The equipment assets under $5,000 acquired prior to July 1, 2016 will remain active in the OASIS fixed asset system, until they are fully depreciated. These assets will have a new title and the asset information will continue to be available to departments through the OASIS ad hoc reporting function. After July 1st, these items will no longer be included in the physical inventory process.

Click on a topic (right) and/or add a search term (below) to limit results.

Threshold Change - Equipment Management

After July 1st, departments will no longer be required to physically inventory equipment under $5,000 and EIO will not be tracking new equipment purchases under $5,000 (with the exception of sensitive items, such as weapons and art collections). Asset information for purchases prior to July 1st, will be available through the OASIS ad hoc reporting function.

New Threshold - Threshold Change (General)

This change will bring UW in line with the $5,000 capitalization threshold that our peer institutions have implemented. All of our top 25 research peers now use the $5,000 threshold.

Historically, the UW has defined capital equipment as tangible property (other than land, buildings, improvements other than buildings, or infrastructure) with a unit cost of $2,000 or more (including ancillary costs) used to conduct UW instruction, research and public service with a useful life of more than one year.

Effective July 1, 2016, the unit cost threshold will increase to $5,000.

A webpage was created on Equipment Inventory Office’s (EIO) website for information specific to the equipment threshold change. Visit the webpage periodically, we will continue to post information as it becomes available.

Yes, all campuses must implement the change in the same way.

Campus partners who participated in the decision making process include the Faculty Council on Research, the Research Advisory Board, Associate Deans for Research, and the Post-Award Administrative Advisory Group.

Over 40,000 of UW’s assets fall between $2,000 and $4,999. A full costing study of the administrative burden of maintaining a physical inventory for these 40,000 assets revealed that the cost and burden of maintaining the lower threshold is significant. The driving force behind this change is a significant reduction in both faculty and staff administrative burden at all three campuses. The change will also address threshold alignment issues between the UW and federal, State and local government. Almost all government agencies use the $5,000 threshold and, at times, our lower threshold causes misunderstandings when dealing with these entities.

The types of assets that will be included are: fabricated equipment, furniture and other tangible items of personal property that meet the definition of equipment above.

Art collections, sensitive inventories and special collections are not part of the change.

Threshold Change - Sponsored Projects

Yes, when equipment fabrication costs total $5000 or more, those costs are excluded from F&A. Please see the Equipment Inventory Office instructions on equipment fabrication for more details.

Contact Grant and Contract Accounting (GCA) through Grant Tracker or at gcahelp@uw.edu.

For more information: http://finance.uw.edu/gca/contacts

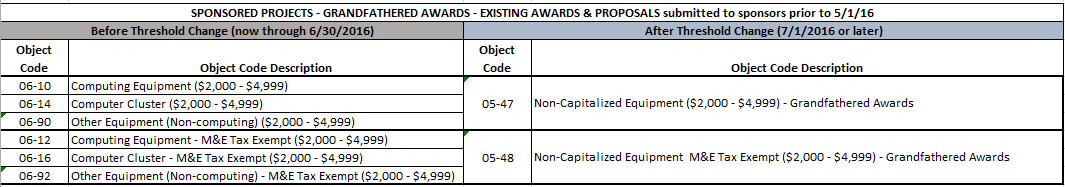

Beginning 7/1/2016, two new object codes will be available for equipment purchases of $2,000 - $4,999 for grandfathered award budgets. These new object codes will replace the existing “06” object codes for specific equipment purchases with a cost of $2,000 - $4,999. (See the grandfathered award object code chart below)

- 05-47 non-capitalized equipment ($2,000 - $4,999) – grandfathered awards

- 05-48 non-capitalized equipment M&E tax exempt ($2,000 - $4,999) – grandfathered awards

The University must exercise proper control over its assets. Items on the equipment inventory must be physically verified at least once every two years, according to University policy. Federal regulations require that items that are federally titled must be physically verified at least once a year.

Effective 7/1/2016 the UW will no longer be required to inventory items with a previously acquired value under $5,000 that are still depreciating.

The UW’s cognizant federal agency (DHHS) is currently reviewing our disclosure statement and will be providing guidance with the upcoming rate agreement. We have requested that the new equipment threshold and effective date be added to the equipment section of our F&A rate agreement.

No. Unless an industry sponsor specifically publishes which direct costs must be excluded from F&A, you should use Total Direct Costs (TDC) as the base. For more information, please see GIM 13.

