What is Per Diem

Eligibility

Exceptions to Travel Status

Determining Per Diem Rate

Meals Based on Start/End Travel Status

Exceptions to Per Diem

Additional Meal and Lodging Topics

What is Per Diem?

Per diem is an allowance method by which UW handles lodging and meal reimbursement to an individual. It is best to think of meal per diem as an allowance as receipts are not required per our receipt policy and the reimbursement is based on start and end times of travel status. See receipts and meals for more information.

Meal per diem covers:

- basic cost of meal

- sales tax

- customary tip/gratuity

- incidental expenses

Lodging per diem is best to think of as a cap that is allowed to be spent depending on the location of business. For example traveling to downtown New York versus a small town in Washington will be more forgiving on the amount you get to spend.

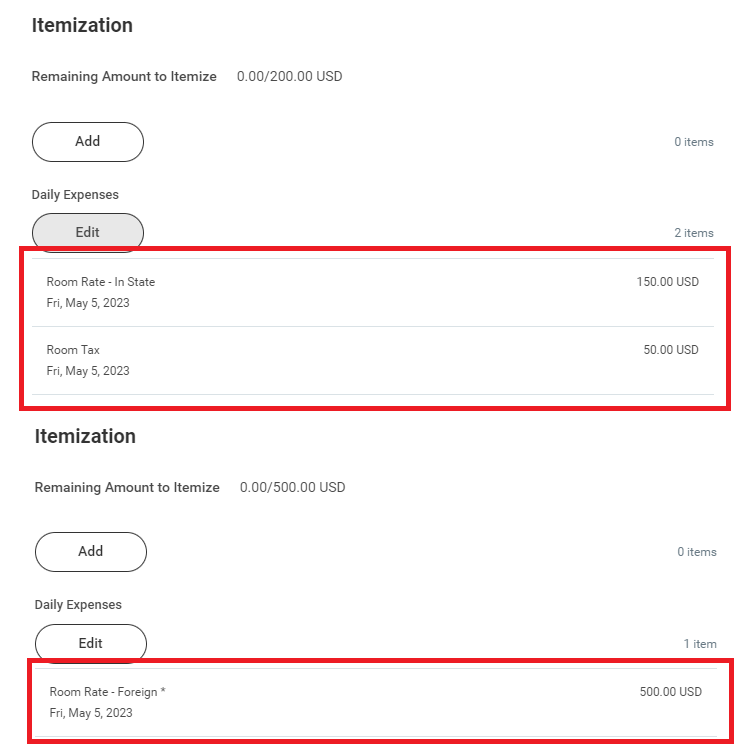

What lodging per diem covers changes based on whether the travel is occurring in the continental US or if it is foreign. For the continental US, per diem covers the nightly rate and fees (the mandatory taxes are still reimbursable, they just aren't matched against the per diem). For foreign locations, per diem covers the room rate & the mandatory fees/taxes. This is why you won't see a tax box on the lodging per diem line item when reimbursing a foreign location:

Incidental expenses:

Fees and tips given to porters, baggage carriers, bellhops, flight attendants, housekeepers, foreign transaction fees, and other for personal services performed. This is not a miscellaneous expense. An allowance for incidental expenses is included within the daily subsistence rates for the area of travel.

Eligibility

Meals & Lodging per diem:

To qualify for meal and lodging per diem, traveler must be on travel status, defined as:

Traveler must be more than 50 miles away from their home and duty station (most direct route) and meet the 11 hour rule. The 11 hour rule is for single day trips when determining if the traveler is eligible for meal per diem. Time when the traveler is in transit to and from the temporary business location, that satisfies the mileage requirement, is eligible to be counted toward the eleven hour requirement. Meal time can not be included in the eleven hours.

To reimburse per diem (meal per diem and/or lodging per diem) when the traveler is not on travel status, one of the following exceptions must be approved by an authorized person and attached to the expense report. Please title the document 'exception to travel status.'

- In an emergency situation, perform critical functions and must remain near a workstation.

- Acting in a custodial or leadership role must, as a part of their duties, lodge with students. Such as coaches lodging with student-athletes.

