Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

Advances

A Travel/Cash Advance (previously Per Diem Advances) are requested through the Spend Authorization task and Expense Report module. Reconciliation of a Travel/Cash Advance is completed through the Expense Report module. Learn more.

Living Allowance: A department may issue a Living Allowance to defray costs that a non-UW Foreign National may incur while in Seattle for UW Business. Living Allowances will be submitted through the Miscellaneous Payment module.

Restrictions:

• Limited to the GSA meal per diem rate for actual dates of stay in Seattle

• Payment will not be released until all required foreign national documentation is attached to the expense report

• May not be used to defray expenses for others

Time Limitations:

•allowance may not exceed 30 days at a time

•WT/B2 visa types limited to 9 days reimbursement every 6 months

Airfare

It will depend on the type of funding. The Fly America Act mandates the use of U.S. certificated air carriers for federally funded international travel. Non-federal funding is not subject to air carrier restrictions.

The Change/Cancellation Policy is sufficient in most instances for reimbursement when a non-refundable ticket is purchased. We recommend having a business purpose for purchasing a fully refundable ticket.

Expense Reports

After submitting an expense report, a questionnaire will appear to fill out regarding personal time. Under "Did you take any personal days or trips while traveling for business?", Select "Yes". In the box below, please provide dates, times, and location of personal travel. Airfare costs for destination other than the UW business location is not reimbursable and must be deducted from the total airfare cost. Learn more about responsibilities during personal time.

Use the County Search link to identify if the city is in a high-cost county for domestic locations. Learn more.

Select Other when the location is not listed for Foreign and Non-Contiguous areas. Learn more.

Travel expenses paid by CTA and Procard will be recorded through a Procard Verification (Task: Verify Procurement Card Transactions) OR a separate expense report (Business Purpose: CTA Verification). They cannot be combined into an ER for Business Travel Reimbursement.

UW employees are no longer required to approve their expense reports and are not part of the approval flow process in Workday.

To review transactions in Workday Expense a UW NetID and password are required as well as a Workday profile. We have taken additional security measures to protect what may be considered sensitive information by limiting access to documentation: Attachments (receipts) and comments in the system will only be visible to those authorized on the ER business process: expense data entry specialist (if applicable), approvers, procurement analysts, and you, the traveler of course.

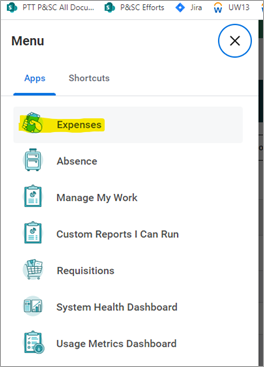

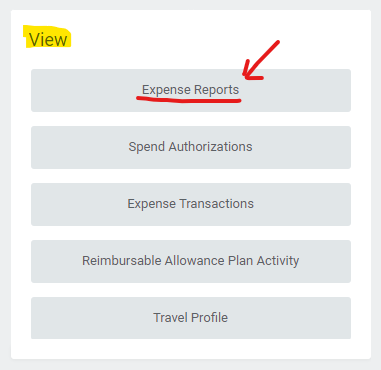

This information is accessible for users by accessing their Expenses App in Workday:

From there, click on Expense Reports from the View menu:

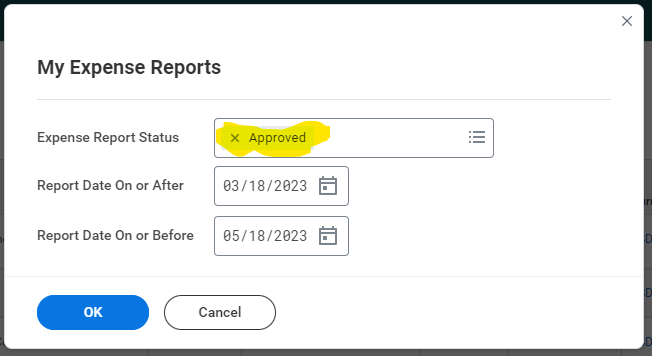

Users can view all approved expense reports and then see what the status is.

Payment type will default to your default in Workday HCM.

See the Scanning Policy set forth by UW Records Management for more information.

Per Diem no longer in Workday?

- Using the ‘Legacy Per Diem' line item, you will manually calculate the per diem and input into the total amount field.

- Please note the location and dates in the appropriate fields.

- Documentation of the old per diem must be attached to the expense report as a PDF:

- Domestic (contiguous states) can be found at: https://www.gsa.gov/travel/plan-book/per-diem-rates

- Foreign (including non-contiguous states) can be found at: https://www.defensetravel.dod.mil/site/perdiemCalc.cfm

- Add a comment indicating this procedure was followed due to the per diem no longer being listed in the Workday system.

