Frequently Asked Questions

- Click question to view answer.

- Search all categories or a specific category selected from the list at right.

General

- Effective January 1st, 2018

- To ensure expenses are properly accounted for, documentation must comply with the IRS Accountable Plan

- If itemized receipts are obtainable and compliant with IRS Accountable Plan, reimburse expenses as usual on their appropriate line items

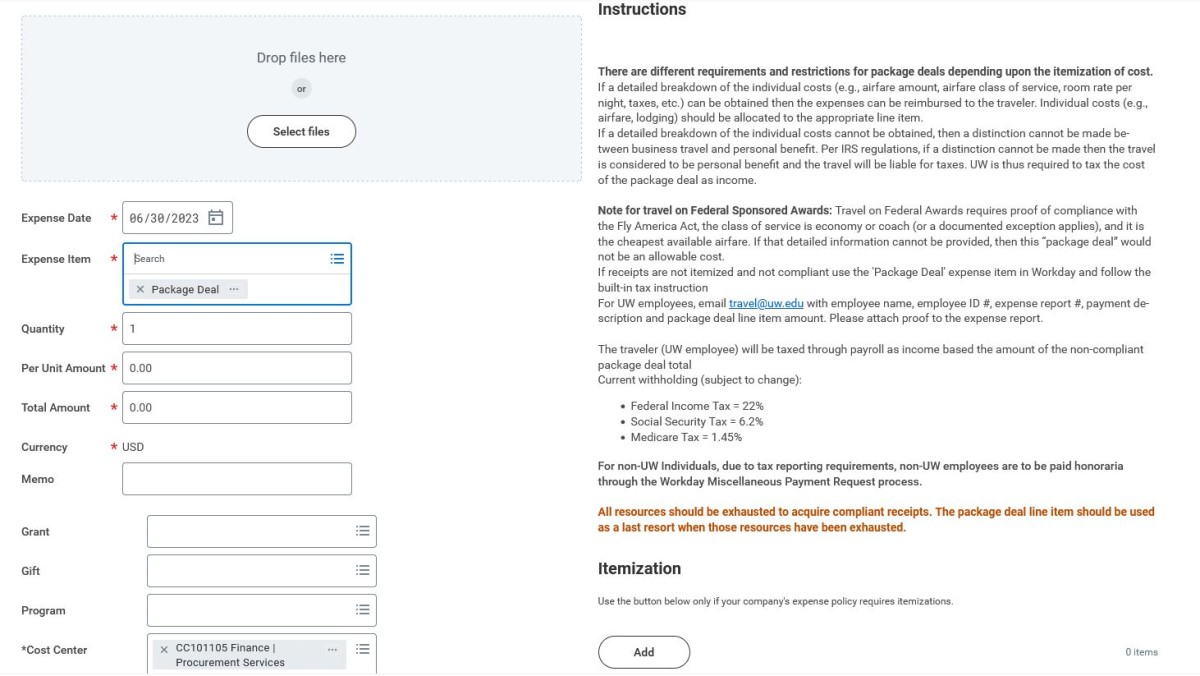

- If receipts are not itemized and not compliant with the IRS Accountable Plan, use the 'Package Deal' line item in Workday and follow the built in tax instruction

- For UW employees, email travel@uw.edu with employee name, employee ID #, expense report #, payment description and package deal line item amount. Please attach proof to the expense report.

The traveler will be taxed through payroll as income based on the amount of the non-compliant package deal total:

- Current withholding (subject to change):

- Federal Income Tax = 22%

- Social Security Tax = 6.2%

- Medicare Tax = 1.45%

- For non-UW Individuals, due to tax reporting requirements, non-UW employees are to be paid honoraria through the Miscellaneous Payments process

**All resources should be exhausted to acquire IRS Accountable Plan compliant receipts. The package deal line item should be used as a last resort when those resources have been exhausted.

►Mozilla Firefox:

Go to : Tools->Options->Advanced Panel->Network->Cashed Web Content->Clear Now

After clearing cache log out of all browsers and restart the computer.

►Internet Explore (IE9):

- Close all browser sessions (if needed restart computer)

-

Open a new Internet explorer browser, and go to delete browsing history

Go to : Tools->Internet Options->Browsing History->Delete or ctr+shift+del - Make sure “Preserve Favorites website date” is unchecked and “Temporary Internet Files” and “Cookies” are checked

- Click Delete, it may take some time to complete

- Close browser

-

Open a new browser and login into Ariba

https://ar.admin.washington.edu/AribaBuyer/uw/login.asp

Note: As a reminder is important to never use the back arrow on the browser, and use the “Logout” button on the screen rather than just closing the browser.

►Other Internet Browsers:

For more information on clearing your internet cache using other browsers, see the WikiHow article: How to Clear your Browser's Cache

Only if you share a joint account with the person who paid, for example a husband and wife who share the same bank account. If this is the case, add a comment to the expense report (ER) indicating this. In all other instances, reimbursement must go to the traveler who actually paid for the expense. See claimant.

Expenses paid on behalf of another are reimbursable but are not recommended.

If a spouse incurs travel expenses on behalf of the traveler, there are two options:

- If the spouse and traveler are connected to the same credit card account, the traveler may be reimbursed directly. The department can clarify the context in a comment.

- If the spouse and traveler are not connected, then a separate miscellaneous payment in the name of the spouse must be submitted claiming expenses on behalf of the traveler. Additionally, please note the context in a comment.