- An overnight stay in a commercial lodging facility to avoid having a traveler drive back and forth for back-to-back late night/early morning.

- When the health and or safety of the traveler is of concern.

Lodging per diem:

The lodging accommodation must be considered a commercial lodging facility, defined as:

A business, non-profit or governmental entity that provides lodging accommodations for a fee. A commercial lodging facility other than a hotel must be supported by a tax ID number or a published advertisement. The facility must be available to the general public to qualify as commercial lodging (i.e. listed with a rental agency, newspaper ad, etc.). Reimbursements for lodging at private residence not supported by a tax ID number or a rental listing are not allowed under State and University policies and procedures. AirBnb and VRBO are considered commercial accommodations.

Determining Per Diem Rate

Instruction: To determine the lodging per diem, you will only need to follow step 1. For meal per diem, follow step 1 & 2 due to UW breaking down the daily per diem rate differently than the agencies the rates come from.

Step 1: Acquire the daily meal per diem & lodging per diem rate for business location using the corresponding links below:

- Domestic Per Diem Rates

- For lodging per diem - the rate you see is the nightly rate

- For meal per diem- use the M&IE Total as daily rate

- Includes 48 contiguous States and District of Columbia high cost locations

- This county search can be used to identify if the city is in a high cost county

- Location not listed? Use the city's county.

- Domestic Non-Contiguous Rates

- For lodging per diem - the rate you see is the nightly rate

- For meal per diem - the daily rate is determined by adding the local meals + local incidental

- Includes Alaska, Hawaii and other U.S. territories

- Location not listed? Use city: [OTHER] for that state

- List of Foreign Per Diem Rates

- For lodging per diem - the rate you see is the nightly rate

- For meal per diem - use the M & IE Rate as daily rate

- Location not listed? Use city: [OTHER] for that country

Step 2: The following chart can be used to determine the amount allotted for Breakfast, Lunch and Dinner

- This breakdown is based on WA State requirement of 26% for breakfast, 29% for lunch, 45% for dinner - Reference

- Ignore the breakdown done by GSA or other agencies (this is not how the UW breaks down the per diem rates)

- To determine per diem for the first and last day of travel, please see Meals Based on Start/End Travel Status

- The GSA has stated that FY2025 (Oct 2024-Sept 2025) and FY2026 (Oct 2025-Sept 2026) will use the same breakdown. GSA FY2026 Per Diem News Release

| Daily Rate | Breakfast | Lunch | Dinner |

|---|---|---|---|

| $59 | $15.34 | $17.11 | $26.55 |

| $61 | $15.86 | $17.69 | $27.45 |

| $64 | $16.64 | $18.56 | $28.80 |

| $66 | $17.16 | $19.14 | $29.70 |

| $68 | $17.68 | $19.72 | $30.60 |

| $69 | $17.94 | $20.01 | $31.05 |

| $71 | $18.46 | $20.59 | $31.95 |

| $74 | $19.24 | $21.46 | $33.30 |

| $76 | $19.76 | $22.04 | $34.20 |

| $79 | $20.54 | $22.91 | $35.55 |

| $80 | $20.80 | $23.20 | $36.00 |

| $86 | $22.36 | $24.94 | $38.70 |

| $92 | $23.92 | $26.68 | $41.40 |

Rev. 10/03/2024

Procedure: Travel date too old & per diem no longer in Workday

Meals Based on Start/End Travel Status

Daily meal allowance is allowable according to the following time guidelines:

- Entering travel status by departing from official duty station/residence; travel status begins when the traveler leaves their official duty station/residence. It's allowable to arrive at the airport up to three hours before domestic flights and up to four hours before international flights

- Coming off travel status by returning to official duty station/residence

- Do not account for time zone changes, use local time from start to finish

| Entering Travel Status | Meal(s) Reimbursed That Day |

|---|---|

| Up to 8:00 AM | Breakfast, Lunch, Dinner |

| After 8:00 AM and up to 2:00 PM | Lunch, Dinner |

| After 2:00 PM and up to 6:00 PM | Dinner |

| Coming Off Travel Status | Meal(s) Reimbursed That Day |

|---|---|

| After 6:00 AM and up to 12:00 PM | Breakfast |

| After 12:00 PM and up to 6:00 PM | Breakfast and Lunch |

| After 6:00 PM | Breakfast, Lunch, Dinner |

Exceptions to Per Diem

Since meal per diem is treated like an allowance based on start and end times of travel status, there are no exceptions to go over the meal per diem allowance.