No, an F&A waiver is not the appropriate method to meet the total cost dollar cap amount. If your sponsor imposes a total cost dollar cap, you must budget within that cap consistent with University policy. You may want to consider seeking additional funding to meet your budget needs or reduce the scope of work.

The financial system is set up with indirect cost base codes to inform the correct application of F&A. When F&A is calculated, it is applied to those direct cost object codes that are subject to the F&A base. The base code for Modified Total Direct Costs (MTDC) will be changed to reflect that equipment costs under $5,000 for grandfathered budgets are not charged F&A. Only tangible items of personal property (greater or equal to $5,000) that meet the UW definition of equipment should be classified with an object code within the “06” range.

Please check the applied Base Type selected for the budget in question. The base type determines whether the new “05” codes are excluded from the base and therefore not charged F&A or whether the “05” object code is included in the base and therefore charged F&A. Possible Base Types include:

- Salary and Wages (S&W) – the new “05” object codes are excluded from being charged F&A

- Total Direct Cost (TDC) – the new “05” object codes, along with all other direct costs, are charged F&A

- Modified Total Direct Cost (MTDC) – the new “05” object codes are excluded from being charged F&A

- Total Direct Cost less Equipment & Tuition (TDC less E&T) – the new “05” object codes are excluded from being charged F&A

You can review the applied Base Type by clicking on the F&A tab of your budget. The “Change the F&A Rate or Base Type” link below the base type allows you to change the base type if needed. You must provide a justification when you select a custom base type and identify the object codes to which the custom F&A rate should be applied. The F&A rate will be applied to these budget categories only.

If the budget is prepared and submitted to the sponsor on or after May 1, 2016, the cost of the microscope must be reflected in supplies (object code 05-40 or 05-41) and included as a direct cost to which F&A will be charged. For more information on F&A base exclusions, please see GIM 13.

If the request will be submitted to the sponsor before May 1st, use the $2000 threshold. If the request will be submitted on or after May 1st, use the new $5000 threshold. When the funding arrives in response to this request, it will be “separated” from the existing award through use of a sub-budget.

Your award, when it arrives, will be “grandfathered in” using the $2000 threshold.

The University prefers a “bright line” date to use in order to begin using the new threshold in proposal budgets. Therefore, proposal budgets should continue using the $2000 threshold for submissions prior to May 1st. If you believe you have a reason to use the new threshold sooner, then please contact OSP at osp@uw.edu with your eGC1 # and your reasoning.

The University intends to “grandfather in” usage of the $2000 threshold for proposals submitted prior to May 1st, no matter the award start date, so there should not be a negative impact to the budget.

Starting July 1st, grandfathered award budgets will be identified by grant flag 14 in the FIN budget index. The grandfathered award budget indicator (grant flag 14) can also be found in the budget profile in MyFD. See the instructions below to locate the grant flag.

- Log into MyFD http://ucs.admin.uw.edu/MyFD/Home.aspx

- Under the reports drop down arrow, select budget profile

- In the view budget # field, enter the budget number (no dash)

- Scroll down to the Grant section, look at GrantFlag14

- Grandfathered award – Flag turned on

- Non-grandfathered award – Flag turned off

“Grandfathered awards” are those that continue to use the $2000 equipment threshold beyond July 1st. These come in three categories:

- Existing funding already at the University

- Funding received in response to a proposal submitted prior to May 1st (no matter the start date of that funding)

- Noncompeting renewals (a form of the above)

No. This is effective July 1, 2016. If you have already submitted a proposal or received an award prior to this date, the threshold remains at $2,000 until a subsequent request for new funds is processed at which time the new threshold.

Implementing this change via a phased approach will allow Principal Investigators the opportunity to request funding that reflects the new capitalization threshold when submitting competitive proposals. If all aspects of this change were implemented on July 1, 2016, sponsored projects would feel an immediate impact.

EXISTING AWARDS & PROPOSALS approved prior to May 1, 2016

The $2,000 threshold will continue to apply to existing funding. The $2,000 threshold will also continue to apply to non-competing renewals. In addition, funding received in response to proposals with an EGC-1 approval date prior to May 1, 2016 will continue to have the $2,000 threshold apply, even if the award has a start date of 7/1/2016 or later, to accommodate the use of the lower threshold in budgeting.

PROPOSALS FOR NEW, COMPETING RENEWALS & SUPPLEMENTS approved on or after May 1, 2016

Proposals for new, competing renewal, and supplemental funding with an EGC-1 approval date on or after May 1, 2016 will be subject to the new $5,000 threshold. Budgets submitted with these proposals must categorize items with an acquisition cost of $5,000 or more and a useful life exceeding one year as equipment. Indirect cost (F&A) must be calculated on all non-capital equipment/supplies with an acquisition cost under $5,000.

