- Effective January 1st, 2018

- To ensure expenses are properly accounted for, documentation must comply with the IRS Accountable Plan

- If itemized receipts are obtainable and compliant with IRS Accountable Plan, reimburse expenses as usual on their appropriate line items

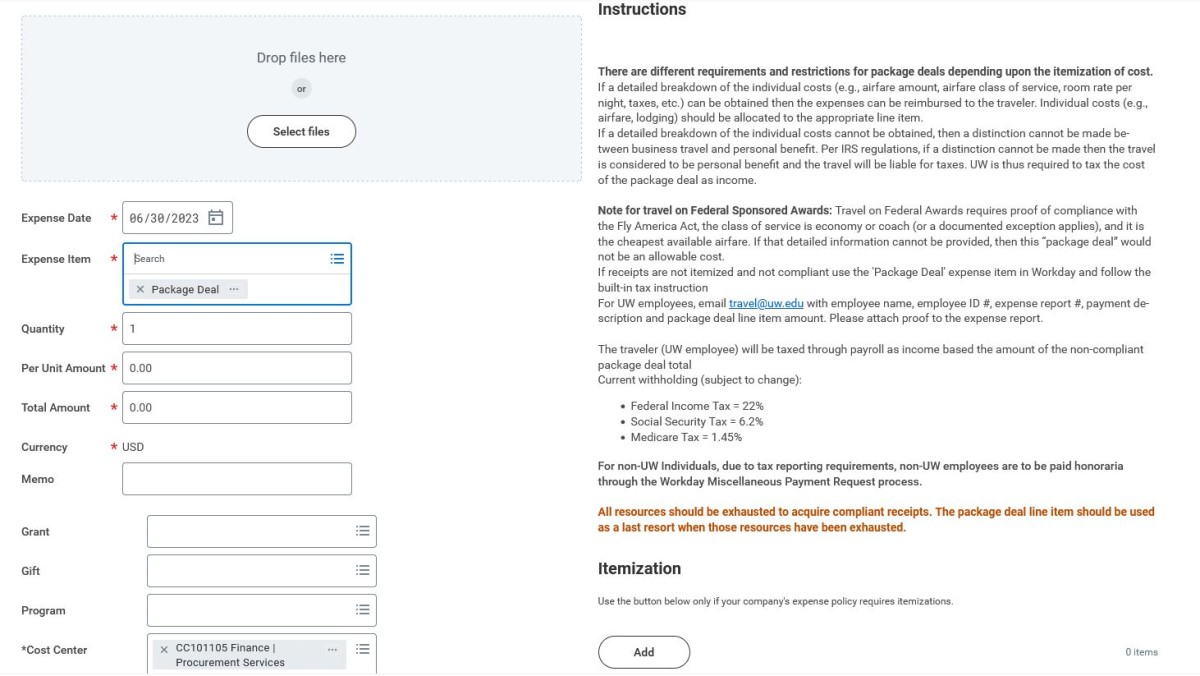

- If receipts are not itemized and not compliant with the IRS Accountable Plan, use the 'Package Deal' line item in Workday and follow the built in tax instruction

- For UW employees, email travel@uw.edu with employee name, employee ID #, expense report #, payment description and package deal line item amount. Please attach proof to the expense report.

The traveler will be taxed through payroll as income based on the amount of the non-compliant package deal total:

- Current withholding (subject to change):

- Federal Income Tax = 22%

- Social Security Tax = 6.2%

- Medicare Tax = 1.45%

- For non-UW Individuals, due to tax reporting requirements, non-UW employees are to be paid honoraria through the Miscellaneous Payments process

**All resources should be exhausted to acquire IRS Accountable Plan compliant receipts. The package deal line item should be used as a last resort when those resources have been exhausted.