Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

Lodging

Prepaid lodging receipts may state the prepaid date, payment method, amount paid, etc. The email confirmation may also show an amount of $0 due at the hotel (other than resort fees for selected hotels).

For travelers to use a prepaid lodging receipt for prior-trip reimbursement, the lodging amount may be paid in full or as a deposit.

Non-Reimbursable Examples

This is not a proper audit trail. It is not reimbursable, Either split payment to the vendor directly and obtain receipts showing both payments made or have one person pay for the entire expense (see claimant).

No, travel expenses for spouses and family are not reimbursable. Spouses and family must have a bona fide business purpose when participating in UW business.

Examples of a bona fide business purpose:

- Required attendance at business meetings

- Presentation at business meetings

- Officially hosting a University event if the host function includes the planning of the event, and where attendance is required because the spouse is responsible for certain logistics of the event

- The primary purpose of the spouse’s attendance is to serve in University business, and the spouse spends more time on business activities than on personal activities during the trip

- The presence of the spouse is essential to the function

Examples that are not considered a bona fide business purpose:

- Situations where the spouse attends because he or she is “expected” to be present or where the spouse is present primarily to promote generosity or support for the University

- Situations where the spouse provides incidental business services, such as secretarial services, attending to scheduling matters or attendance at meals

- Attendance at receptions or dinners or assisting in entertaining students or donors

- Participation in tourist activities

- Attendance with children or other family members

- The presence of the spouse is only beneficial, not essential to the function/trip

If the department would like to continue to reimburse the spouse and family travel expenses when there is no bona fide business purpose, the department must do the following:

(1) Discretionary funding must be used. (The Resource Worktag must state one of the following: "RS100203 Discretionary Gift Resource" OR "RS100376 Other Discretionary Gift Resource")

(2) The spouse and family travel expenses will be considered taxable income to the traveler.

(3a) For UW employees, please email travel@uw.edu with the employee name, employee ID #, expense report #, payment description, and spouse/family expense line item(s) amount. Please attach proof to the expense report.

(3b) For Non-UW travelers, please use the "Non-Employee Travel 1099 (SC2567)".

For spouse and family travel expenses regarding Prospective Employees, please see here.

Payment Options

- Please fill out a Check Cancellation Request Form from UW Connect.

- Miscellaneous Payments:

- Once the check has been canceled, the MP will be canceled in Workday. If payment is still due, Shared Environment should submit a new MP in Workday.

- Expense Reports:

- Once the check has been canceled, the ER will not be canceled in Workday and instead, the ER will re-run for settlement that evening.

- Refer to payment tracking information below to determine the check status

- Once the check has been canceled, the ER will not be canceled in Workday and instead, the ER will re-run for settlement that evening.

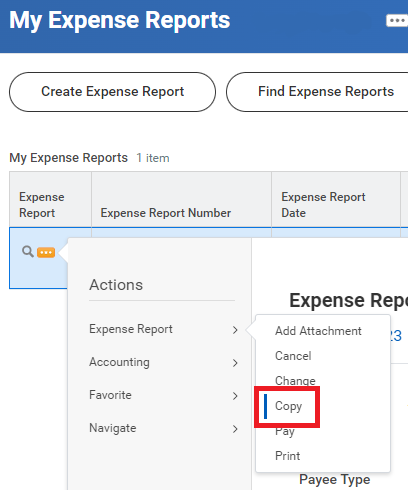

- To expedite, the 'copy' function can be used on the previous ER. Note that all attachments & comments will need to be re-added. Here are the instructions:

- Go to the Expenses App, click on Expense Reports, choose 'Approved' in the status field

- Select the Expense Report by clicking on the Related Actions icon (do not actually open the report)

- Under Expense Report, click on the 'copy' button

- A new copy of ER will open or you can find the new copy in your drafts under My Expense Reports

- Please attach all of the required receipts/documents, as they won’t be automatically copied

- Please re-input line item details and all overall comments, as they won’t be duplicated either

- Under the Handling Code field, choose "Campus Mail"

- Under the Miscellaneous Fields tag, under Miscellaneous Field 7, input the Box Number

- Have the check sent to yourself or your department

- Reroute the check through the USPS (US Postal Service)

Sending checks to foreign addresses is highly discouraged as they tend to take a long time to reach their destination and more often than not they are lost. Additionally, most foreign banks do not accept US checks. We recommend processing a foreign wire in lieu of a check to a foreign location.

