Federal Purchasing

Federal Contracts vs. Federal Grants

A Federal Contract is a mechanism used by the Federal Government to provide funding for research and development projects. Unlike a grant, the Federal Government uses contracts as a procurement mechanism. The principal purpose of the Federal Contract instrument is to purchase property or services for the direct benefit or use of the United States Government. Federal Contracts are governed by a strict set of terms and conditions, including clauses from the Federal Acquisition Regulation (FAR).

These contracts usually require frequent reporting and a high level of responsibility to the sponsor. A failure to perform and achieve the promised results or product on time and on budget could result in criminal and/or civil actions and/or financial consequences to the University, administrators, or others involved.

A Federal Grant is used as a means of assisting researchers in developing research for the public good. Grants are much more flexible than contracts. Typically in Federal Contracts, changes cannot be made to the scope of work or budget, whereas in Grants these changes can usually be made with the University’s approval. Failure to deliver under a Federal Contract can have potential legal or financial consequences to all parties at the University, whereas in the case of a Grant typically a final report explaining the outcome is sufficient.

Independent Contractors and Federal Contracts

On December 31st, 2016; the Federal Government started requiring parties that spend Federal Contract funds to send a notification document to independent contractors (IC). The notification document is a reminder to the IC that they are in fact an independent contractor. The purpose of this reminder is make the IC aware that their tax status is an independent contractor and they should operate as such.

- What is an Independent Contractor?

- An independent contractor is a person, business, or corporation that provides goods or services to another entity under terms specified in a contract. Unlike an employee, an independent contractor does not work regularly for an employer but works as and when required, during which time he or she may be subject to law of agency. Independent contractors are usually paid on a freelance basis. Contractors often work through a limited company or franchise, which they themselves own.

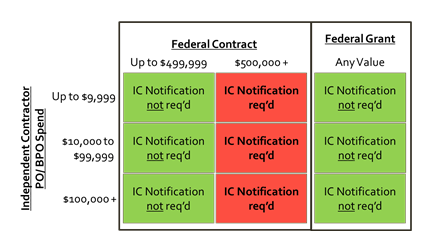

- Based on the criteria below, the UW needs to notify the IC if:

- Funds are disbursed from a Federal Contract that has a total value of $500,000 or greater

- Independent contractor (IC) being used as the vendor

- For example, an IC is hired for $8,000 on a Federal Contract with a total value of $750,000

- The UW is required to send an IC notification document to the IC (link to the Sample Notification Doc below)

- The following are excluded from this Federal requirement:

- Funds spent from Federal Grants

- IC engagements on Federal Contracts < $500,000

- Non-IC engagements on Federal Contracts > $500,000

Sample notification document for contacting an Independent Contractor