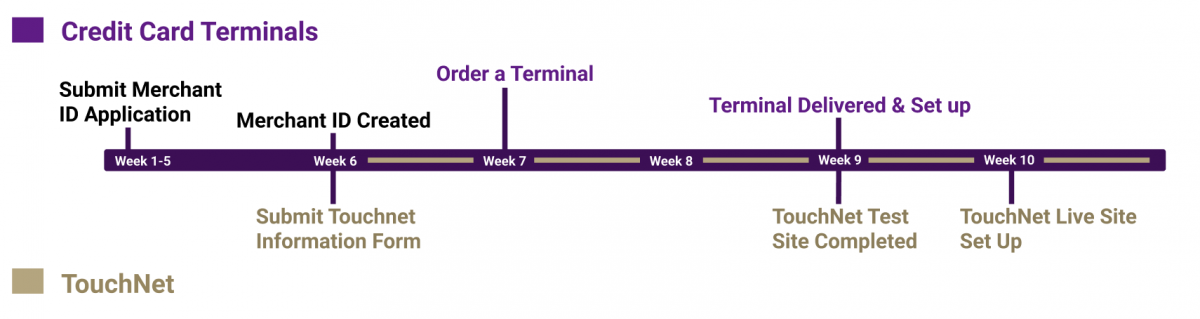

Merchant Timeline

Merchant Account Application

A Merchant Account is the relationship established between a department accepting payment cards (including both credit and debit cards) and the processor. Submit the application below and review the OMS Standards document.

PCI Compliance

All financial transactions processed by the University of Washington are required to be in compliance with the Payment Card Industry Data Security Standards (PCI DSS) and the Washington State Law (RCW 19.255)

Understand the Fee Structure

Credit card processing fees include internal merchant and external processor fees. The fee structure page shows what fees your department/school will be charged when you begin accepting credit card payments.

Please contact us at pcihelp@uw.edu with any questions.