Per Diem

Tips for transportation, such as taxis and shuttles are ok to reimburse, any other tips are considered an incidental expense which is included in the meal per diem as meal per diem has an added amount for incidentals.

Personal Time

Please prorate the car rental. Take the total amount and divide by the number of days. Multiply the daily rate by the total number of business days (please also do this if they rented at a weekly rate but business days were less).

Receipts

We understand this. From talking to other departments that travel a lot globally, they have said they just carry a receipt book that can be handwritten and have the individual providing the service sign. For taxis and things like this we know this is probably the most we will get unless they pay with a credit card. We need the amount listed and which currency it was paid in, the service they paid for and the date.

Yes, mobile payment applications such as Venmo, PayPal, Apple Pay, and Google Pay, are reimbursable payment methods. Please contact your department if they have internal policies for additional documentation.

Mobile payment applications are not allowed to be used for an Exchange of Funds.

No, perjury statements are not accepted as receipt documentation. Please follow the documentation requirements for all travel-related expenses on our website: Requirements for Receipt Documentation

Workday General

We recommend using Google Chrome when processing an Expense Report (ER) in Workday as it has reported the least amount of issues.

Alternative web browsers do work but we have come across some minor bugs in them. Mozilla Firefox we have come across the most issues with over the years.

We also recommend making sure that your Google Chrome is up to date and is set to automatically stay up to date. The Workday developers match the system with more current versions of web browsers so it's generally best to let your web browsers stay up to date. Here are some screenshots that walk through how to check on this for Google Chrome:

All UW employee are able to create Expense Reports for themselves. For creating ERs on behalf of others, the Expense Data Entry Specialist Security Role must be assigned to the user.

The initiator and individuals on the approval flow (Shared Environment Expense Specialist, Funding Manager) receive email notifications indicating the ER/MP status unless each changes their own email notification preferences.

Receipts must be attached to ER/MP for all expenses $75 or over and all receipts regardless of costs for airfare, lodging,rail, car rental, laundry, and meals paid on the behalf for others are required.

* Ensure you check with your department/medical center administrators on which receipts they require.

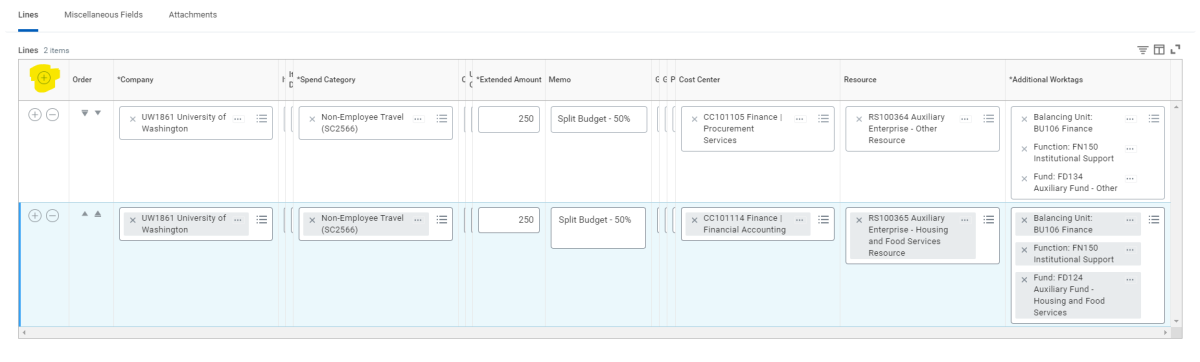

Miscellaneous Payments may be split by adding a line item. (Click Photo to Enlarge)