- For any questions, please email the Travel Services office: travel@uw.edu

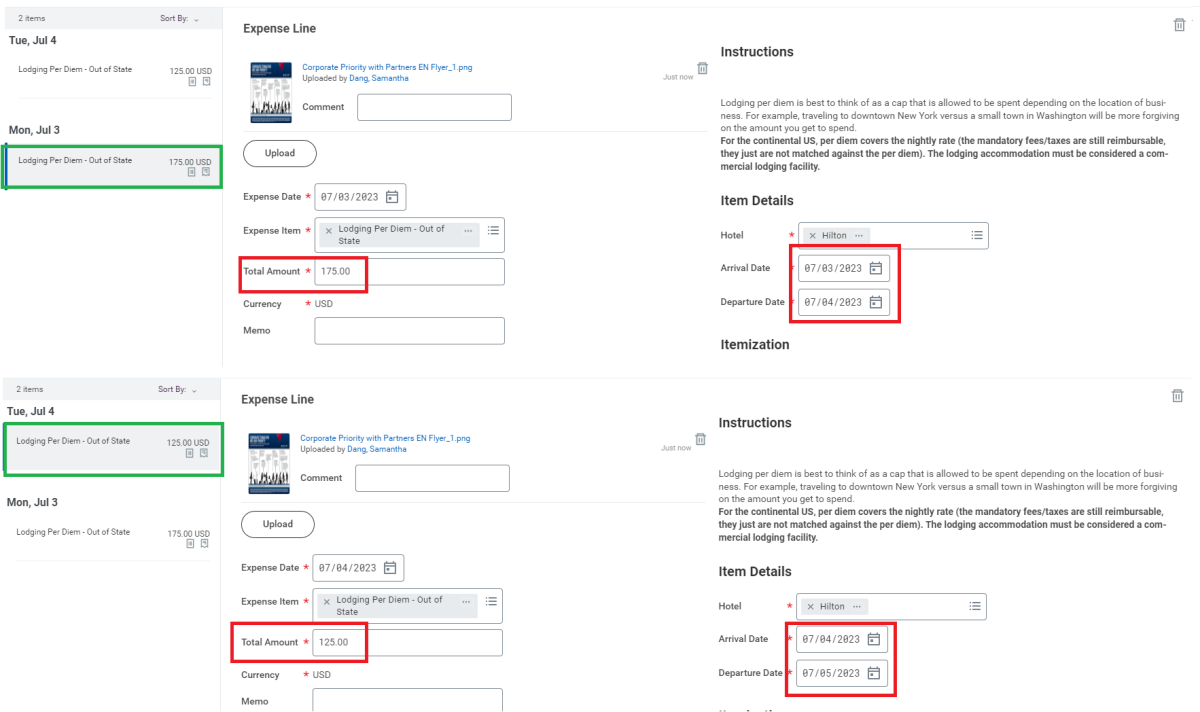

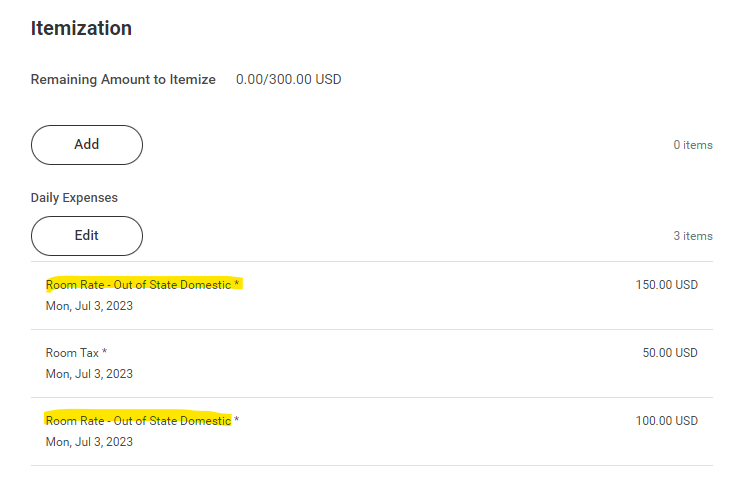

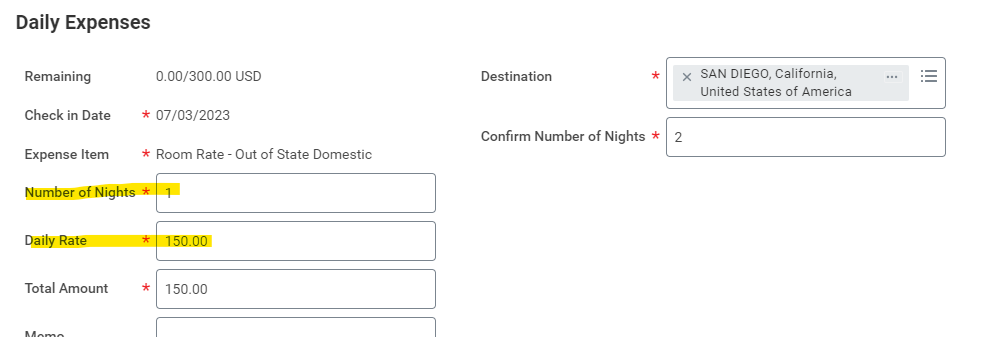

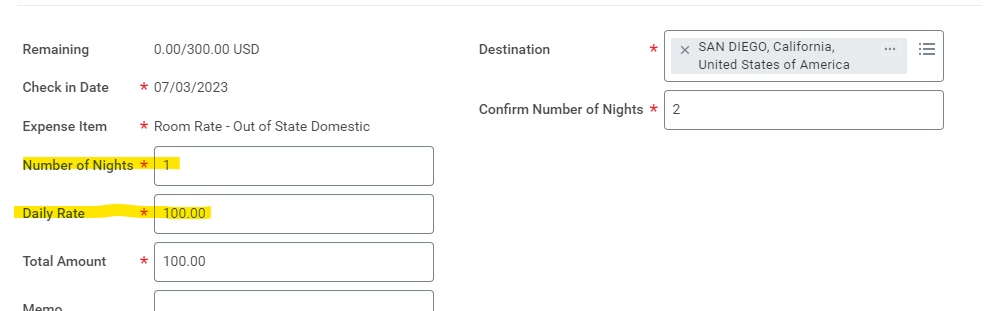

Here are two methods to show how to input different daily rates:

Example: Traveler A went to San Diego from 7/3-7/5 and had two different nightly rates.

- Nightly Rate: 7/3 - $150, 7/4 - $100

- Daily Tax: $25

- Total: $300

1. Itemization > Daily Expenses > Edit

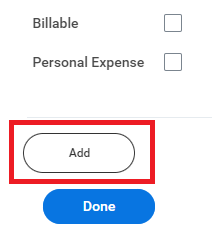

You can change the number of nights to 1 and input the amount into the "Daily Rate". To add the other nights, click on "Add".

2. Additional Lodging Per Diem expense items (click photo to enlarge)

No, averaging room rates are not allowed. If they are under per diem, please create additional room rate itemization expense items. If they are over per diem, please add the Lodging Per Diem Overage itemization expense item and input the per diem exception with documentation.

Federal Awards

Travel charges to grants and contracts should comply with university travel policies unless the sponsor/award imposes more restrictive travel provisions. Or an exception is approved by the sponsor.

Yes, unless the sponsor/award imposes a more restrictive travel provision.

