Introduction

Effective October 1, 2025, the Washington State Department of Revenue (DOR) implemented changes under Engrossed Substitute Senate Bill (ESSB 5814) that broaden the scope of retail sales tax to include certain services.

Procurement Services, in collaboration with the Tax Office, issued an initial announcement about this law on September 2, 2025. This document provides follow-up guidance for the University of Washington (UW) Academy to help campus partners understand the changes and ensure compliance.

Key Changes

As of October 1, 2025, the following services are now generally considered taxable in Washington State.

- Advertising Services

- Live Presentation/Training

- Background Checks, Security, Armored Car Services

- Temporary Staffing Services (note: there is an exemption for hospitals)

- Information Technology Services

- Custom Website Development

- Custom Software/Customization of Prewritten Software

- Digital Automated Services (DAS)

This change affects both UW Academy and Medicine.

What Spend Categories in Workday are Affected?

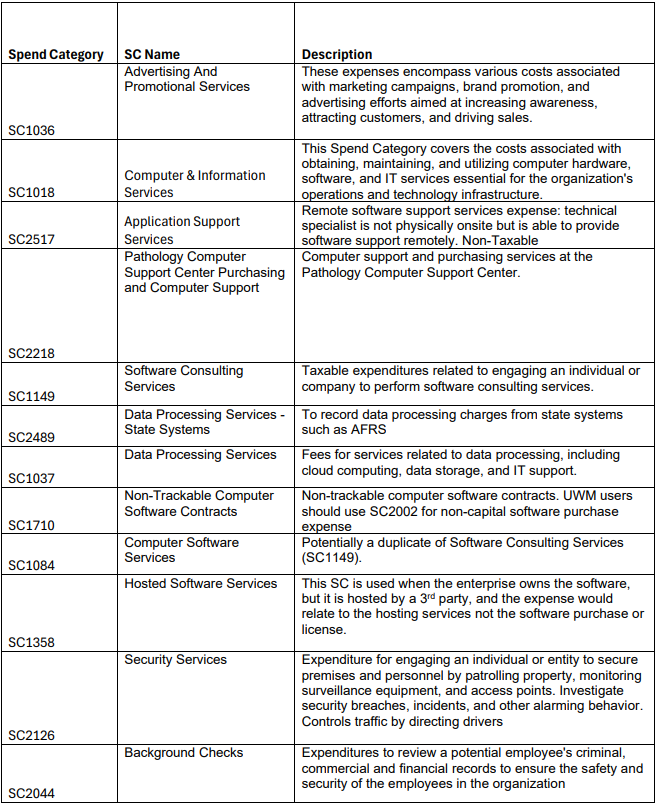

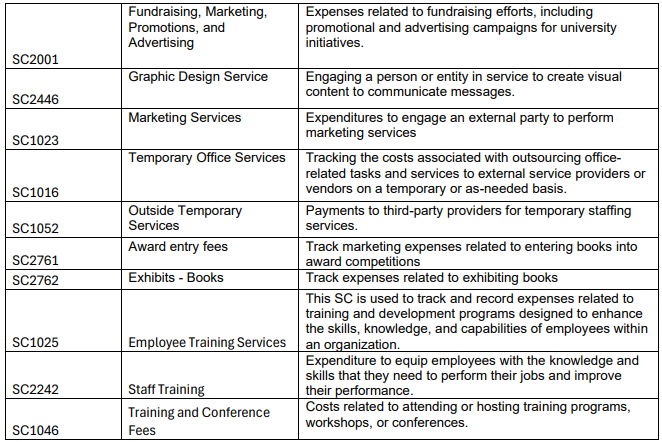

The Spend Category drives taxability in Workday, so it is very important that the correct Spend Category is used to ensure accurate tax assessment. The following list of Spend Categories is affected by this change and are now subject to Washington State sales tax:

How does ESSB5814 affect existing service contacts that were executed before the effective date of October 1 of this new law?

The DOR provides transition relief for existing contracts that were signed before October 1, 2025. To qualify for the transition relief, the existing contract must:

- Be signed and executed before October 1, 2025

- Cover services that are provided on or after October 1, 2025.

- Includes only services that are newly taxable under ESSB 5814 (e.g., IT services, advertising, custom software, security services, etc.)

Other Considerations for Our Campus Stakeholders

- The department will not have to manually calculate and code the sales tax, it will be addressed in the Workday configurations for the applicable spend categories as shown above.

- The sales tax rates are updated on a quarterly basis in Workday to comply with the Washington State DOR's sales tax publication. The current rates are available on the DOR website. The rates should be charged based on where the purchase was first received or used.

- If an academic department is providing services to external parties outside of UW, they need to change the appropriate sales tax for the services that are now taxable under ESSB 5814.

- For additional details regarding ESSB 5814, please visit the DOR website for their interim guidance which is updated regularly.

Contacts

Please direct tax questions to taxofc@uw.edu.

Please direct payment questions to pcshelp@uw.edu