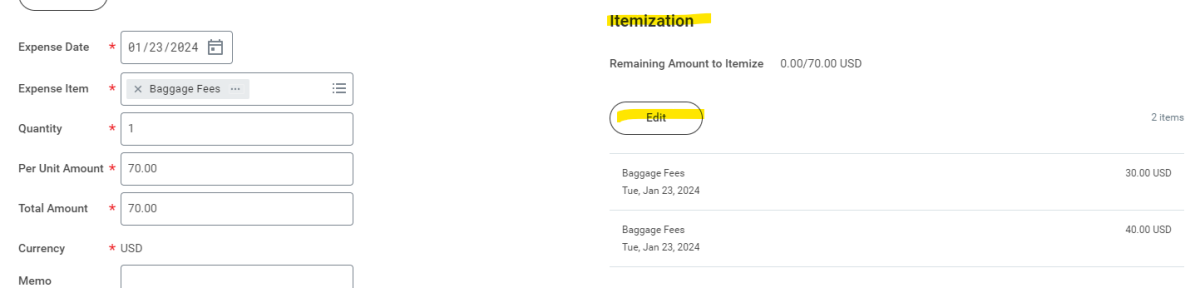

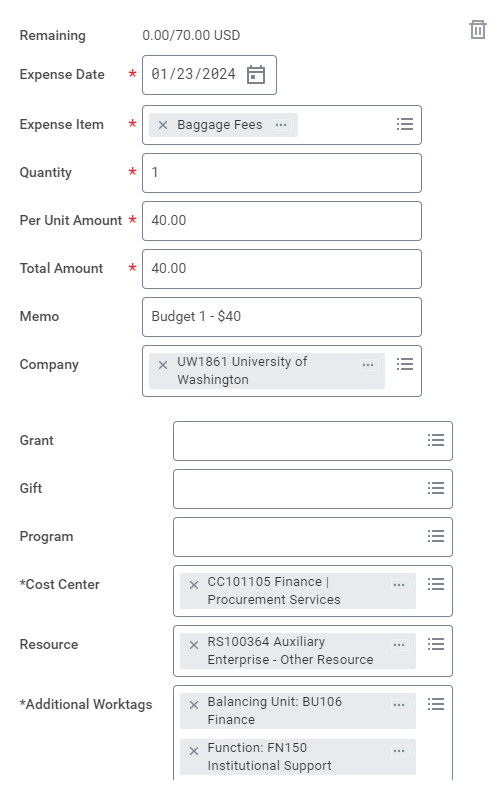

Expense Reports may be split under the Itemization or the Daily Expenses of expense items. Users can insert by clicking the Add button. (Click Photos to Enlarge)

Please note: In the ER module, Workday does not allow equal splitting. Using the example above, it cannot be split $35 and $35 as this will cause a "Duplicate" error to appear. The workaround is to put $34.99 on Budget 1 and $35.01 on Budget 2.

