (MTDC) will be changed to reflect that equipment costs under $5,000 for grandfathered budgets are not charged F&A. Only tangible items of personal property (greater or equal to $5,000) that meet the UW definition of equipment should be classified with an object code within the “06” range.

Yes, when equipment fabrication costs total $5000 or more, those costs are excluded from F&A. Please see the Equipment Inventory Office instructions on equipment fabrication for more details.

No, an F&A waiver is not the appropriate method to meet the total cost dollar cap amount. If your sponsor imposes a total cost dollar cap, you must budget within that cap consistent with University policy. You may want to consider seeking additional funding to meet your budget needs or reduce the scope of work.

No. Unless an industry sponsor specifically publishes which direct costs must be excluded from F&A, you should use Total Direct Costs (TDC) as the base. For more information, please see GIM 13.

The UW’s cognizant federal agency (DHHS) is currently reviewing our disclosure statement and will be providing guidance with the upcoming rate agreement. We have requested that the new equipment threshold and effective date be added to the equipment section of our F&A rate agreement.

The University must exercise proper control over its assets. Items on the equipment inventory must be physically verified at least once every two years, according to University policy. Federal regulations require that items that are federally titled must be physically verified at least once a year.

Effective 7/1/2016 the UW will no longer be required to inventory items with a previously acquired value under $5,000 that are still depreciating.

Transfer In

The original institution should have that information available for you in the transfer paperwork. If the original equipment cost is not included, contact Surplus for assistance.

Enter the information into our UW Equipment Information Card (Web Form). When you submit this web form, the information is sent directly to Equipment Inventory and we will enter it into OASIS for you.