Lodging per diem does however have exceptions to go over, if they can be properly documented/justified. 4 exceptions are allowed up to a cap set by what we call the 150% rule.

Exceptions to Per Diem (up to 150%):

Conference Hotel: traveler is attending a conference, meeting, convention or training where the traveler is expected to have business interaction with other participants in addition to scheduled events. Hotel is the official conference location, a recommended hotel by the conference, or within 5 miles of the conference location (vicinity clause).

- Documentation required: Official document from conference/meeting organizers indicating hotel as conference location or one of the recommended hotel locations. For vicinity clause, a Google Maps verifying the hotel as being less than 5 miles from official conference location. Official conference/meeting location documentation required to verify location.

Comparative Advantage (lower cost overall): When lodging accommodations in the area of the temporary duty station as not available at or below the maximum lodging per diem, and the savings achieved from occupying less expensive lodging at a more distant site are consumed by an increase in transportation or other costs.

- Documentation Required: Attachment substantiating hotel to be the lowest cost option in the business area with no other choices at or below per diem or the cost savings of selecting the hotel vs another hotel at a more distance site within the allowable per diem.

Suite Required: meeting room is necessary for UW business and is more economical than acquiring a meeting room in addition to lodging accommodations.

- Documentation Required: UW business need documented and approved by administrator. See sample approval form.

Special Event or Disaster: When costs in the area have escalated for a brief period of time during a special event or disaster.

- Documentation Required: Attachment substantiating the event or disaster that took place in the area. Show pertinent information substantiating a substantial rise in prices in the area due to the event or disaster.

ADA or Safety Health: To comply with provisions of the Americans with Disabilities Act or when the health and safety of the traveler is at risk.

- Documentation Required: For ADA, see more information. For Safety/Health attach an administrator approval acknowledging the safety/health concern. See sample approval form.

Non-UW: When the traveler is not affiliated with the UW.

- Documentation Required: Documentation not required.

Exceptions to Per Diem (more than 150%):

Conference Hotel: traveler is attending a conference, meeting, convention or training where the traveler is expected to have business interaction with other participants in addition to scheduled events. Hotel is the official conference location, a recommended hotel by the conference, or within 5 miles of the conference location (vicinity clause).

- Documentation required: Official document from conference/meeting organizers indicating hotel as conference location or one of the recommended hotel locations. For vicinity clause, a Google Maps verifying the hotel as being less than 5 miles from official conference location. Official conference/meeting location documentation required to verify location.

Non-UW: When the traveler is not affiliated with the UW.

- Documentation Required: Documentation not required.

The 150% rule defined:

The 150% serves as a cap for all but 2 of the below lodging per diem exceptions. The way it is calculated is as follows:

150% rule = 1.5(X + Y) where:

- X = the lodging per diem rate

- Y = the meal per diem rate

Example:

Say we are determining the 150% rule for St. Augustine, Florida in July 2024. The meal per diem and lodging per diem rates are $69 and $148 respectively. Therefore plugging these numbers into the formula for the 150% rule we get:

1.5($69+$148) which comes out to $325.50.

Therefore, for all lodging per diem exceptions where the 150% rule applies, the exception will allow lodging per diem to be exceeded in St. Augustine, Florida during July 2024 up to $325.50.

Please note: the 150% rule does not apply to how much meal per diem can be claimed.

Visit the following pages for additional topics related meals and lodging:

- Provided Meals

- Meals Paid for Others

- Banquet Meals

- Guidance for Additional Nights of Lodging

- Additional guidance

- Contracted hotels