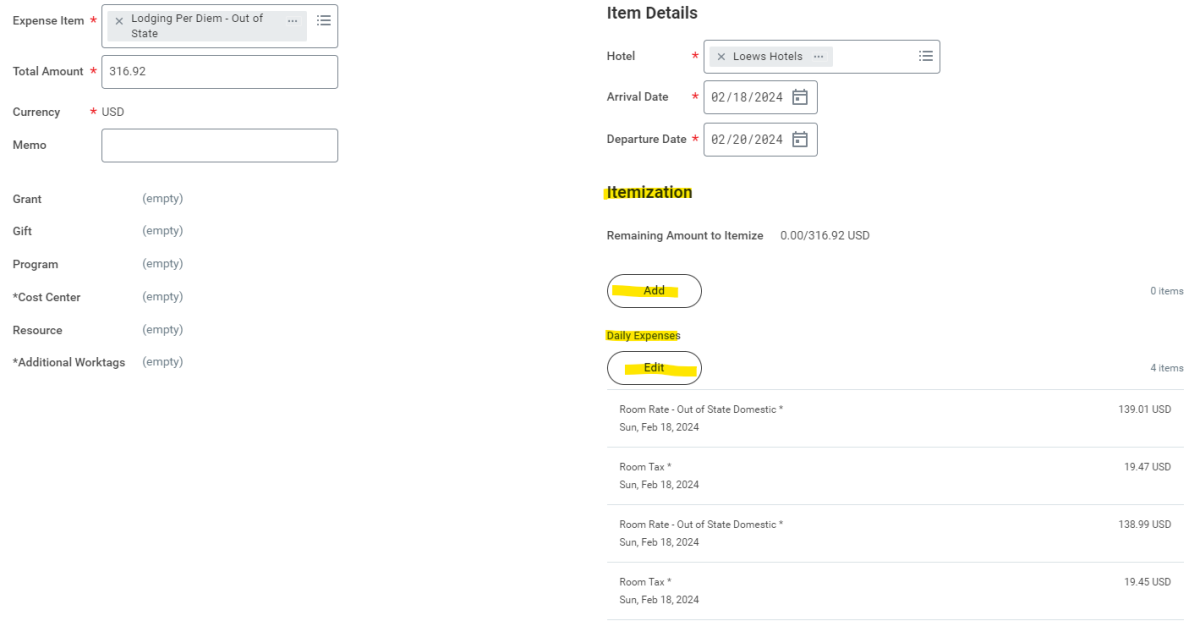

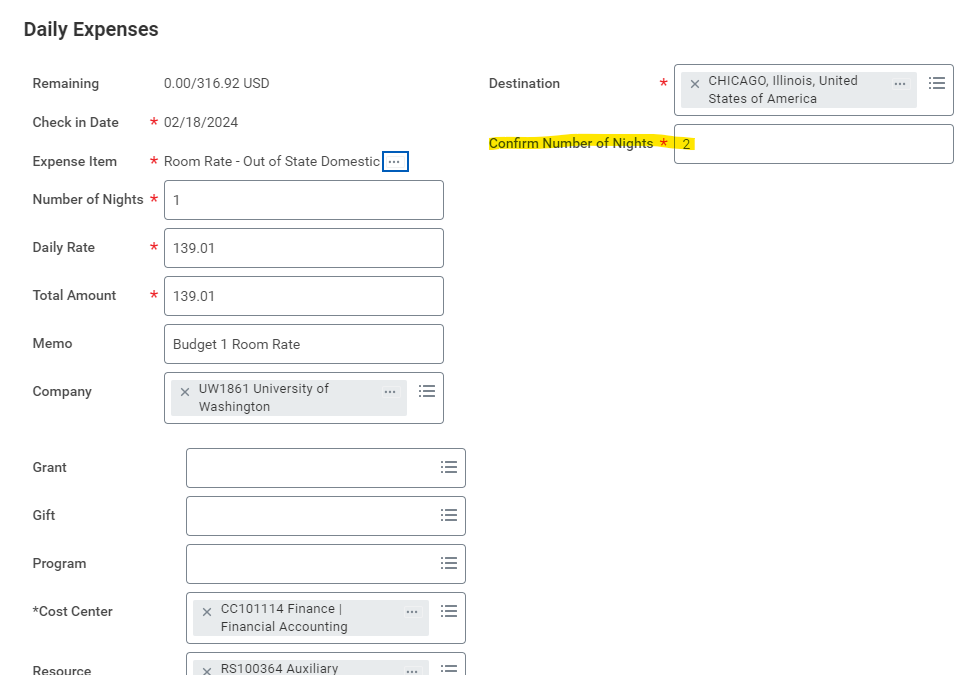

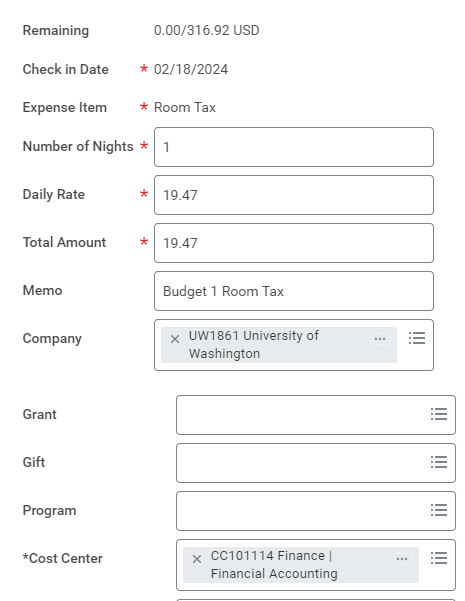

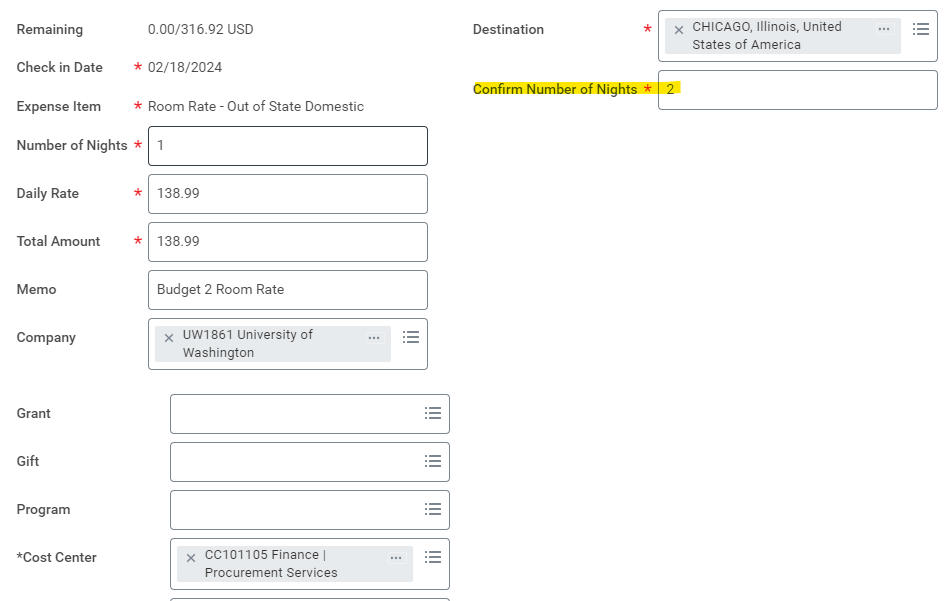

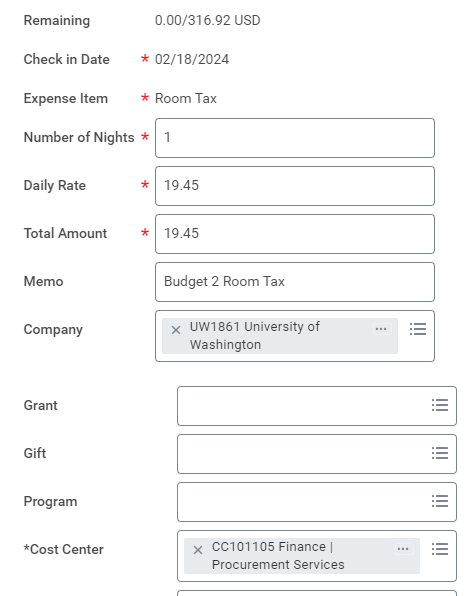

Here is an example for Lodging: (Department splitting 50% between 2 budgets)

For Room Rate, (1) the Confirm Number of Nights field must be the total number of nights (2) the Number of Nights field is the amount of nights being reimbursed by the budget.