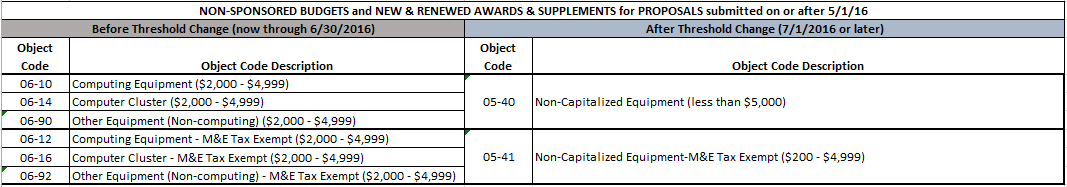

Threshold Change - Financial Accounting

Beginning 7/1/2016, object codes “05-40 non-capitalized equipment (less than $5,000)” and “05-41 non-capitalized equipment - M&E tax exempt ($200 - $4,999)” will replace the existing “06” object codes for specific equipment purchases with a cost of $2,000 - $4,999. (See the non-sponsored budgets and non-grandfathered award object code chart below)

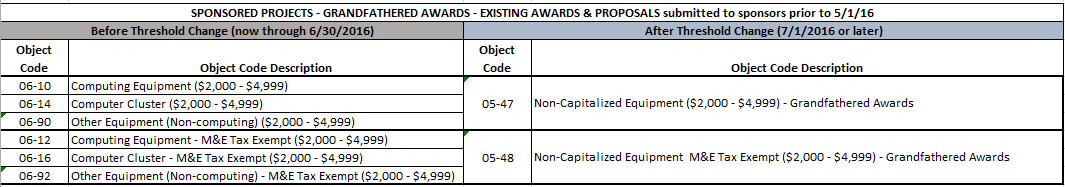

Beginning 7/1/2016, two new object codes “05-47 non-capitalized equipment ($2,000 - $4,999) – grandfathered awards” and “05-48 non-capitalized equipment M&E tax exempt ($2,000 - $4,999) – grandfathered awards” will be available for equipment purchases of $2,000 - $4,999 for grandfathered award budgets. These new object codes will replace the existing “06” object codes for specific equipment purchases with a cost of $2,000 - $4,999. (See the grandfathered award object code chart below)

This change will not affect the University’s capital construction threshold, but may affect the overall construction project budget. After the change, equipment purchases between $2,000 and $4,999 that were previously budgeted as capital purchases, will become operating expenditures.

Equipment purchases from $2000 to $4,999 will now be included as operating expenses rather than depreciable assets.

Effective 7/1/2016 the UW will no longer be required to inventory items with a previously acquired value under $5,000 that are still depreciating.

UW Financial Reporting has consulted with the University’s auditor (KPMG) and has determined that the impact to the financial statements will be material if records with previously acquired values under $5,000 are removed from the inventory system and written-off from the financial records. We will continue to depreciate these items over the next 5 years (FY17 – FY21) until they are fully depreciated or disposed of (asset retirement), then remove these items from the fixed asset system. In FY22, the remaining items under $5,000 will be written-off and removed from the fixed asset system.

The exception to this will be equipment deemed as sensitive items in the 10XX class code series (weapons, firearms, signal guns and accessories). These items are considered at risk or vulnerable to loss and will remain in the inventory system (regardless of the acquisition cost) and physically verified periodically.

For non-sponsored budgets, the requisition must be fully executed (BPO or EI number assigned) before June 30, 2016 for the $2,000 threshold to apply. All fully executed purchase orders (BPO or EI number assigned) after July 1, 2016 would use the new $5,000 threshold.

For Non-Sponsored and State Budgets

The purchase order date will determine which threshold will apply. The $2,000 threshold will apply in cases where a purchase order has been fully executed (EI or BPO number issued) prior to July 1, 2016, with the equipment object code “06” regardless of when the equipment is paid for and/or received. We will continue to depreciate these items until they are fully depreciated or disposed of (asset retirement), then remove them from the inventory system.

Purchase orders executed on or after July 1, 2016 will be subject to the new $5,000 threshold.

Threshold Change - Medical Center

In order to minimize confusion, remain consistent and take advantage of this opportunity to relieve administrative burden, UW Medical Center and Harborview Medical Center have decided to migrate at the same time as the University.