Travel Advance

How to Create a Travel Advance

Living Allowance

Prior-trip Reimbursement

Travel Advance

A department may issue a Travel Advance (per diem advance) through a spend authorization to defray costs a UW employee traveler may incur while traveling on official UW business. In requesting an advance, the traveler and the funding approver acknowledge responsibility for its reconciliation.

Do not issue an advance to reimburse expenses paid in advance of a trip, they should be reimbursed as a normal expense report.

Notice as of 3/11/2025: The University is pausing advance spending on foreign research activities where no active award or award notice has been received. Advances will not be issued unless an award notice is on file.

If the Travel Advance is for foreign location(s) and planned to be reconciled on a grant, the department must do the following:

- Attach documentation substantiating that the grant funding is approved by the funding source

Eligibility

- Must be a UW employee, and employed through the travel end date

- Advance is issued at the allowable per diem rate (not to exceed) for the dates of business travel

- No outstanding advances

- Employees paid as a student, stipend, hourly, or a temporary appointment will require a discretionary fund/worktag for lodging per diem advance

- Must be a minimum of $300.00

- Must be issued on GOF/DOF funds and UW1861 Cost Centers.

Time Limitations

- Advance is not to exceed 90 days

- Advance is not to be issued more than 30 days prior to travel start date

Restrictions

- For use of privately owned vehicles

- For the purchase of commercial airfare

- For expenses for others

- Allowed for UW1861 cost centers only.

Reconciliation

- Must be reconciled within 60 days from the travel end date

- Includes check repayment of unused expense

- Reconciliation procedure - PDF

Default on Repayment

- Failure to reconcile (and repay unspent amounts) by the 60 day deadline can result in the outstanding balance being considered a misappropriation of state funds as well as a loss to the University to be handled by the University restitution process for financial losses or irregularities (APS 47.4).

- See SAAM Manual - Section 10.80.70.

- See RCW 43.03.200

- See APS 47.4

How to Create a Travel Advance

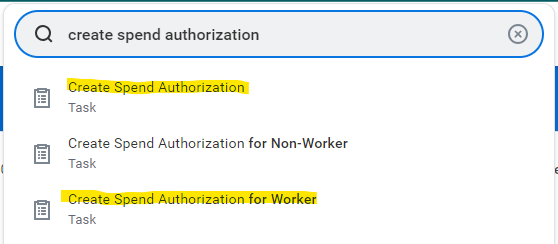

In the search bar, type in "Create Spend Authorization", if this advance is for another person, type in "Create Spend Authorization for Worker".

*Please note that "Spend Authorization for Non-Worker" is not built into Workday at this current time.

To view a larger image, please click photo.

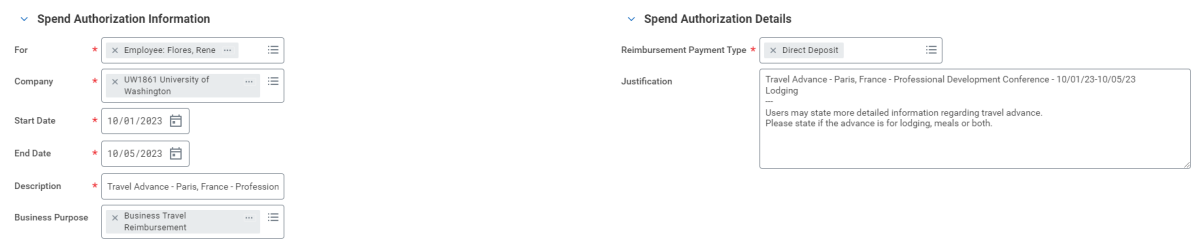

- For = Payee's Name

- Company = UW1861

- Start and End Dates = Dates of Trip

- Description = Short Description of Trip (City - Conference - Dates)

- Example: Travel Advance - Paris, France - Professional Development Conference - 10/01-10/05

- Please reach out to your department for further guidance on their naming convention for advances.

- Business Purpose = Business Travel Reimbursement

- Reimbursement Payment Type = Direct Deposit or Check (This choice is automatically inputted based on the payee's WD profile)

- Justification = Longer Description of Trip

- Users may input what type of per diem they are requesting (Meals, Lodging, or both) and other details that are required by the user's department policies.

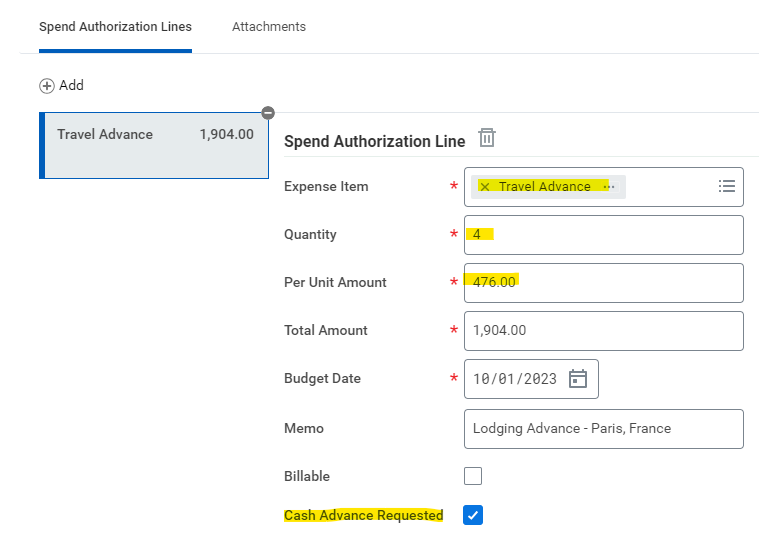

Click the "+ Add" to add the lines to the Travel Advance. To ensure that your request is a Travel Advance and not a Spend Authorization for pre-encumbrance, please input the following:

- Expense Item = Travel Advance

- Quantity = Number of Days

- Per Unit Amount = Per Diem Rate

- Memo = Type of Per Diem (Lodging, Meals, or Both)

- Cash Advance Requested = Must be checked

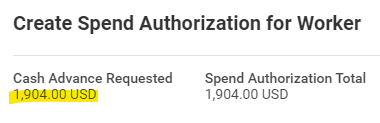

Once the Cash Advance Requested is checked, the amount will also show under "Cash Advance Requested" at the top of the page.

Living Allowance

A department may issue a Living Allowance to defray costs that a non-UW Foreign National may incur while in Seattle for UW Business.

Eligibility

- Must be a foreign national (non-UW)

- Must be traveling to Seattle

- Must be in travel status

Time Limitations

- Allowance may not exceed 30 days at a time

- WT/B2 visa types limited to 9 days reimbursement every 6 months

Restrictions

- Limited to the meal per diem rate for actual dates of stay in Seattle

- Payment will not be released until all required foreign national documentation is uploaded through the DocuSign procedure. Please inquire with Accounts Payable for DocuSign status.

- Can not be used to defray expenses for others

- Must be done through the Miscellaneous payment module in Workday and attach the non-employee claim form.

Prior-trip Reimbursement

It is allowable to reimburse travel expenses prior to the trip as long as it meets all other travel compliance requirements (keeping in mind our receipt policy). Reimbursement is processed the same as after the trip. The most common expenses include airfare, registration, and prepaid lodging. When reimbursing lodging prior, the Workday expense report module (ER) allows you to select future dates.

Restrictions

The following expenses are not eligible for prior-trip reimbursement:

- Meal per diem allowance (see per diem advance above for advancing per diem)

- Mileage

- Meals paid for others

- Car Rental (final rental agreement required per receipt policy)

- Gas

- Laundry

- Tolls