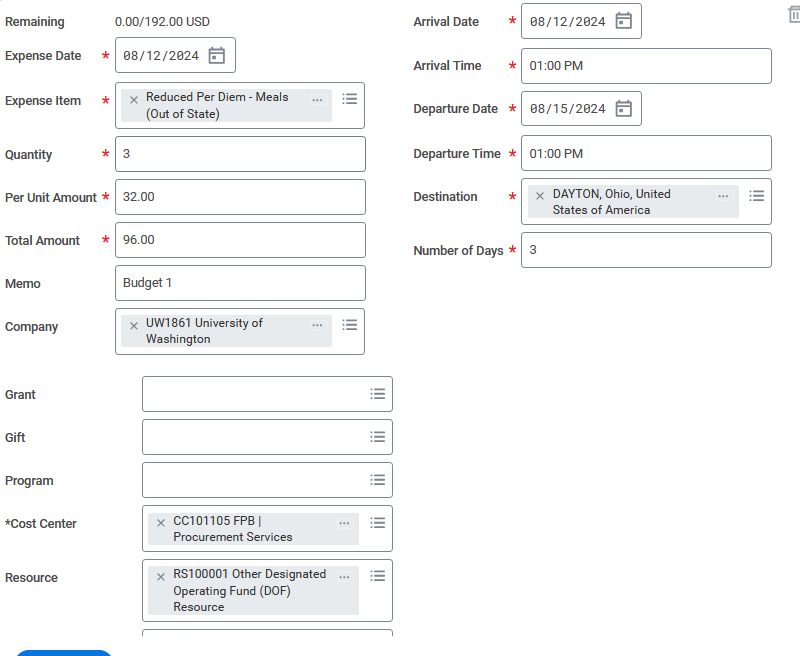

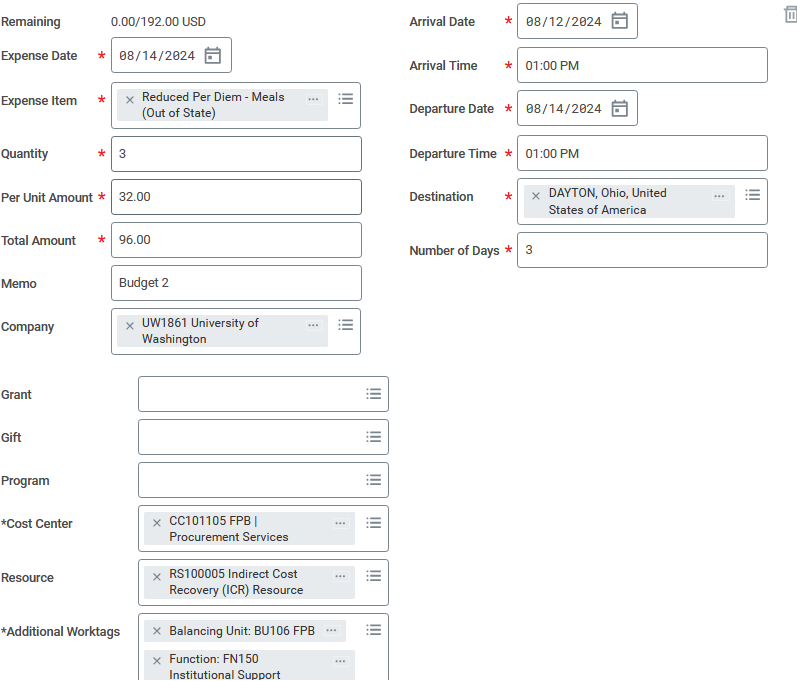

Here is an example for Meals: (Department splitting 50% between 2 budgets)

Create one reduced per diem - meals expense item making sure to use the correct one in relation to the travel destination. Enter the details in total as you normally would. Above we split the Dayton daily per diem of $64 for 3 days and entered it as a whole first.

Then add itemization lines to break the expense into two and make sure to change the expense dates on each itemization line if they are to be matching amounts such as in our 50/50 split above. (Note: this only applies to meal per diem as it spans across multiple days and the expense date may be changed)

Below you can see how each itemization line was entered with different resource tags:

Resource Tag 1:

Resource Tag 2:

PCA codes will be changed into Worktags in Workday. Please input these Worktags into the "Additional Worktags" in the header or individually per line item.

As of January 1, 2018, due to changes in the tax code, all moving and travel expenses regarding relocation has been moved to Workday through the Moving Expenses "Request One-Time Payment" Module.

For all expenses, when reimbursing travelers who paid on behalf of others, please include the other travelers' names, purpose of trip, home address (city and state), and duty station (city and state) in the comment section of the travel reimbursement request.

For UW Employees, input the total amount for all participants (including themselves) into the Lodging Per Diem item. If there is an overage, input the overage amount under the Daily Expenses in the Lodging Per Diem - Overage item and write into the memo field, "Claimant - # of travelers".

Meals paid for others are separate from this and are reimbursed at actual costs as evidenced by receipts and cannot exceed the allowable meal per diem rate per person according to the location of travel.

For Non-employees, in the Miscellaneous Payment module, the initiator will choose payee's name in the Payee field. The department can explain in the memo field or comment that the payee is claiming expenses on behalf of another traveler (input the traveler's name and business purpose).

If the ER or MP is submitted and completely approved prior to 6:00pm, the check is issued the following day.

Expense Reports: Wires are currently not an option to choose for expense reports.