General

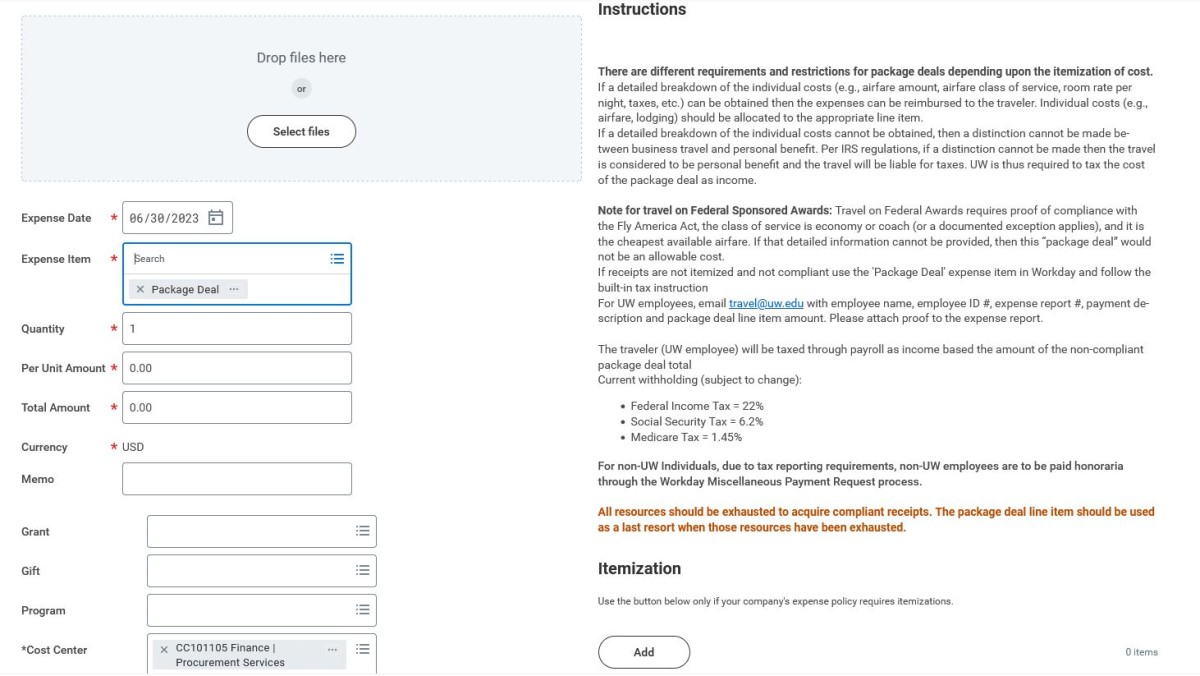

- Effective January 1st, 2018

- To ensure expenses are properly accounted for, documentation must comply with the IRS Accountable Plan

- If itemized receipts are obtainable and compliant with IRS Accountable Plan, reimburse expenses as usual on their appropriate line items

- If receipts are not itemized and not compliant with the IRS Accountable Plan, use the 'Package Deal' line item in Workday and follow the built in tax instruction

- For UW employees, email travel@uw.edu with employee name, employee ID #, expense report #, payment description and package deal line item amount. Please attach proof to the expense report.

The traveler will be taxed through payroll as income based on the amount of the non-compliant package deal total:

- Current withholding (subject to change):

- Federal Income Tax = 22%

- Social Security Tax = 6.2%

- Medicare Tax = 1.45%

- For non-UW Individuals, due to tax reporting requirements, non-UW employees are to be paid honoraria through the Miscellaneous Payments process

**All resources should be exhausted to acquire IRS Accountable Plan compliant receipts. The package deal line item should be used as a last resort when those resources have been exhausted.

►Mozilla Firefox:

Go to : Tools->Options->Advanced Panel->Network->Cashed Web Content->Clear Now

After clearing cache log out of all browsers and restart the computer.

►Internet Explore (IE9):

- Close all browser sessions (if needed restart computer)

-

Open a new Internet explorer browser, and go to delete browsing history

Go to : Tools->Internet Options->Browsing History->Delete or ctr+shift+del - Make sure “Preserve Favorites website date” is unchecked and “Temporary Internet Files” and “Cookies” are checked

- Click Delete, it may take some time to complete

- Close browser

-

Open a new browser and login into Ariba

https://ar.admin.washington.edu/AribaBuyer/uw/login.asp

Note: As a reminder is important to never use the back arrow on the browser, and use the “Logout” button on the screen rather than just closing the browser.

►Other Internet Browsers:

For more information on clearing your internet cache using other browsers, see the WikiHow article: How to Clear your Browser's Cache

Only if you share a joint account with the person who paid, for example a husband and wife who share the same bank account. If this is the case, add a comment to the expense report (ER) indicating this. In all other instances, reimbursement must go to the traveler who actually paid for the expense. See claimant.

Expenses paid on behalf of another are reimbursable but are not recommended.

If a spouse incurs travel expenses on behalf of the traveler, there are two options:

- If the spouse and traveler are connected to the same credit card account, the traveler may be reimbursed directly. The department can clarify the context in a comment.

- If the spouse and traveler are not connected, then a separate miscellaneous payment in the name of the spouse must be submitted claiming expenses on behalf of the traveler. Additionally, please note the context in a comment.

Ground Transportation

The following car rental class types are considered upgrades to the full-size sedan and will require a business justification for reimbursement:

- Premium/Luxury

- Minivan/Vans

- SUV

- Compact

- Midsize

- Standard

- Full-size

- Premium

- Truck

- Electric Vehicle (EVs)

- Hybrid

- Jeep

The following car service types are considered the lowest logical cost/most economical and do not require administrator approval for reimbursement:

Uber: UberX, Uber Green/Electric, Uber Wait & Save, Women Drivers

Lyft: Standard, Wait & Save, Green/Electric

The following car service types and fees are considered upgrades to the full-size sedan and will require a business justification for reimbursement:

Uber: Comfort, Uber XL, Black, Black SUV

Lyft: Extra Comfort, Lyft XL, Black, Black SUV

Fees: Priority Pickup, Wait Time

EV charging is to be treated the same as gas expenses. Reimbursement will depend on whether it is a privately owned vehicle or a car rental:

Privately Owned Vehicle (Mileage): Not to be reimbursed as a separate expense; and will be included in Mileage reimbursement with wear and tear.

Car Rental: May be reimbursed as a separate expense or be included in the final car rental agreement.

This fee is not reimbursable; only one person should incur the Uber fare.

Lodging

Yes, both AirBnB and VRBO are considered commercial lodging facilities. Please be sure to itemize all fees as accurately as possible in the itemization of the expense.