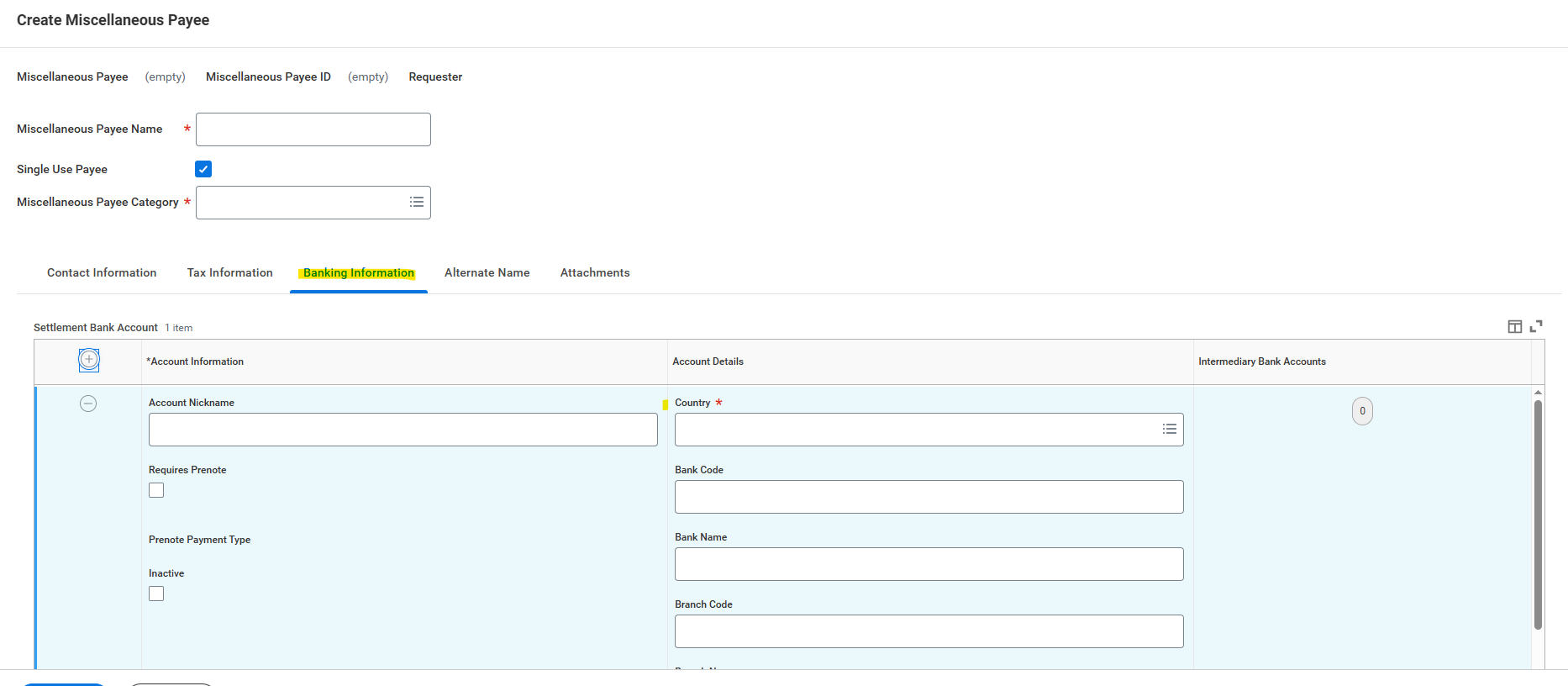

Miscellaneous Payments: When creating a miscellaneous payee profile, under the Banking Information tab, please input the wire information to the relevant fields (required fields will vary as every country has different requirements).

Once in the Miscellaneous Payment module, select Wire from the Payment Type options.

For any questions regarding wire payments, contact AP Wires apwires@uw.edu.

Only use Workday Expense if you are reimbursing the traveler. Pertinent information to be included: proof of payment, lease/rent agreement and validation of commercial lodging facility. If reimbursing property management company contact Real Estate Office.

Yes, see the Scanning Policy set forth by UW Records Management for more information.

When reimbursing a new employee before their start date, please use the Miscellaneous Payment module. On the Non-Employee Claim Form, choose "Faculty/Staff Candidate" as their traveler type.

If the reimbursement is created on or after their start date, please use the Expense Report module.

If the taxes are not separated on the receipt, the whole amount is to be treated as the room rate. For domestic locations, the Room Tax in the Itemization may be input as $0.01, and the rest should be adjusted accordingly as the Room Rate.